ICSI - WIRC FOCUS

Vol. XXX • No. 10 •Oct 2013

Chairman’s Blog

A "No" uttered from deepest conviction is better and greater than a "Yes" merely uttered to please, or what is worse, to avoid trouble.

- Mahatma Gandhi

A "No" uttered from deepest conviction is better and greater than a "Yes" merely uttered to please, or what is worse, to avoid trouble.

- Mahatma Gandhi

My Dear Professional Friends,

Greetings

The period between September - October 2013 witnessed various programs at ICSI- WIRC and at various Chapters in the Region. The response of the members in programs conducted on the Companies Act, 2013 was overwhelming as imminent from the attendance at the programs.

ICSI-WIRC forwarded its suggestions and comments on Rules and e-forms under the Companies Act, 2013 to ICSI-HO. ICSI-WIRC appreciates the efforts and contribution of the members of the Experts’ Group, and it is hoped that the suggestions and comments would be considered by the Ministry while finalizing the Companies Rules.

On 11th October 2013, the ICSI-WIRC celebrated its 42nd Foundation Day with program on Companies Act, 2013 at BSE International Convention Hall, which was attended by more than 375 members. On the auspicious day, the renovation work of Office No. 56-57, Jolly Maker Chambers II, Nariman Point also begun with performance of ‘puja’ at the worthy hands of our President CS S. N. Ananthasubramanian. I was privileged to attend the ‘puja’ along with my colleagues CS Mahavir Lunawat, Immediate Past Chairman-WIRC, CS Ragini Chokshi, Vice-Chairperson-WIRC, CS Sanjay Gupta, Treasurer-WIRC, CS Hitesh Kothari, Regional Council Member-WIRC, CS Atul Mehta, Council Member, and the staff of WIRO.

As always, before concluding, I again appeal the members to join COMPANY SECRETARIES BENEVOLENT FUND.

With Warm Regards,

CS Hitesh Buch

Chairman

ICSI-WIRC

Ahmedabad, 12th October 2013

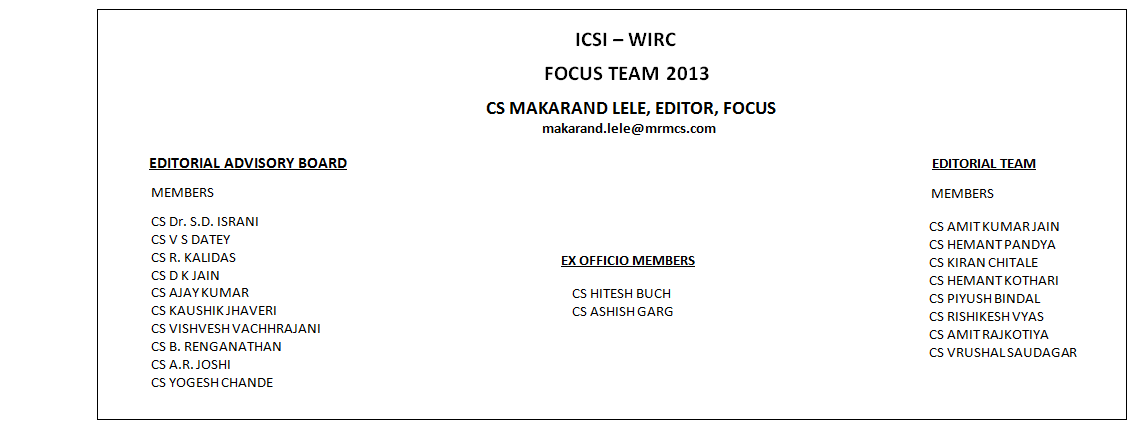

Editorial Board

Photo Feature

SEBI’s new Foreign Portfolio Investor Regulations

Introduction

Introduction

“There are many categories of foreign portfolio investors such as FIIs, sub-accounts, QFIs etc. and there are also different

avenues and procedures for them. Designated depository participants, authorized by SEBI, will now be free to register different

classes of portfolio investors, subject to compliance with KYC guidelines.

SEBI will simplify the procedures and prescribe uniform registration and other norms for entry of foreign portfolio investors.

SEBI will converge the different KYC norms and adopt a risk-based approach to KYC to make it easier for foreign investors such

as central banks, sovereign wealth funds, university funds, pension funds etc. to invest in India”

Union Budget Speech for 2013-14 of P. Chidambaram (Hon’ble Finance Minister)

SEBI vide Press Release PR No. 99/2013 on 5th October, 2013 conveyed the approval of draft SEBI (Foreign Portfolio Investors) Regulations,

2013 (the draft Regulations) in the Board Meeting of SEBI.. The draft Regulations will merge all the existing FIIs , Sub Accounts

and Qualified Foreign Investors (QFIs) into a new investor class termed as “Foreign Portfolio Investor ”( FPI).

2013 (the draft Regulations) in the Board Meeting of SEBI.. The draft Regulations will merge all the existing FIIs , Sub Accounts

and Qualified Foreign Investors (QFIs) into a new investor class termed as “Foreign Portfolio Investor ”( FPI).

The base of the draft Regulations has been (Foreign Institutional Investors) Regulations, 1995, Qualified Foreign Investors (QFIs) framework and the recommendations of the “Committee on Rationalization of Investment Routes and Monitoring of Foreign Portfolio Investments” (the Committee Report) dated 12th June, 2013.

Background

SEBI Board in its meeting held on October 06, 2012 decided that SEBI will prepare a draft guideline based on the guidance of the

Working Group on Foreign Investment (WGFI) and formed a “Committee on Rationalization of Investment Routes and Monitoring of Foreign

Portfolio Investments” under the Chairmanship of Shri K. M. Chandrasekhar, comprising of representatives from GoI, RBI and various market

participants.

The rationale behind having an integrated policy on foreign investments is that it would reduce the overall complexity and number of regulations governing inbound investments.

Hence, in the Committee Report, it was recommended to merge FII, Sub Account and QFI into FPI and have common market entry, limit monitoring and reporting norms and have segregations for applying risk based Know Your Customer (KYC) norms, Investment guidelines and restrictions. As per the Committee Report, the harmonized model would achieve the following twin objectives –

i. Provide a unified market entry for foreign portfolio investors, and

ii. Retain the ability of government/regulatory authorities to incentivize or restrict end use of foreign capital.

A quick analysis of the Draft SEBI (Foreign Portfolio Investors) Regulations, 2013 (the Regulation) are as below:

1. When do the Regulations come into effect?

This regulation shall come into force on the date of notification in official gazette on such date as the Board may specify

and different dates may be specified for different provisions of these regulations and any reference in any provision to the commencement

of these regulations shall be construed as a reference to the commencement of that provision.

2. Who are Foreign Portfolio Investors (FPI)?

Earlier the FII, QFI and Sub Accounts had their own set of regulations to be qualified as FII, QFI and Sub Accounts. However with

the new SEBI (FPI) Regulation 2013, all these have been merged into one called “FPI”

Further, “Foreign Portfolio Investor” means a person who has been registered under Chapter II of these regulations, which

hereinafter shall be deemed to be an intermediary in terms of the provision of the Act;

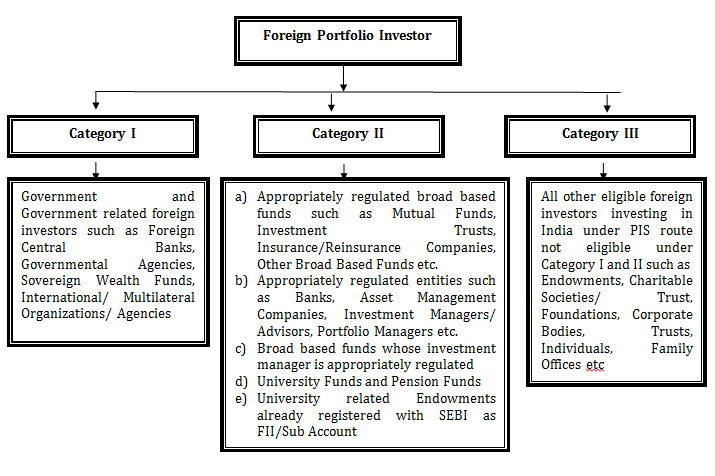

3. Are there any Categories of FPIs?

Yes, the FPIs are further divided into 3 categories as below :< br />

Though there is an integration of portfolio investors in to a single category called FPI’s, from KYC point of view, the Committee

recommended for categorization of FPIs based on the perceived risk profile. Subsequently, SEBI vide CIR/MIRSD/ 07 /2013 dated

September 12, 2013 issued circular specifying KYC requirements for these categories:

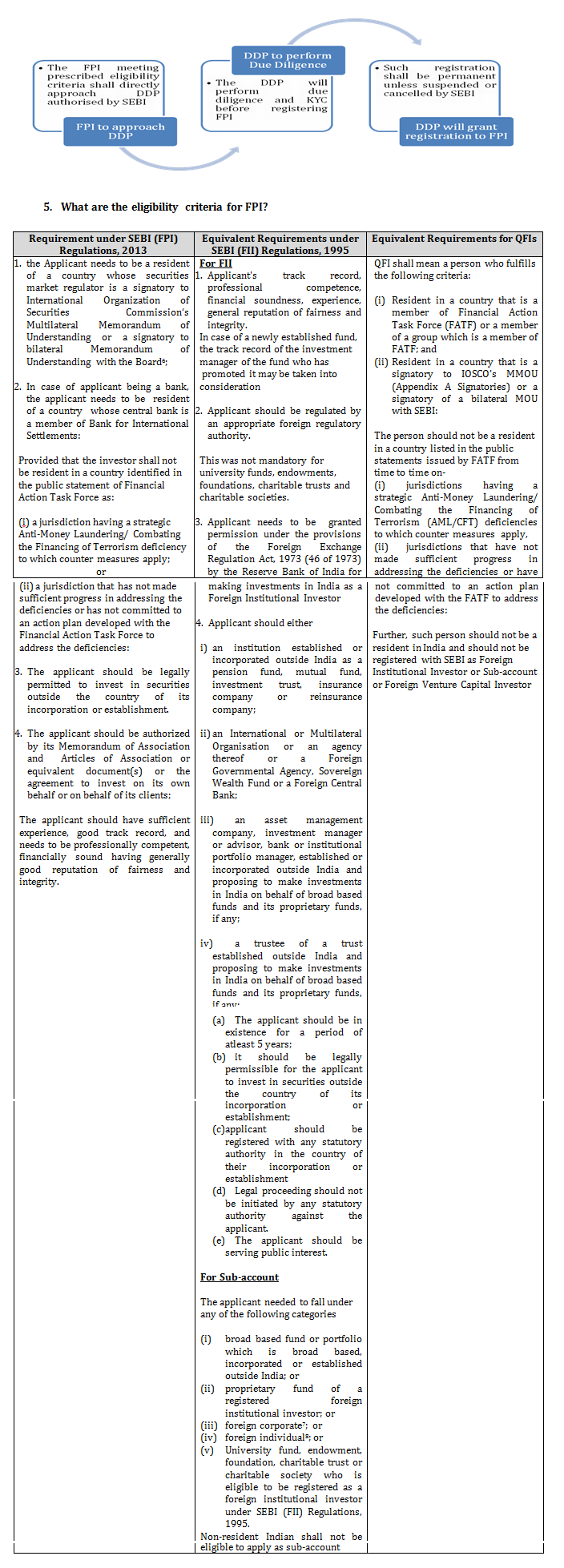

4. What is the Registration process for FPI’s?

Application to be made to the DDP in Form A (format as prescribed) after satisfying the eligibility criteria’s. The process is explained

as under:

