ICSI - WIRC FOCUS

Vol. XXX • No. 13 •Jan 2014

Chairman’s Blog

You cannot believe in God until you believe in yourself.

You cannot believe in God until you believe in yourself.

- Swami Vivekanand

My Dear Professional Friends,

Year 2014 is expected to be as eventful as Year 2013 for company secretaries, with the coming into effect of the Companies Act, 2013, in its entirety along with Rules. The learning process, which started during the later half of 2013, will continue and will keep us all busy in understanding and interpreting the provisions of the Companies Act, 2013. I wish a successful and eventful year 2014 to all of you when I demit the august office of the Chairman, ICSI - WIRC.

I know that each New Year unfolds with some new initiatives, new resolutions, new agenda and new hopes and ICSI-WIRC cannot be any exception. The profession continues to, and has to develop every year, and the elected leadership is just an iota of the entire fraternity, which has onerous task to contribute its mite and lead it from the front. But at the same time, the success of any leader or organization can be attributed only to the contribution, co-operation, dedication and devotion of the members. I was indeed fortunate to have been entrusted the job of heading the Best Regional Council of ICSI. The voluntary position especially in a body of professionals bestow huge amount of accountability. I know that there is always “unfinished agenda” at the end of any tenure, but I believe that I have been able to implement some important decisions and have put in best of my efforts during my tenure as Chairman of ICSI – WIRC.

Friends, to be at the helm of affairs of the Region which is the recipient of the Best Regional Council Award is always an uphill task. I am indeed fortunate that with the continuous support of a spirited team, which also included the members of various committees we have accomplished many innovative things during this magnificent year.

I am sure that most of you are aware of the Fourteen Golden Principles of Management prescribed by Sir Henry Fayol. The first among the principle is Division of Work and the last being Espirit d corps which means Team Work. Similarly though we formed various committees under various council members, it is finally the “Entire Team” which has set the ‘Tone at the Top’. The word TEAM signifies TOGETHER EVERYONE ACHIEVE MORE and that actually happened in Year 2013. I would like to highlight some of the milestones which we have achieved in Year 2013.

In pursuit of the ‘Green Initiative’ which is more by compulsion than by choice, we came out with e-focus, which is welcomed by all. The year witnessed maximum number of enrolments to CSBF from the Western Region due to special personal efforts.

The renovation of two offices of WIRC on the 5th Floor of Jolly Maker Chambers II, Nariman Point, Mumbai finally happened after acquisition of the premises in the year 2009. The Inaugural function was organized on December 13, 2013 in the august presence of CS S N Ananthasubramanian, President, the ICSI, CS Harish K Vaid, Vice President and CS M S Sahoo, Secretary, the ICSI and other Council and Regional Council members. This year we could also repay the entire overdue loan to the Head Office which was availed for purchase of premises in 2009. I am glad that with the co-operation of CS S N Ananthasubramanian, President, the ICSI, the repayment of the balance unpaid loan of Rs. 2.25 crores was waived by the ICSI, HO.

The Professional Development Committee which was headed by CS Prakash K Pandya has done an outstanding and enviable work during this year with many innovative programs. We made the on-line registration compulsory for all the programs. We have also organized many new programs like “Enhance Your Effectiveness” and topics of contemporary relevance. I must make a mention that there were at least three major programs every month including during the monsoons. The Professional Development Committee was instrumental in organizing three mega events during the year i.e. Annual Regional Conference-2013 at Ahmedabad, Maharashtra State Conference at Aurangabad and Two Day’s Workshop and Panel Discussions on Companies Act, 2013 at Indore which received overwhelming response of our members and other professionals. The PDC jointly with TEFC also initiated the holding of program for students with the Bombay Stock Exchange.

The Research and Publication Committee which was again headed by CS Prakash K Pandya has also done an excellent job during the year which has come out with five publications on Companies Bill 2012, Supreme Court Judgments on SEBI Act, Rules & Regulations, Foreign Direct Investment, Service Tax, Transfer Pricing. The publications undoubtedly were well appreciated and received by the members. The year has also seen a remarkable increase in sale of publications.