6. What will happen to existing FIIs and sub-accounts?

A foreign institutional investor or sub-account who has been granted registration by the Board prior to the commencement of these regulations, shall be deemed to be a

foreign portfolio investor, subject to payment of fees as specified in Part A of Second Schedule

7. Will QFIs require fresh registration under FPI regulations?

Yes, the QFIs will need to get a fresh registration. All existing Qualified Foreign Investors (QFIs) may continue to buy, sell or otherwise deal in securities subject to the provisions of these regulations, for a period of one year from the date of commencement of these regulations, or if he has made an application under this regulation for registration, till disposal of such application.

8. What are the Fees applicable to FPIs?

• Fees of US $1000 to be paid by existing FIIs, Sub Accounts, and QFIs to obtain registration certificate to act as Foreign Portfolio Investor

• Category I- Nil

• Category II- Registration fees of US $ 1000 annually, till the validity of its registration

• Category III- Registration fees of US $ 100 annually, till the validity of its registration

Foreign Portfolio Investor belonging to Category II and III shall pay registration fees, before commencement of its activity.

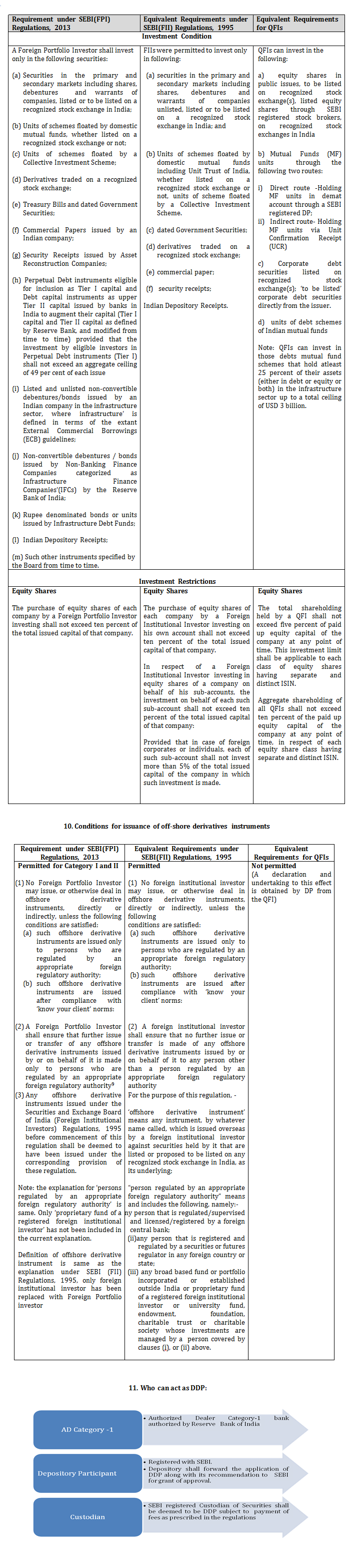

9. Investment restrictions/ permissibility for existing:

Note: SEBI approved Qualified Depository Participant not meeting the DDP eligibility criteria may operate as DDP for a period of one year

The DDP needs to have multinational presence either through its branches or through agency relationships with intermediaries regulated in their respective home jurisdictions. Further, the DDP should have systems and procedures to comply with the requirements of Financial Action Task Force Standards, Prevention of Money Laundering Act, 2002, Rules prescribed thereunder and the circulars issued from time to time by SEBI.

12. What is the process for registration as DDP?

An application for approval to act as DDP shall be made to SEBI through the depository in which the applicant is a participant and shall be accompanied by the application fee.

Application Fees - INR 10,000/- at the time of making application, by way of Draft in the name of ―”Securities and Exchange Board of India” payable at Mumbai

Approval Fees- INR 5,00,000/- by way of Draft in the name of ―Securities and Exchange Board of India” payable at Mumbai, at the time of grant of prior approval

by the Board

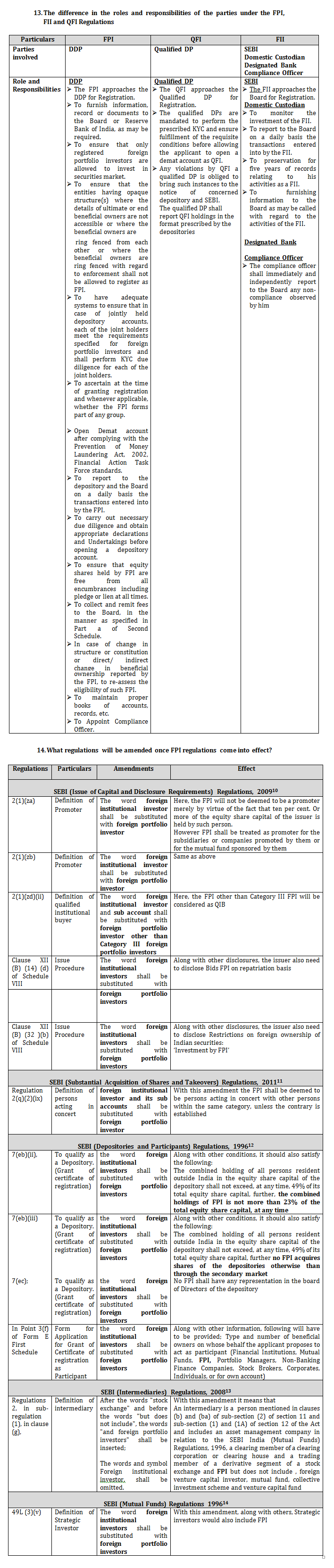

15. What regulations/circulars will be repealed/ rescinded?

The Securities and Exchange Board of India (Foreign Institutional Investors) Regulations, 1995 and Qualified Foreign Investor framework shall stand repealed.

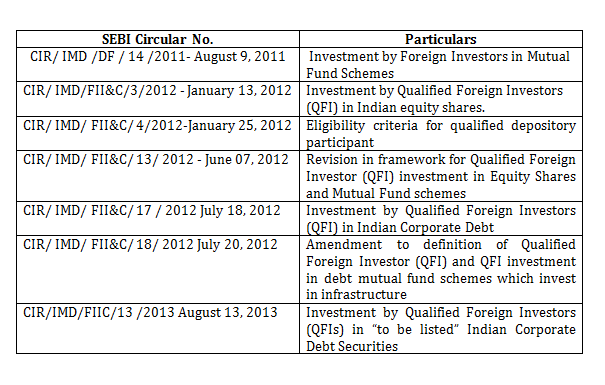

Following SEBI circulars shall stand rescinded:

16. What are the likely amendments in FEMA Regulations?

In Foreign Exchange Management (Transfer or Issue of Security by a Person Resident outside India) Regulations, 2000 as amended from time to time; the words FII and QFIs

will be needed to be replaced with FPIs.

Effective Communication

We are sure that you had fun practicing new learning from the Focus April 2013 issue the rule of communication “The meaning of my communication is the response I get”. This makes us more aware, more responsible and gears us for ‘high-stake conversations’ in life. At the dawn of this decade, some people criticized that newer and advanced technology would diminish the importance of our human brain. They continue to argue, “How many of us still memorize others’ phone numbers as we did a decade ago? Thanks to the ever expanding phone book memory of our modern day smart phones”. Is this criticism still valid? Do we stimulate our brain enough to create new possibilities for a better future?

What if our communication style is ‘thought-provoking’ and leads to creative / sustainable solutions for the challenges we face in managing relationships and results in organizations? This is the aim of our article, to provide you a useful framework, a powerful tool to engage with your co-workers, clients and teams, by stimulating their brain.

We as professionals have to coordinate with the top management, promoters, directors, stakeholders, various government agencies and authorities, auditors, team mates, lawyers, and others in personal and professional life. Life would be simpler, if only, we can communicate in a manner that makes the receiver gets the intended message ‘right’ the very first time and we are open to receive ours. Is there a ‘quick-fix’ to ensure that our communication stays effective, always? The straight answer is ‘there is no quick fix’. Does it mean there is no solution to this age old challenge? Not necessarily. There is a way! Learning key habit patterns that help us in communicating without creating a room for any gap in perception/ misinterpretation is the solution. Once we wear the right kind of glasses, we start seeing the brighter side of the world.

We as professionals have to coordinate with the top management, promoters, directors, stakeholders, various government agencies and authorities, auditors, team mates, lawyers, and others in personal and professional life. Life would be simpler, if only, we can communicate in a manner that makes the receiver gets the intended message ‘right’ the very first time and we are open to receive ours. Is there a ‘quick-fix’ to ensure that our communication stays effective, always? The straight answer is ‘there is no quick fix’. Does it mean there is no solution to this age old challenge? Not necessarily. There is a way! Learning key habit patterns that help us in communicating without creating a room for any gap in perception/ misinterpretation is the solution. Once we wear the right kind of glasses, we start seeing the brighter side of the world.