The Training &, Educational Facilities Committee which was headed by CS Amit Kumar Jain also performed well during the year. The MSOP of ICSI-WIRC is one of the best MSOPs organized in the country with tailor made curriculum where there is a good blend of soft skills and technical sessions. 10 MSOPs were held by ICSI – WIRC during the year. The Committee also organized various conferences across the region during the year jointly with Raipur and Aurangabad Chapters. The Class Room Teaching Centres were established at eminent educational institutions like R A Podar College, Matunga and N M College, Vile Parle, Mumbai and at Vikas College, Vikhroli, Mumbai. The Class Room Teaching Centres at R A Podar College was inaugurated by CS S N Ananthasubramanian, President and the alumni of the College. The All-India Elocution Competition – 2013 was organized by ICSI – WIRC during the year.

The Cultural, Sports & Health Committee which was headed by CS Hitesh Kothari and the PCS Committee headed by CS Ashish Doshi has also done a commendable job by organizing various programs during the year.

ICSI – WIRC introduced “Talentick” a Placement Initiative of ICSI-WIRC in collaboration with Camplace Pvt. Ltd. “Talentick” is a platform through which students / members can have interface with prospective trainers/employers. The efforts of CS Makarand Lele in this initiative need a special mention.

During the year, around 70 Investor Awareness Programs were conducted by ICSI –WIRC in association with BSE and MCA at prominent Universities and Management Schools.

In the various activities taken up by WIRC, the Chapters of the Region had shown tremendous enthusiasm and had come forward with proposals for organizing various programs. The chairmen and managing committee members of all the Chapters need special compliments for their dedication, and for successfully conducting various programs, which included conferences and competitions.

With the untiring efforts of Regional Council members and WIRO staff we could achieve the greatest milestone by becoming the BEST REGIONAL COUNCIL FOR THE YEAR 2012. I must thank the entire Regional Council particularly CS Mahavir Lunawat, the then Chairman, staff members of WIRO and all others who have contributed directly or in directly in this first-ever feat.

I take this opportunity to thank all the regional council/council members, staff of WIRO, members from the media and press, members from academician, BSE, MCA and all others who have helped ICSI-WIRC to achieve various milestones. I thank all the co-ordinators of ICSI-WIRC study circle for the selfless efforts which they have put during the year. I must also thank CS Gopal Chalam, Dean, ICSI-CCGRT, Navi Mumbai who always supported ICSI-WIRC. I am also thankful to Team FOCUS – authors and editorial team, and also the faculty who have been part of ICSI – WIRC.

Lastly I express sincere gratitude to CS M.S. Sahoo, Secretary, and CS Sutanu Sinha, Chief Executive, the ICSI and all the Directorates of ICSI for their co-operation and support during the year.

I wish the members in the Regional Council all the very best and pray to bestow the wisdom to take the initiatives with same vigor in future.

I would like to bid adieu as Chairman with a famous quote of Alice Walker who quoted 'Thank you' is the best prayer that anyone could say. I say that one a lot. Thank you expresses extreme gratitude, humility, and understanding.

With Best Wishes for 2014 and beyond….

With Warm Regards,

CS Hitesh Buch

Chairman

ICSI-WIRC

18th January, 2014

Editorial Board

Photo Feature

Annual Return Under Companies Act, 2013

The Companies Bill, 2012 was passed by the Lok Sabha on 18th December, 2012 and by the Rajya Sabha on 8th August, 2013. Now this Bill is

known as The Companies Act, 2013. The Companies Act, 2013 has widened the scope of Company Secretaries. The duties, responsibilities, roles etc.

of the Company Secretaries has increased much more than what was there under the Companies Act, 1956. Scope of the Company Secretary in practice

has also increased as the Companies Act, 2013 requires compulsory certification of a Practicing Company Secretary on many documents.

The Companies Bill, 2012 was passed by the Lok Sabha on 18th December, 2012 and by the Rajya Sabha on 8th August, 2013. Now this Bill is

known as The Companies Act, 2013. The Companies Act, 2013 has widened the scope of Company Secretaries. The duties, responsibilities, roles etc.

of the Company Secretaries has increased much more than what was there under the Companies Act, 1956. Scope of the Company Secretary in practice

has also increased as the Companies Act, 2013 requires compulsory certification of a Practicing Company Secretary on many documents.

Section 92 of the Companies Act, 2013 deals with annual return. This section is still not yet notified by the Central Government. However it expected to be notified soon. The detailed provision of this section is as follows:

• Every company shall prepare a return (hereinafter referred to as the annual return) in the prescribed form containing the particulars as they stood on the close of the financial year regarding—

(a) its registered office, principal business activities, particulars of its holding, subsidiary and associate companies;

(b) its shares, debentures and other securities and shareholding pattern; .