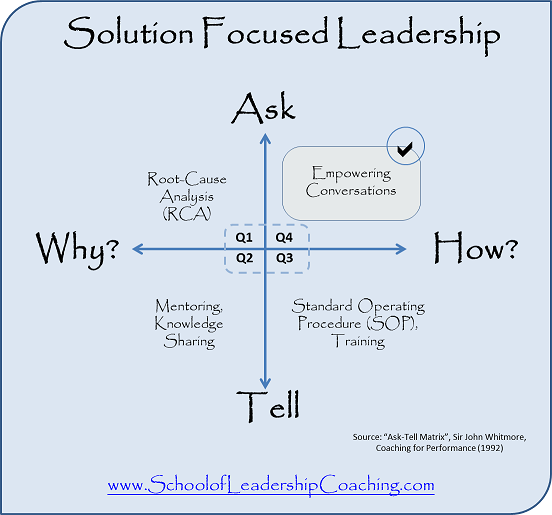

In this article, we shall introduce a new paradigm to communicate effectively, while leading others, using a simple yet powerful approach ‘Asking questions that empowers others to action’. This is illustrated by using a simple model called, ‘Ask-Tell Matrix’.

The “Ask-Tell Matrix”, first popularized by Sir John Whitmore in Coaching for performance (1992), consists of two orthogonal dimensions; an “Ask-Tell” dimension and a “How-Why” dimension.

Below is an image that reflects 4 quadrants (Figure 1). They are very useful. We can decide where we need to stay in a particular situation. We can choose our words accordingly. This is situational and ‘Solution Focused Leadership’. An effective leader knows that it’s important to stay most of the times in ‘Ask-How quadrant’ (Q4) to ensure ‘Empowering Conversations’ with his/her team and other stakeholders. It helps the other person to think better and come out with sustainable solutions for the challenges faced.

This provides a useful framework for discussing the differences between solution-focused and problem-focused approach to leadership and communication.

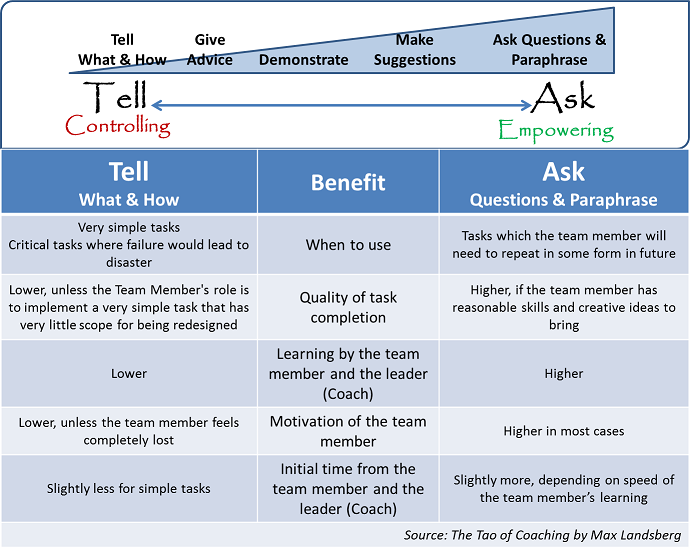

The following table (Table 1) illustrates the continuum of ‘Asking vs. Telling’:

Now, let us consider this dimension in light of the other continuum - ‘Why – How’:

• Quadrant 1 (Q1): Asking ‘Why’ questions help finding the ‘Causality’ (Root Cause Analysis - RCA) of the problem. This approach is useful in certain situations and more often considered for a ‘Problem-Centered’ approach, where the answer to the current problem lies in the past. Fixing the root cause would enable to team and the leader to progress further.

Sample Questions

- Why did this happen?

- Why did you carry out this procedure?

- Why can’t you adopt a different approach?

- Why it is important for you to do this procedure this way?

• Quadrant 2: Telling ‘Why’ the approach / solution ‘may’ or ‘may not’ work has its own utility. Leaders find this approach useful in certain situations.

• Quadrant 3: Telling ‘How’ it has to be done or executed may be useful when the team member is new to the role or not adequately skilled. It may also be essential in highly regulated environments having Standard Operating Procedures (SOPs). In a flight emergency landing situation, the pilot / the flight crew is expected to tell HOW the evacuation procedure is carried out. Other approaches may not be appropriate in this situation.

• Quadrant 4: However, Asking ‘How’ or ‘What’ questions leads to thought-provoking conversations that help the team member to come up with creative and sustainable solutions to the challenges at hand. Table 1 illustrates this succinctly.

Sample questions that reflect a deeper understanding of leading from ‘Ask-How’ quadrant (Q4):

• What keeps you awake at night?

• What would you like to improve/change?

• How important it is for you to achieve this?

• How much of that can you begin, continue and complete in the next six months?

• How would you approach this challenge differently?

• What resources do you already have? Skill, time, money, support, etc.?

• How does success look / feel / taste like?

• How committed are you to make this happen?

• We are familiar with illustrious leaders who ‘walk the talk’ and command respect for their empowering style. We often find great leaders adopt a style of inquiry not suggesting; commanding not demanding. They practice the habit of remaining in “ask how quadrant”. They hardly indulge in blaming others for failures instead trust others and empower them with more responsibilities.

Staying in ‘Ask-How’ Quadrant is an art and science of achieving willing participation from team members. All great leaders like Abraham Lincoln, Mahatma Gandhi, APJ Abdul Kalam commanded respect by asking tough, thought provoking questions to their teams, encouraging them to share their ideas and not suggesting or imposing their own.

This can be practiced in a few simple steps –

1. Meaning of my communication is the response I get. Be responsible.

2. Each person has a view; acknowledge, appreciate and respect the same.

3. Inquire about the other person’s view before you embark on the conclusion.

4. When inquiring, it’s better to stay longer in ‘Ask How quadrant’ (Q4). The other person feels important and hence gets interested in co-creating a solution.

5. Always acknowledge and appreciate the efforts, views and concerns of another person.

However, please note that it's not expected that one must always stay in “ask how quadrant”. Situations demand when you need to shift on “tell how”, “tell why” and “ask why” quadrants as well. However, use it sparingly. We at ‘The School of leadership Coaching’ believe that an effective leader communicates to ‘Express’ and not to ‘Impress’ and that is the only way to win his/her stakeholders’ trust.

Do write to us at focus@schoolofleadershipcoaching.com. We eagerly look forward to hear your suggestions, queries or comments about this article.

SME IPO Listing

SME LISTING INTRODUCTION

SME LISTING INTRODUCTION

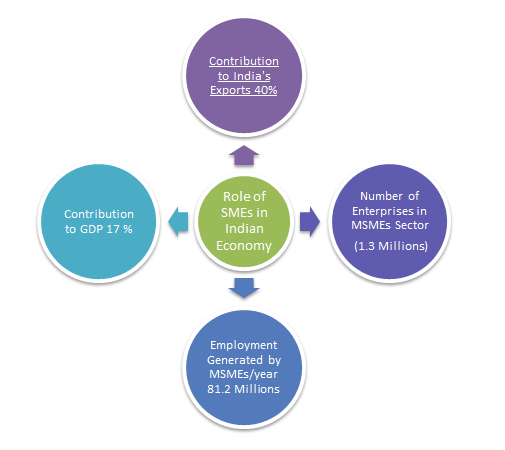

The Indian Micro and Small-Enterprises is a Limited company incorporated under the Companies Act, 1956. In recent years, the MSME sector has consistently registered a higher growth rate than the overall industrial sector. The major advantage of the Micro, Small and Medium Enterprises (MSME) sector is its employment potential at a low capital cost. According to available statistics (Census of MSME Sector), the sector employs an estimated 81.2 Million people in 1.3 Millions Lacks enterprises; labor intensity in the MSME sector is estimated to be nearly four times that of large enterprises.

Small and medium enterprises (SMEs), particularly in developing countries like India are the backbone of the nation's economy. MSMEs contribute 17% of the country's Gross Domestic Product (GDP) & estimated about 22% in 2020, 45% of the manufactured output and 40% of our exports. It forms a major portion of the industrial activity.

There are several factors that have contributed towards the growth of Indian SMEs. Few of these include; funding of SMEs by local and foreign investors, the new technology that is used in the market to assist SMEs to add considerable value to their business, various trade directories and trade portals that help facilitate trade between buyer and supplier, thereby reducing the barrier to trade.

With this huge potential – backed up by strong government support– Indian SMEs continue to post their growth stories. However, despite this strong growth, there is still a huge potential amongst Indian SMEs that remains untapped. Once this untapped potential becomes the source for growth of these units, there would be no stopping India from posting a GDP higher than that of US or China and becoming the world’s economic powerhouse.

. SEBI has also laid down the regulations for the governance of SME Platform. To this initiative, the Bombay Stock Exchange and the National Stock Exchange have established BSE SME Platform and EMERGE respectively. The Stock Exchanges are continuously working towards making the platform most suitable for companies to become big from small by raising funds from Capital Market.

WHERE TO LIST

SME’s In India have great opportunity to get listed in the National Stock Exchange and Bombay Stock Exchange. Both the Exchanges have multiple benefits to offer to SMEs, and in this scenario, a very vital question for every SME - which intends to go for SME listing - is the platform which they should choose so that their companies can reach new heights.

At present, there are only two SME Exchanges in India i.e. BSE SME platform (BSE) and EMERGE Platform (NSE). Both have their own eligibility norms, in addition to SEBI norms for listing.

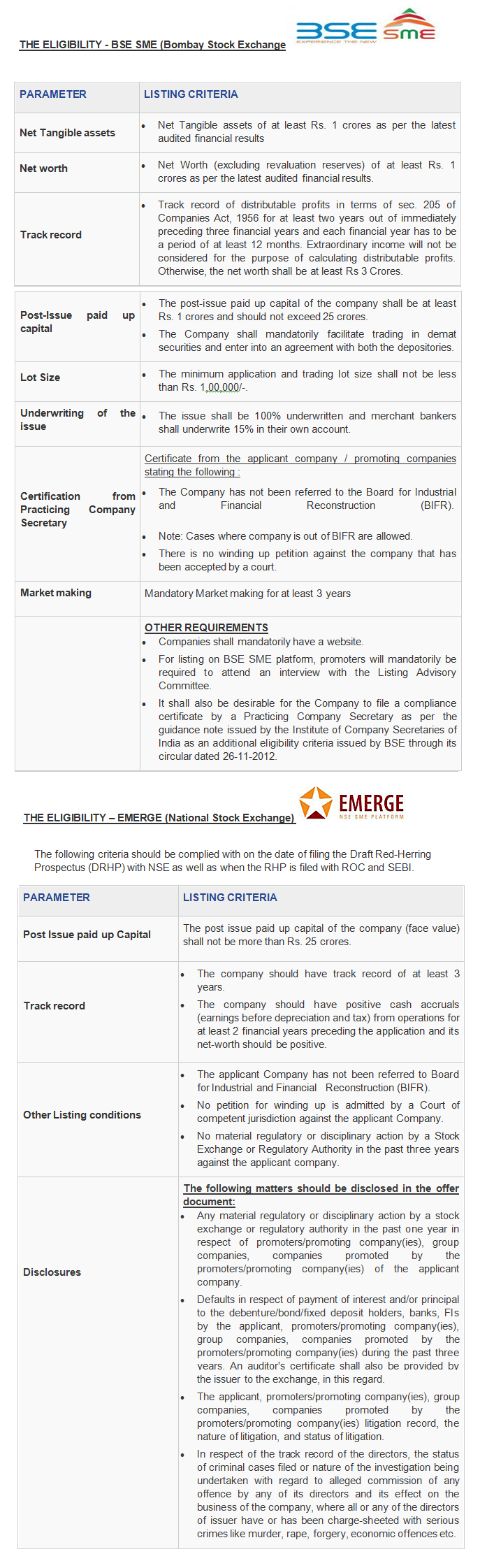

BSE SME – BSE

The Prime Minister's Task Force (Jan. 2010) had recommended the setting – up of a dedicated Stock Exchange/ Platform for SME. SEBI has also laid down regulations for the governance of SME Platform. Bombay Stock Exchange Ltd, an Exchange which has founded the equity cult in the country, has witnessed many companies becoming big from small by raising funds from the Capital Market. BSE was keen on setting up an exchange for small and medium enterprises and after necessary changes and amendments are made in the rules, bye-laws and regulations of the cash market, the BSE SME Platform was set up. BSE SME Platform has shown tremendous progress and at present, there are about 22 or 23 listed companies.

EMERGE – NSE

EMERGE is a credible and efficient market place to bring about convergence of sophisticated investors and emerging corporates in the country. It offers opportunities to informed investors to invest in emerging businesses with exciting growth plans, innovative business models and commitment towards good governance and investor interest.

EMERGE will have customized processes and systems which will help prospective issuers in their journey of metamorphosing into listed public companies. This platform will provide capital raising opportunities to credible and fast growing businesses with good governance standards. It will be an ideal platform to raise funds for companies on a growth path, but not large enough to list on the main board. At present there are about 2 or 3 listed companies on NSE EMERGE Platform.

WHO CAN LIST

Only a Public Limited Company can be listed in SME Platforms so if you are a Private Limited Company, Proprietary Firm or a Partnership Firm, first of all, conversion to a Public Limited Company is required. Both BSE SME Exchange and EMERGE – NSE Exchange have their own eligibility criteria for SME Listing, in addition to SEBI norms for listing.

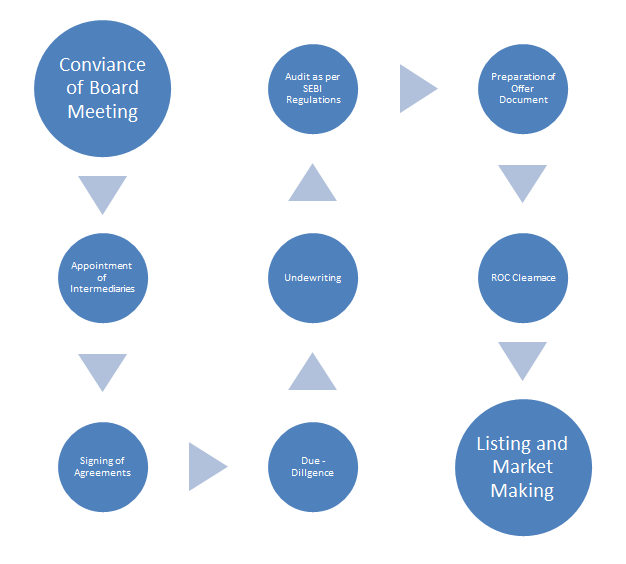

HOW TO LIST

Going for an IPO requires the following procedures to be complied with:

• First of all a board meeting shall be convened to consider the following :

a. To consider the quantum of issue;

b. Making of mandatory website of company;

c. Appointment of merchant banker, lead managers, legal advisors and bankers;

d. To decide time, place, date for EGM for Consideration of Issue by Shareholders of the Company;

e. Approval of application for BSE/NSE (SME platform) Clearances and ROC clearances;

f. Approval to open escrow account; and

g. Any other incidental and related matter.

• Appointment of intermediaries and other parties including :

• Underwriters

• Market Makers

• Registrars to Issue

• Bankers to issue

• Legal Counsel/ Advisor to the issue

• PR Agency, Printer etc

• Signing of Agreements between company and Intermediaries

a. Memorandum of understanding among company and registrar to the issue,

b. Memorandum of understanding among company and lead manager,

c. Market Making agreement between company , lead manager and market maker,

d. Underwriting agreement between company and lead manager and other Agreements as may be required.

• Due-Diligence

Certificate as per Form A of Schedule VI including additional confirmations as provided in Form H of Schedule VI, along with the offer document has to be submitted to the SEBI. The Due - Diligence report has to be very detailed with respect to the functions of the company, management of the company, financial structure and standing of the company, approvals, licenses and registrations required by the company, litigations and documenting its magnitude and ramifications and every other details in connection to the company.

The Lead Merchant Banker shall submit a Due - Diligence report to SEBI along with filing of prospectus with SEBI.

• Underwriting

The issue has to be 100% underwritten by the underwriter. In addition to this, the Merchant Banker/s shall underwrite at least fifteen per cent of the issue size on his/ their own account/s.

The issuer company, in consultation with the Merchant Banker may appoint underwriters in accordance with Securities and Exchange Board of India (Underwriters) Regulations, 1993 and the Merchant Banker may enter into an agreement with the nominated investor, indicating therein the number of specified securities which they agree to subscribe at issue price in case of under-subscription.

• Audit as per SEBI Regulations

Identification and appointment of peer review auditors and getting the financials of last 5 years restated, and for last 1 year re-audited from peer review auditors as per SEBI (ICDR) Regulations, 2009.

• Preparation of Offer Documents

The offer document is one of the most important documents in the SME IPO wherein the company explains its competitive strengths, strategy, market opportunity and risks involved. The offer document is the main marketing document for any IPO or for any SME IPO. Therefore, it is important that the offer document is prepared with the utmost care and shall be prepared by a highly qualified professional team having technical knowledge and domain business expertise.

The offer document should contain true and fair statements and conditions of the company and should not contain any statement which is ambiguous or not supportable by evidence. This involves cross checking of all the statement in the offer document and their legitimate source for avoiding liability of company and the directors.

• ROC clearance

Once approval is obtained from the Stock Exchanges for the listing of securities the Draft offer documents needs to be submitted to ROC for its clearance.

After ROC clearance the Offer Document has to be filed to SEBI and the Stock Exchange. As per the circular issued on 18th May, 2010 by SEBI following are some of the obligations that have to be complied with:

• Post issue face value capital should not exceed Rs -25 Crores

• The minimum application and trading lot size shall not be less than Rs. 1 Lac.

• The existing members would be eligible to participate in SME Platform.

• The issues shall be 100% underwritten and merchant bankers shall underwrite 15% in their own account.

• Mandatory Market Making for all scrips listed and traded on SME Platform.

• Listing and Market Making

The Merchant Banker shall ensure compulsory Market Making through the stock brokers of SME exchange in the manner specified by the Board for a minimum period of three years from the date of listing of specified securities issued under this Chapter on SME exchange or from the date of migration from Main Board in terms of regulation, as the case may be. The obligations for market makers are as follows:

• The Merchant Banker to the issue will undertake Market Making through a stock broker who is registered as Market Maker with the SME Platform.

• The Merchant Bankers shall be responsible for Market Making for a minimum period of 3 years.

• The Market Makers are required to provide two way quotes for 75% of the time in a day. The same shall be monitored by the exchange.

• There will not be more than 5 Market Makers for a scrip.

• Market Makers will compete with other Market Makers for better price discovery.

• The exchange shall prescribe the minimum spread between the bid and ask price.

• During the compulsory Market Making period, the promoter holding shall not be eligible for the offering to market makers.

• Market Maker shall be allowed to deregister by giving one month notice to the exchange.

• Trading system may be either order driven or quote driven.

The application and trading lot size is being kept at Rs. 1 Lack so as to curtail the entry of retail investors. It has also been stated that the minimum depth shall be of Rs 1 Lack and at any point of time it can not go below that amount. The investors holding with value less than Rs. 1 Lack shall be allowed to offer their holding to the market maker in one lot. However, in functionality, the market lot will be subject to revival after a stipulated time.

WHY TO LIST

Benefits of Listing at SME Platforms in India.

1. Future Financing Opportunities

Going public would provide the MSME's with equity financing opportunities to grow their business- from expansion of operations to acquisitions. The option of equity financing through equity market allows the company to raise long-term capital and also get further credits from banks or other financial institutions on the basis of additional equity infusion. The issuance of public shares expands the investor base, and this in turn will help set the stage for secondary equity financings, including private placements.

In addition, companies often receive more favorable lending terms when borrowing from financial institutions. Moreover, equity financing lowers the debt burden, leading to lower financing costs and healthier balance sheets for the firms.

The continuing requirement for adhering to the stock market rules for the issuers lower the on-going information and monitoring costs for the banks. Equity financing lowers the debt burden leading to lower financing costs and healthier balance sheets for the firms.

2. Increased visibility and prestige

Going public is likely to enhance the company's visibility. Greater public awareness gained through media coverage, publicly filed documents and coverage of stock by sector investment analysts can provide the SME with greater profile and credibility. This can result in a more diversified group of investors, which may increase the demand for the company's shares, leading to an increase in the company's value. .

3. Liquidity for shareholders

Becoming a public company establishes a market for the company's shares, providing its investors with an efficient and regulated vehicle in which to trade their own shares. Greater liquidity in the public market can lead to better valuation for shares than would be seen through private transactions. .

4. Migration to Main Board

All Companies listed on SME Exchange can anytime migrate to the main Board of BSE, provided that the shareholders’ approval is accorded. .

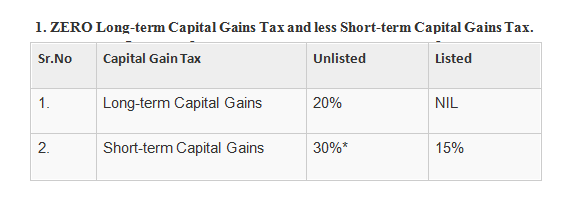

5. TAX BENEFITS

Besides other benefits, both BSE and NSE SME Exchange have a lot to offer in the form of Tax Benefits to the SMEs getting listed on their SME Platforms. Some of the tax benefits are listed below:

AMOUNT TO RAISE

This is the one of the main questions which comes to the mind of SME Promoters-/ Directors.

Generally, there is a perception that the company may raise any amount from the market as may be desired but the amount that can be raised, depends upon various factors such as regulations, rules, company’s financial status, etc. The amount that can be raised through SME IPO depends on the following points:

1. The post issue face value capital shall be more than 10 crores rupees and up to 25 crores rupees,

2. The size of application in terms of number of specified securities shall not be less than 1 lacks rupees per application.

3. Minimum number of allotees has to be more than 50.

4. As per the ICDR Regulations, the company desiring to come with the IPO has to offer a minimum of 25 % of the post-issue, paid-up capital to the general investors.

LISTING WITHOUT IPO

The Finance Minister of India in the Union Budget for the year 2013-2014 (20th February 2013)announced changes in the capital market for Small and Medium Enterprises so as to help them grow big with the liberalized policy.

Union Budget 2013-14 will allow the Small and Medium Enterprises (SME) to list on the SME exchanges without even making an Initial Public Offering (IPO). The Finance Minister, P. Chidambaram, announced that the norms enabling start-ups to list would be announced soon.

The benefits enjoyed by them will stay with them for up to three years after they grow out of the category in which they obtained the benefit. While only informed investors can subscribe to the SME issues, how the 'informed investors' are defined needs to be seen.

It will surely make a huge difference for the SME’s which have informed investors as the cost for coming up with IPO would not be there and more and more SME’s will be encouraged to get their companies listed on the SME Platforms of BSE SME and EMERGE.

The sale of listed securities in the short term attract a capital gain tax of 15% and there is no long term capital gains tax, provided that it has been subject to STT. This makes it clear that the listing of shares on SME is very attractive.

CONCLUSION

World economy is witnessing a tough time during few years and unfortunately Indian economy has also faced problems due to several factors in the world economy, however with the good domestic demand India has tried to survive during tough time, and small medium enterprises has also contributed their best in this fight. New initiative like SME Listing, easy financing, Tax relaxation, Government has also tried to provide relief to SMEs in India. Now the ball is in the court of market and Investors, let’s hope for the best.

Investors can now Demat their insurance policies

Finance minister P. Chidambaram recently launched the Insurance Repository System (IRS) of the Insurance Regulatory and Development Authority.( IRDA)

With this, all insured can now enjoy the comfort of storing all their policies electronically under a single electronic insurance account or e-Insurance account, just like investors hold their shares in demat account .

IRDA has registered five companies so far to act as Insurance Repositories—

NSDL Database Management Ltd,

Central Insurance Repository Ltd,

SHCIL Projects Ltd,

Karvy Insurance Repository Ltd and

CAMS Repository Services Ltd.

These companies, will be linked to all insurance companies, and also will maintain data of policies electronically for insurers and will open e-Insurance accounts for policyholders.

To store all policies online, investors will have to create an e-Insurance account with a repository either directly or through an insurer.

While creating an account, investors have to provide relevant information such as address and identity proofs. Once an investor has an e-Insurance account, investor will have an account number, username and password. When investors buys a policy, he will need to quote his e-Insurance account number and request for dematerialization when he fills up the proposal form. This also applies when purchasing insurance online. Investors can also demat their existing policies by sending a request to your insurer or the repository.

Benefits for INVESTORS

1) The biggest benefit of holding all your policies electronically is that there’s no risk of losing physical documents. Life insurance is long term contract, so the need to dematerialize them is more.

2) Besides, it’s easier for nominees to track insurance details.

3) The account will allow you to hold all insurance policies—life, health, car and others—at one place. You can’t open multiple accounts. Initially, you will be able to demat only life insurance policies.

4) An added benefit of having an e-Insurance account would be that insurers will not insist on KYC (know your customer) every time when insurance is bought. For example if an investor or insured changes address, he or she just need to register that change with Repository.

5) Insured can also pay premium or send service requests such as switching investment funds in an equities-linked insurance plan with your e-Insurance account, in time to come.

6) Please note that storing policy details online is different from buying a policy online. Even when you buy a policy online, you get a policy in a physical form. But, with your e-Insurance account, you will be able to hold this policy electronically .

Can Investors demat right now?

Although you can open an e-Insurance account right away, dematerializing policies will take some more time. I feel investors are to be educated, guided and helped as awareness is minimal in this area.

I feel that this is welcome step for all investors who got tremendous benefit after Depositories Act 1996 came into force. Personally I feel that at every point of time , Investors should be guided to make them know the changes taking place across.

Noteworthy & Welcome provisions in the Companies Act, 2013

Introduction: The Government of India finally achieved success in the year 2013 by legislating a new Companies Act, which received the assent of the President of India on 29th August 2013. There are some crucial provisions in the Companies Act, 1956 (herein after referred to as “1956 Act”) that are ambiguous. Various attempts were made by the DCA (now “MCA”) to clarify the exact legal position through Circulars or Notifications. Now, in the Companies Act, 2013 (herein after referred to as “2013 Act”); sufficient steps have been taken to remove such ambiguities. This article makes a summary of some of the significant changes made in 2013 Act. In this article, the author will first discuss the provisions of the 1956 Act followed by a discussion on the provisions of the 2013 Act and lastly the change / impact due to the 2013 Act.

1. Private Company which is subsidiary of Public Company: Section 3 (1) (iv) of the 1956 Act; defined “Public Company” and clause (c) of the section stated that “Public Company means a company which is a private company which is a subsidiary of a company which is not a private company.” i.e. in simple words - Private Company which is a subsidiary of a Public Company is a Public Company. Thus the question arises whether such a private company is required to alter the Articles of Association by deleting the reference of Section 3(1)(iii) of the 1956 Act, increase the minimum number of Directors and increase the minimum number of members? .

With reference to the judgment of Company Law Board in Hillcrest Realty Sdn. Bhd. v Hotel Queen Road (P) Ltd [2006] 71 SCL 41 (CLB);[2006] 133 Comp Cas 742 (CLB); it was held that the basic characteristics of a private company in terms of Section 3(1)(iii) of the 1956 Act do not get altered just because a private company is a subsidiary of a public company in view of the fiction in terms of s 3(1)(iv)(c) of the 1956 Act that it is a public company. May be it is a public company in relation to other provisions of the Act but not with reference to its basic characteristics. In terms of that section, a company is a private company when its Articles restrict the right of transfer of shares, restrict its membership and prohibits invitation to public to subscribe to its shares. Therefore, all the provisions in the articles to maintain the basic characteristics of a private company in terms of s 3(1)(iii) of 1956 Act will continue to govern the affairs of the company even though it is a subsidiary of a public company. One of the basic characteristics of a private company in terms of that section is restriction on the right to transfer and the same will apply even if a private company is a subsidiary of a public company. .

Therefore, in 1956 Act; we had to rely on the CLB judgment to determine the status of a Private Company which is a subsidiary of Public Company. .

Now, in the 2013 Act; there is ample clarity provided in the proviso to Section 2 (71) which states: A company which is a subsidiary of a company, not being a private company, shall be deemed to be public company for the purposes of this Act even where such subsidiary company continues to be a private company in its Articles.

Therefore, now it is clear from the statute that the basic structure of a private company which is a subsidiary of public company remains the same and such a company need not amend the Articles of Association. But, such a company has to comply with the provisions which are applicable to public companies as provided in 2013 Act. .

2. Service of documents by Companies: Section 53 of the 1956 Act relates to “Service of documents on members of the company”. The corresponding provision is provided in Section 20 of the 2013 Act and now there are more alternatives provided to the company to serve documents on Registrar of Companies or Members as follows: .

i. By sending it to him by post or;

ii. By registered post or;

iii. By speed post or;

iv. By courier or;

v. By delivering at his office or address or;

vi. By such electronic or other mode as may be prescribed;

vii. A member may request for delivery of any document through a particular mode, for which he shall pay prescribed fees.

The 2013 Act has also considered the technological development in this regard.

3. Minutes of Meeting & Circular Resolutions: Section 193 of the 1956 Act relates to maintaining the Minutes of the General Meetings, Board Meetings, Committee Meetings of the companies and Section 289 of the 1956 Act relates to passing of Circular Resolution.

Section 118 of the 2013 Act relates to “Minutes of proceedings of General Meeting, Board Meeting and other meeting and resolutions passed by Postal Ballot” and Section 175 of the 2013 Act relates to “Passing of resolution by circulation”. Following are the note worthy changes made in the 2013 Act; which will ensure higher compliance by companies:

i. Maintenance of Minutes of the creditors;

ii. Maintenance of Minutes of the Resolution passed by Postal Ballot;

iii. Every company shall observe the Secretarial Standards relating to General Meetings & Board Meetings specified by the ICSI and as approved by the Central Government;

iv. Noting of the Circular resolution at the subsequent meeting of the Board of Directors or Committee;

v. Circular Resolution is a part of the minutes of the Meetings of the Board of Directors or Committee.

Therefore, the check list for preparation and finalization of the Minutes of the Meetings will significantly change due to the above mentioned provisions of the 2013 Act; the compliance of the Secretarial Standards and requirements of the specific provisions of the 2013 Act.

4. Maintenance & inspection of documents in Electronic form: Section 120 of the 2013 Act is a completely new section that has been introduced. Accordingly, it seeks to provide that any Document, Record, Register or Minutes required to be kept or allowed to be inspected or copies given may be kept or inspected or copies given in the electronic form in the prescribed manner. The Draft Rules (Chapter VII) provide for a 13 point checklist with respect to security of records maintained in electronic form. Some of the key points mentioned in the check list are:

i. Ensure that records are kept in a non-rewriteable and non-erasable format like pdf. version or some other version which cannot be altered or tampered;

ii. Ensure that at least two backups, taken at a periodicity of not exceeding one day, are kept of the updated records kept in electronic form, every backup is authenticated and dated and such backups shall be securely kept at such places as may be decided by the Board;

iii. Arrange and index the records in a way that permits easy location, access and retrieval of any particular record;

iv. Take necessary steps to ensure security, integrity and confidentiality of records.

5. Appointment of the 1st Auditors of Company: Section 224 (5) of the 1956 Act relates to the appointment of first Auditor of the company and states that first Auditor should be appointed within one month from the date of registration of the company and if the Board of Directors fails to exercise its powers; the company in general meeting may appoint the first Auditor(s). There is no prescribed time limit for the appointment of first Auditors in the General Meeting.

In the 2013 Act, the process for appointment of Auditors has been made time bound. As per Section 139(6) of the 2013 Act; if the Board of Directors of the company fail to appoint the first Auditor of a company (other than a Government Company) within 30 days from the date of registration, then the Board of Directors shall inform the members of the company. Then the members shall at an Extraordinary General Meeting appoint such Auditor. The Auditor shall hold office till the conclusion of the first Annual General Meeting of the company.

6. Definition - Nominee Director: The 1956 Act does not have provision about “Nominee Director” nor does it explicitly empower any shareholder, creditor or any person having special interests in a company, to nominate or appoint a director of the company to represent such shareholder or the person having special interests.

Section 149 of the 2013 Act relates to “Company to have Board of Directors” and in the Explanation to Section 149(7) of 2013 Act; Nominee Director has been defined for the purpose of Section 149 as “A director nominated by any Financial Institution in pursuance of the provisions of any law for the time being in force, or of any agreement, or appointed by any Government, or any other person to represent its interests.”

Now, in 2013 Act; there is a definition (though as an “Explanation”) of Nominee Directors and has covered not only the Nominees from Financial Institutions but also covered other ways of appointments.

7. Meetings of Directors through Video Conferencing: There is no provision in the 1956 Act for the participation of the Directors in the Board Meetings through video conferencing or other audio visual means. MCA had issued Circulars (No. 27/2011 and 28/2011) regarding the same. There were many issues like: - Are the Circulars issued by MCA binding on the stakeholders? Is it desirable to have a provision in the Articles of Association rather than relying on the Circular issued by MCA? Can meetings be conducted through video conferencing even without any provision in the Articles of Association?

Now, as per the provisions of Section 173 (2) of the 2013 Act; the Directors of the company can participate in the meeting of Board of Directors by any of the following ways:

i. In person;

ii. Through video conferring;

iii. Through other audio visual means as may be prescribed.

This is the most noteworthy and welcome provision in the 2013 Act which gives statutory recognition to electronically hold the meeting of Directors.

Conclusion: The above mentioned changes are some of the noteworthy, significant and welcome changes made in 2013 Act and are just a few to mention. There are many other significant changes in the 2013 Act which are worth welcoming and will simplify the day to day working of companies in India. Also, the role of Company Secretary (in employment or practice) will significantly change to ensure the compliance of the 2013 Act.

Adios !!!

Dear professional collegues.

Dear professional collegues.

This is my last communiqué through this column, since I am retiring from the Service of the Ministry of Corporate Affairs on attaining age of superannuation.

As I look back, I feel satisfied and contented that WIRC of ICSI has maintained good relations with my office by organsing friendly Cricket Matches annually and by giving us an opportunity to present Ministry’s view points by inviting at various programs .

The Companies Act, 2013 is opening new vistas. In my opinion,The Act now places greater reliance and responsibilities on Company Secretaries. Articles of Associations of almost all companies will have to be replaced where the reference is made to sections of old Act. Companies will have to give new look to the Board of Directors and comply with the provisions of the Act relating to appointment of Independent Directors, Women Directors , Small Shareholders Directors wherever applicable. Company Secretaries will have to ensure that Board and General Meetings of the Company not only comply with the revised requirements of the Act but also Secretarial Standards I and II, which will soon become mandatory. Company Secretaries now get their due recognition as Key Managerial Persons in the echelons of Management. But every opportunity creates new challenges since the new Act is increasing the responsibilities I may perhaps say that new Act is emplaning CSR in another sense Company Secretaries Responsibilities.

Before I say goodbye, kindly note that for any academic interest I will be available for the benefit of professionals on makuvadia@yahoo.com /cell- 9320220229

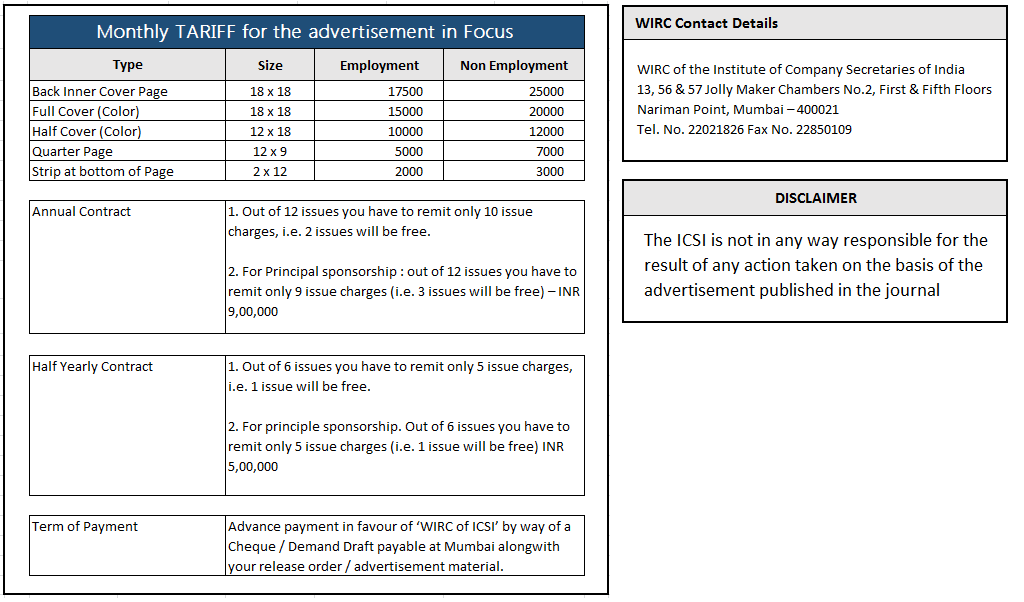

WIRC Advertisements

Case Laws at a Glance

A Bird’s Eye View: Recent judgements on Company Law

1) COMPROMISE AND ARRANGEMENT

1) COMPROMISE AND ARRANGEMENT

Petitioner companies sought for sanction of proposed scheme of arrangement. Scheme had been approved by equity shareholders and creditors. Regional Director stated that accounting treatment proposed to treat reserves arising under scheme as General Reserve and to treat same as free reserves was contradictory to provisions of section 205. Since shareholders, secured creditors, unsecured creditors and even concerned stock exchanges had approved scheme with said treatment, objections raised by Regional Director did not survive. Since scheme of arrangement was in interest of its shareholders and creditors as well as in public interest, proposed scheme was to be sanctioned.

– PRAYAS ENGINEERING LTD. IN REJOINDER [2013] 119 SCL 297 (GUJRAT)

2) OPPRESSION AND MISMANAGEMENT

Petitioner – Shareholder filed a Petition under sections 397/398 against Respondents on ground of oppression and mismanagement. Shareholding of Petitioner which was 10.005 per cent was joint shareholding with Respondents whose interest was in conflict to cause taken by Petitioner. Since interest of joint shareholders was in conflict, shareholding shown by Petitioner was not a representation of 10 per cent shareholding in company. Since Petitioner independently did not have requisite qualification required under section 399, Petition filed under sections 397/398was to be dismissed.

– KAILASH NATH ROY V. BENGAL BONDED WAREHOUSE ASSOCIATION [2013] 119 SCL 304 (CLB - KOL)

3) NAME OF COMPANY

Merely because subsequent company is registered by a name which is identical with a name by which a company in existence has been previously registered, it does not follow that it should be directed by the Central Government to change its name in terms of section 22.

– VOV COSMETICS (P.) LTD. V. UNION OF INDIA [2013] 115 CLA 239 (BOM)

4) RECTIFICATION OF NAME OF COMPANY

The root cause for enabling a party to invoke proceedings for rectification of name of company is with reference to the registration of company.

– ASTEN MATHER REALTORS (P.) LTD. V. MATHER & CO. (P.) LTD. [2013] 115 CLA 232 (KER.)

5) ARRANGEMENT BY A NON-BANKING FINANCE COMPANY

Scheme of arrangement will not be sanctioned when material facts have not been disclosed to the shareholders. Sections 391 to 394 and 58A read with sections 45Q and 45QA of the Reserve Bank of India Act, 1934.

– INTEGRATED FINANCE CO. LTD. V. RESERVE BANK OF INDIA [2013] 115 CLA 329 (SC)

6) OFFENCES AND PROSECUTION

No criminal proceedings can be instituted against director where company is neither benefitting nor any person is prejudiced thereby.

– GOODRICKE GROUP LTD. V. REGISTRAR OF COMPANIES [2013] 115 CLA 411 (CAL.)

7) AMALGAMATION

The sanctioning court is duty bound to ensure that the scheme of amalgamation is not being propounded for an oblique purpose. – Sections 391-394 and 237(a)(ii)

– MAHAK VYAPAAR (P.) LTD. V. REGISTRAR OF COMPANIES [2013] 115 CLA 376 (CAL.)

Circulars & Notifications

MINISTRY OF CORPORATE AFFAIRS

MINISTRY OF CORPORATE AFFAIRS

1. REGARDING CLARIFICATION ON THE NOTIFICATION DATED 12.09.2O13.

General Circular No. 15/2013

Source: www.mca.gov.in

1. The Companies Act 2013 received the assent of the President on 29th August, 2013 and was notified in the Gazette of India on 30th August, 2013.

Towards the proper implementation of the Companies Act 2013, first tranche of Draft Rules on 16 Chapters have been placed on the website of the

Ministry on 9.9.2013 for inviting comments and objections/suggestions from the general public/stakeholders. Of the 16 Chapters, only 13 Chapters

require specifying of Forms referred to in those Chapters. The draft Forms shall be placed on the website shortly.

Ministry on 9.9.2013 for inviting comments and objections/suggestions from the general public/stakeholders. Of the 16 Chapters, only 13 Chapters

require specifying of Forms referred to in those Chapters. The draft Forms shall be placed on the website shortly.

2. Ministry of Corporate Affairs has also notified 98 sections for implementation of the provisions of the Companies Act, 2013 (the "said Act") on 12.9.2013. Certain difficulties have been expressed by the stakeholders in the implementation of following provisions of the said Act. With a view to facilitate proper administration of the said Act, it is clarified that —

(i) Sub-section (68) of section 2:- Registrar of Companies may register those Memorandum and Articles of Association received till 11.9.2013 as per the definition clause of the 'private company' under the Companies Act 1956 without referring to the definition of 'private company' under the "said Act".

(ii) Section 102:- All companies which have issued notices of general meeting on or after 12.9.2013, the statement to be annexed to the notice shall comply with additional requirements as prescribed in section 102 of the "said Act".

(iii) Section 133:- Till the Standards of Accounting or any addendum thereto are prescribed by Central Government in consultation and recommendation of the National Financial Reporting Authority, the existing Accounting Standards notified under the Companies Act, 1956 shall continue to apply.

(iv) Section 180:- In respect of requirements of special resolution under Section 180 of the "said Act" as against ordinary resolution required by the Companies Act 1956, if notice for any such general meeting was issued prior to 12.9.2013, then such resolution may be passed in accordance with the requirement of the Companies Act 1956.

3. This issues with the approval of competent authority.

2. REGARDING CLARIFICATION ON THE NOTIFICATION DATED 12.9.2013.

General Circular No. 16/2013

Source: www.mca.gov.in

This Ministry had issued a notification on 12.09.2013 bringing into force to 98 sections or part thereof of the companies Act, 2013. The said notification is available on the Ministry's website. This Ministry has been receiving requests for clarification as to whether the provisions of the companies Act, 1955 corresponding to such 98 sections would continue to apply or not.

lt is hereby clarified that with effect from 12.09.2013, the relevant provisions of the companies Act, 1956, which correspond to provisions of 98 sections of the companies Act, 2013 brought into force on 12.09.2013, cease to have effect from that date.

This issues with the approval of competent authority.

CUSTOMS

1. REGARDING GUIDELINES FOR ARREST AND BAIL IN RELATION TO OFFENCES PUNISHABLE UNDER CUSTOMS ACT, 1962-

Circular No. 38/2013 – Customs

Source: www.cbec.gov.in

Attention of the field formations is invited to the amendments to section 104 of the Customs Act, 1962 vide Finance Act, 2013 (with effect from 10.05.2013) whereby all offences are bailable other than the categories of offences punishable under section 135 of the Act ibid , which are classified as non-bailable. These are offences relating to:

(a) evasion or attempted evasion of duty exceeding fifty lakhs rupees; or (b) prohibited goods notified under section 11 of the Customs Act, 1962 (as amended) which are also notified under sub-clause (C) of clause (i) of sub-section (l) of section 135 of the Customs Act, 1962 (as amended); or

(c) import or export of any goods which have not been declared in accordance with the provisions of this Act and the market price of which exceeds one crore rupees; or

(d) Fraudulently availing of or attempt to avail of drawback or any exemption from duty provided under this Act, if the amount of drawback or exemption from duty exceeds fifty lakh rupees.

2.1 The existing guidelines on the subject have been re-examined in the light of the above legislative amendments. As afore-stated, offences under the Customs Act, 1962 are placed in two categories i.e. (i) bailable; or (ii) non-bailable. Since arrest takes away the liberty of an individual, the power must be exercised with utmost care and caution in cases where a Commissioner of Customs or Additional Director General has reason to believe on basis of information or suspicion that such person has committed an offence under the Act punishable under the sections 132 or 133 or 135 or 135A or 136 of the Customs Act, 1962.

It is emphasized that arrest of persons in terms of section 104 (1) of Customs Act, 1962 should be resorted to only where the facts and situations of a particular case demand such action. Persons involved should not be arrested unless the exigencies of certain situations demand their immediate arrest. These situations may include circumstances:

(i) to ensure proper investigation of the offence;

(ii) to prevent such person from absconding;

(iii) cases involving organized smuggling of goods or evasion of customs duty by way of concealment;

(iv) masterminds or key operators effecting proxy/benami imports/exports in the name of dummy or non-existent persons/IECs, etc.

2.2 The decision to arrest should be taken in cases which fulfill the requirement of the provisions of Section 104 (1) of Customs Act, 1962 and after considering the nature of offence, the role of the person involved and evidence available.

2.3 While the Act does not specify any value limits for exercising the powers of arrest, it is clarified that arrest in respect of an offence, categorized as bailable offence, should be effected only in exceptional situations which may include:

(a) Outright smuggling of high value goods such as precious metal, restricted items or prohibited items or goods notified under section 123 of the Customs Act, 1962 or foreign currency where the value of offending goods exceeds Rs. 20 lakh.

(b) In a case related to importation of trade goods (i.e. appraising cases) involving willful mis-declaration in description of goods/concealment of goods/goods covered under section 123 of Customs Act, 1962 with a view to import restricted or prohibited items and where the CIF value of the offending goods exceeds Rs. 50 lakh.

2.4 There is no prescribed format for arrest memo but an arrest memo must be in compliance with the directions in “D.K Basu vs. State of W.B.” reported as 1997 (1) SCC 416 (see para 35). The arrest memo should include:

(a) brief facts of the case;

(b) details of the person arrested;

(c) list of evidence against the person;

(d) relevant Section (s) of the Customs Act, 1962 or other laws attracted to the case and to the arrestee;

(e) the grounds of arrest must be explained to arrestee and this fact noted in the arrest memo;

(f) a nominated person (as per details provided by arrestee) of the arrestee should be informed immediately and this fact also may be mentioned in the arrest memo;

(g) the date and time of arrest may be mentioned in the arrest memo and the arrest memo should be given to person arrested under proper acknowledgement;

(h) a separate arrest memo has to be made and provided to each individual/arrestee.

2.5 Further, there are certain modalities that should be complied with at the time of arrest and pursuant to an arrest, which include the following:

(i) Female offender should be arrested by or in the presence of woman Customs officers.

(ii) Medical examination of an arrestee should be conducted by a medical officer in the service of Central or State Government and in case such medical officer is not available, by a registered medical practitioner soon after the arrest is made. If an arrested person is a female then such an examination shall be made only by, or under supervision of a female medical officer, and in case such female medical officer is not available, by a female registered medical practitioner.

(iii) It shall be the duty of the person having the custody of an arrestee to take reasonable care of the health and safety of the arrestee.

2.6 Further, in every case of arrest effected in accordance with the provisions of section 104 (1) of the Customs Act, 1962, there should be immediate intimation to the jurisdictional Chief Commissioner or DGRI, as the case may be.

3.1 In regard to the grant of bail and terms of bail, a person arrested for a non-bailable offence should be produced before concerned Magistrate without unnecessary delay in terms of provisions of Section 104 (2) of the Act.

3.2 Under sub-section (3) of section 104 an officer of Customs (arresting officer) has the same powers as an officer in charge of a Police Station under the Cr.PC. Thus, a Customs officer (arresting officer) is bound to release a person on bail for offences categorized as bailable under the Customs Act, 1962. Thus, release on bail must be offered to a person arrested in respect of bailable offence and bail bond accepted for bailable offence. The amount of bail bond/ surety for bailable offences should not be excessive and the bail conditions should be informed by the arresting officer in writing to the arrestee and also informed on telephone to the nominated person (as per details provided by the arrestee) and the arrestee should be also allowed to talk to nominated person. If the conditions of the bail are fulfilled by the arrestee, he shall be released by the officer concerned on bail forthwith. The arresting officer may, and shall if such a person is indigent and unable to furnish surety, instead of taking bail from such person, discharge him or her executing a bond without sureties for his appearance as provided under Section 436 of Cr.PC. However, only in cases where the conditions for granting bail are not fulfilled, the arrestee shall be produced before the appropriate Magistrate without unnecessary delay and within twenty-four (24) hours of arrest.

3.3 Only in the event of circumstances preventing the production of the arrestee before a Magistrate without unnecessary delay, the arrestee may be handed over to nearest Police Station for his safe custody during night, under proper Challan, and produced before the Magistrate on the next day, and the nominated person of the arrestee may be also informed accordingly.

4. The guidelines issued vide F.No. 394/71/97-Cus (AS) dated 22.6.1999 (including the threshold limit specified at para 2.3) stand modified to the above extent.

5. Chief Commissioners/DGRI shall send a report on every arrest to the concerned Member within twenty-four (24) hours of the arrest. To maintain an all India record of arrests made under the Customs Act, 1962, a monthly report of all persons arrested in the Zone shall be sent by the Chief Commissioner to DRI (Hqrs) in the format prescribed and enclosed, by the 5th of the succeeding month and the same would be compiled and sent to Anti-Smuggling Unit, CBEC by 10th of every month zone wise.

6. The Chief Commissioners/Director Generals are hereby directed to circulate the present guidelines to all the formations under their charge. Difficulties, if any, in implementation of the aforesaid guidelines may be brought to the notice of the Board.

2. REGARDING CLARIFICATION ON THE COMMENCEMENT OF THE INTEREST FREE PERIOD OF 90 DAYS UNDER SECTION 61 OF THE CUSTOMS ACT, 1962

Circular No. 39/2013 – Customs

Source: www.cbec.gov.in

1. A reference is invited to Sub-section 2 (ii) of Section 61 of the Customs Act, 1962, which provides that where any warehoused goods specified in sub-clause (b) of sub-section (1) of Section 61 remain in a warehouse beyond a period of ninety days, interest shall be payable at such rate, as may be fixed by the Board, on the amount of duty payable at the time of clearance of the goods in accordance with the provisions of section 15 on the warehoused goods, for the period from the expiry of the said ninety days till the date of payment of duty on the warehoused goods. A doubt has been raised as to when the period of ninety days would commence.

2. In this regard, the term ‘warehoused goods’ is defined under Section 2 (44) of the Customs Act, 1962 as ‘goods deposited in a warehouse’. Section 61 further indicates that the warehoused goods have to remain in the warehouse beyond a period of ninety days, for the interest to be chargeable.

3. Thus, a harmonious reading of the wording of Sub-section 2 (ii) of Section 61 and the definition of the term ‘warehoused goods’ indicates that when the goods deposited in a warehouse remain warehoused beyond a period of ninety days, then the interest starts accruing. In other words, the relevant date when the period of 90 days would commence would be the date of depositing the goods in the warehouse.

4. It is thus clarified that the period of 90 days, under Section 61 (2) (ii) of the Customs Act, 1962, would commence from the date of deposit of goods in the warehouse.

5. Any difficulty faced in the implementation of this circular may be brought to the notice of the Board.

6. Please acknowledge receipt.

7. Hindi version follows.

3. REGARDING OPTION TO CLOSE CASES OF DEFAULT IN EXPORT OBLIGATION (EO) - NOTIFICATION NO. 46/2013-CUSTOMS DATED 26.9.2013

Circular No. 40/2013 – Customs

Source: www.cbec.gov.in

1. The Ministry has issued Notification No. 46/2013-Customs dated 26.9.2013 to amend 36 Customs notifications pertaining to Advance License/DEEC/ Advance Authorization/DFIA/ EPCG relating to the Policy periods from 1992-1997 to 2004-2009. This is to implement the Public Notice No. 22 (RE-2013)/2009-2014 dated 12.8.13 notified by DGFT that has provided a procedure, under category of regularization of bona fide defaults, in which all pending cases of the default in meeting EO may be regularized by the authorization holder on payment of applicable customs duty, corresponding to the shortfall in export obligation, along with interest on such customs duty, but the interest to be so paid, under this option, shall not exceed the amount of customs duty payable for the default. The authorization holder choosing to avail this procedure must complete the process of payment on or before 31.3.2014.

2. The amendments made by the Notification No. 46/2013-Customs provide that in a case of default in export obligation, when the duty on the goods is paid to regularize the default, the amount of interest paid by the importer shall not exceed the amount of duty if such regularization has been dealt in terms of said Public Notice of DGFT. No other change is involved.

3. It may be noted that the cases where export obligation period is yet to be over, are not covered under the Option. Also, normally no refund is envisaged to arise on account of choosing the Option. However, there may be cases of calculation mistakes to be dealt on merits. Also, the DGFT PN No. 22 (RE-2013)/2009-2014 dated 12.8.13 specifies that necessary procedures would be indicated separately.

4. The Commissioners are to ensure that the cases under the Option are monitored and tracked from the initial stages of exporter approaching for paying the duty, etc. so that there is efficient handling and the subsequent actions, for expeditious closure of these older cases of bona fide EO default, take place seamlessly, if infringement of other conditions is not involved. Suitable mechanism for this should be put in place and closely supervised by the Commissioners.

5. Each Chief Commissioner of Customs / Customs (Prev) / Central Excise & Customs shall provide by 3rd of the succeeding month (beginning with report for October 2013 and ending with report for March 2014) a report to the office of Chief Commissioner of Customs Delhi Zone enabling Delhi Customs Zone to prepare and provide a Zone-wise, all-India monthly report to the Board by 5th of every month in the following format:

6. This Circular may be brought to the notice of all concerned by way of issuance of standing order/instruction/trade notice. Difficulties faced, if any, may please immediately be brought to the notice of the Board.

CENTRAL EXCISE

1. REGARDING ARREST AND BAIL UNDER CENTRAL EXCISE ACT, 1944

Circular No. 974/08/2013-CX

Source: www.cbec.gov.in

1.1 I am directed to invite your attention to the amendments to sections 9A, 20 and 21 of the Central Excise Act, 1944 vide the Finance Act, 2013. A new sub-section (1A) has been inserted in section 9A to specify that the offences relating to excisable goods, where the duty involvement exceeds Rs. fifty lakh and which are punishable under clause (b) or clause (bbbb) of sub-section (1) of section 9, are cognizable and non-bailable. For ease of reference, clause (b) and clause (bbbb) of sub-section 9(1) as well as new sub-section 9A (1A) are summarized below:

(i) Clause (b) of sub-section 9(1) - Whoever evades the payment of any duty payable under this Act;

(ii) Clause (bbbb) of sub-section 9(1) – Whoever contravenes any of the provisions of this Act or the rules made there under in relation to credit of any duty allowed to be utilized towards payment of excise duty on final product.

(iii) Sub-section 9A(1A) - The offences relating to excisable goods where the duty leviable thereon under this Act exceeds fifty lakh rupees and punishable under clause (b) or clause (bbbb) of sub-section (1) of section 9, shall be cognizable and non-bailable.

1.2 All other offences under section 9 are non-cognizable and bailable.

2.1 Thus the offences under Central Excise Act fall in two categories - bailable and non-bailable. Depending on the type of offence committed, a person is liable to be arrested in either of the two category of offence. Since arrest takes away the liberty of an individual, the power must be exercised with utmost care and caution and only when the exigencies of the situation demand arrest.

Non-bailable offences

3.1 A person is liable to be arrested for non-bailable offence only when the offence committed by him is covered under clause (b) or clause (bbbb) of sub-section 9(1) and the duty involvement exceeds Rs. fifty lakh. Thus, it is essential to examine offences in each and every case with reference to each of the clauses of sub-section 9(1) and also the quantum of duty involved prior to invoking the arrest provisions. Only where clause (b) or clause (bbbb) are the most appropriate clauses to describe the offence and duty involved exceeds rupees fifty lakhs, these provisions should be invoked. Any person arrested for offences under these clauses should be informed of the grounds of arrest and produced before a magistrate without unnecessary delay and within 24 hours of arrest.

3.2 A list of non-bailable offences where decision to arrest may be taken by the Commissioner is given below:-

(a) Clandestine removal of manufactured goods;

(b) removal of goods without declaring the correct assessable value and receiving a portion of sale price in cash which is in excess of invoice price and not accounted for in the books of account;

(c) taking Cenvat Credit without the receiving the goods specified in the invoice;

(d) taking Cenvat Credit on fake invoices;

(e) issuing Cenvatable invoices without delivering the goods specified in the said invoice.

3.3 In all other cases of cognizable and non-bailable offences, covered by clause (b) or clause (bbbb) of sub-section 9(1) where the duty involved exceeds rupees fifty lakhs, which are not listed at paragraph 3.2 above, e.g. (i) removal of inputs as such, without reflecting such removal in records, on which Cenvat credit has been taken, without payment of amount equal to the credit availed on such inputs (ii) irregular and wrongful availment of benefit of central excise duty exemption by reason of fraud, collusion, willful misstatement, suppression of facts, or contravention of the provisions of the Act or the rules with intent to evade payment of duty, etc, decision to arrest shall be taken by the Commissioner only with the approval of the jurisdictional Chief Commissioner.

Bailable offence

4.1 A person is also liable to be arrested in case of non-cognizable and bailable offences, when such an offence is committed. Amendments have been made in section 20 and section 21 to provide, inter alia, that powers to grant bail or release an arrested person on execution of bond can be exercised only for offences which are non-cognizable. Any person arrested for non-cognizable offence shall have to be released on bail, if he offers bail, and in case of default of bail, he is to be forwarded to the custody of magistrate. In terms of notification no 9/99-C.E.(N.T.) dated 10-2-99, an officer not below the rank of Superintendent of Central Excise can exercise powers under section 21 including powers to grant bail.

4.2 Bail should be subject to the condition(s), as deemed fit, depending upon the facts and circumstances of each individual case. It has to be ensured that the amount of bail bond/ surety should not be excessive and should be commensurate with the financial status of the arrested person. Further the bail conditions should be informed by the arresting officer in writing to the person arrested and also informed on telephone to the nominated person of the person(s) arrested. Arrested person should be allowed to talk to the nominated person. If the conditions of the bail are fulfilled by the arrested person, he shall be released by the officer concerned on bail. The arresting officer may, and shall if such a person is indigent and unable to furnish surety, instead of taking bail, discharge him on executing a bond without sureties to his appearance as provided under section 436 of CrPC. However, in cases where the conditions for granting bail are not fulfilled, the arrested person shall be produced before the appropriate magistrate within 24 hours of arrest.

4.3 Only in the event of circumstances preventing the production of the person arrested before a Magistrate without unnecessary delay, the arrested person may be handed over to nearest Police Station for his safe custody during night, under proper Challan and produced before the magistrate the next day. These provisions shall apply for non-bailable offence also. The nominated person of the arrested person may also be informed accordingly.

Precautions to be taken by the departmental officers

5.1 Powers to arrest a person needs to be exercised with utmost caution. Chief Commissioners/ Commissioners of Central Excise are required to ensure that approval for arrest for non-bailable offence is granted only where the intent to evade duty is evident and element of mens rea / guilty mind is palpable. Attention is also invited to the decision of the Hon’ble Supreme Court in case of D. K. Basu Vs State of West Bengal, wherein specific guidelines in respect of arrest have been provided. These are required to be followed.

5.2 Decision to arrest needs to be taken on case-to-case basis considering various factors, such as, nature & gravity of offence, quantum of duty evaded or credit wrongfully availed, nature & quality of evidence, possibility of evidences being tampered with or witnesses being influenced, cooperation with the investigation, etc. To summarize, power to arrest has to be exercised after careful consideration of the facts of the case and the above factors.

5.3 There is no prescribed format for arrest memo but an arrest memo must be in compliance with the directions of Hon’ble Supreme Court in case of D. K. Basu Vs State of W.B reported as 1997 (1) SCC 416. The arrest memo should include -

(a) brief facts of the case;

(b) details of the person arrested;

(c) gist of evidence against the person;

(d) relevant Section(s) of the Central Excise Act, 1944 attracted in the case;

(e) the grounds of arrest must be explained to the person arrested and this fact noted in the arrest memo;

(f) a nominated person (as per details provided by the person arrested) of the person arrested should be informed immediately and this fact also may be mentioned in the arrest memo;

(g) the date and time of arrest may be mentioned in the arrest memo and the arrest memo should be given to person arrested under proper acknowledgement;

(h) a separate arrest memo has to be made and provided to each person arrested.

5.4 Further there are certain modalities that should be complied with at the time of arrest and pursuant to an arrest, which include the following:-

(i) Arrest of a female should be carried out by or in the presence of a lady officer;

(ii) Arrest memo should be attested by nominated person (such as member of family) of the person arrested or a respectable member of the locality from where the arrest is made;

(iii) Medical examination of the arrested person should be conducted by a medical officer in the service of Central or State Governments and in case such medical officer in not available, by a registered medical practitioner soon after the arrest is made. If an arrested person is a female then such an examination shall be made only by, or under supervision of a female medical officer, and in case such female medical officer is not available, by a female registered medical practitioner;

(iv) It shall be the duty of the officer having the custody of the arrested person to take reasonable care of the health and safety of the person arrested.

Reports to be sent

6.0 Chief Commissioners shall send a report on every arrest to the Zonal Member within 24 hours of the arrest giving such details as have been prescribed in the monthly report. To maintain an all India record of arrests made in Central Excise, a monthly report of all persons arrested in the Zone shall be sent by the Chief Commissioner to the DGCEI, Headquarters, New Delhi in the format, hereby prescribed and enclosed, by the 5th of the succeeding month.