(c) its indebtedness;

(d) its members and debenture-holders along with changes therein since the close of the previous financial year;

(e) its promoters, directors, key managerial personnel along with changes therein since the close of the previous financial year;

(f) meetings of members or a class thereof, Board and its various committees along with attendance details;

(g) remuneration of directors and key managerial personnel;

(h) penalty or punishment imposed on the company, its directors or officers and details of compounding of offences and appeals made against such penalty or punishment;

(i) matters relating to certification of compliances, disclosures as may be prescribed;

(j) details, as may be prescribed, in respect of shares held by or on behalf of the Foreign Institutional Investors indicating their names, addresses, countries of incorporation, registration and percentage of shareholding held by them; and

(k) such other matters as may be prescribed.

The annual return has to be signed by the director and the Company Secretary. In case the Company does not have a Company Secretary then by a Company Secretary in practice.

• In case of One Person Company and small Company the annual return shall be signed by the Company Secretary. If there is no Company Secretary then the Annual Return has to be signed by the director of the Company.

• In case of Listed Company or the Company having such paid up Capital and turnover as may be prescribed, the annual return has to be certified be a Company Secretary in practice in the prescribed form stating that the annual return discloses the facts correctly and adequately and that the Company has complied with all the provisions of this Act. As per the draft rules the paid up Capital is Rupees five crore or more and turnover is Rupees twenty five crore or more. But there may be changes in the paid up Capital and turnover as the rules are not yet notified.

• The extract of the annual return in such a form as may be prescribed shall form part of the Board’s report.

• Every Company has to file the annual return with the Registrar of Companies (ROC) within sixty days from the date of its annual general meeting. If the annual general meeting of the Company is not held in any year then the company has to file the annual return within sixty days from the date on which the annual general meeting should have been held (due date) together with the statement specifying the reasons for not holding the annual general meeting and payment of such fees or additional fees as may be prescribed within the time as specified under Section 403 of the Companies Act, 2013.

If the Company fails to file the annual return within the prescribed time then the Company shall be punishable with a fine which shall not be less than Rupees Fifty thousand but which may extend upto Rupees Five lacs. Every officer of the Company who is in default shall be punishable with imprisonment for a term which may extend to six months or with fine which shall not be less than Rupees Fifty thousand but which may extend upto Rupees Five Lacs or with both. If the Company Secretary in practice certifies the annual return otherwise than in conformity with the requirements of this section or the rules made thereunder, he shall be punishable with fine which shall not be less than Rupees Fifty thousand but which may extend upto Rupees Five lacs.

Conclusion

Every Company should file the annual return of its Company on time as the penal provisions are quite high.

Company Secretary in employment and Company in practice have to ensure that the annual return is prepared with utmost care and is in conformity with the requirements of the Section 92 and rules made there under.

Appointment and/or remuneration of managing or whole-time director - Whether a board resolution for constitutes a contract or arrangement under section 299 of the Companies Act

The statutory provision as to director’s interests in contracts

The statutory provision as to director’s interests in contracts

Section 299(1) of the Companies Act 1956 ('the Act') requires every director of a company who is in any way, whether directly or indirectly, concerned or interested in a contract or arrangement, or proposed contract or arrangement, entered into or to be entered into, by or on behalf of the company, to disclose the nature of his concern or interest at a meeting of the Board of directors.”

Section 299 applies to arrangements, besides contracts, in which a director is concerned or interested ‘in any way’, ‘whether directly or indirectly’, eg, a contract in which a director is interested through his relatives [Pydah Venkatachalapati v Guntur Cotton, Jute & Paper Mills Co Ltd AIR 1929 Mad 353].

Nature of relationship between a company and its managing director

There are several court decisions holding the relationship between a company and its managing director is contractual and the contract is the contract of employment.

In one case, Anderson v James Sutherland (Peterhead) Ltd. 1941 AC 203, the question was whether the managing director was 'employed' by the company in any capacity. The managing director had claimed that he was not employed by the company, but that his position was an office or function of a director, i.e. he was an ordinary director entrusted with some special powers. However, this argument was rejected, and it was held that the proposition that a director can be regarded as having not only the persona of director but also the persona of employee was plain from the case of Beeton & Co In re (1913) 2 Ch 279. Lord Normand summarised the position as follows:

"In my opinion, therefore, the managing director has two functions and two capacities. Qua managing director he is a party to a contract with the company, and this contract is a contract of employment; more specifically I am of opinion that it is a contract of service and not a contract for services. There is nothing anomalous in this; indeed it is a common place of law that the same individual may have two or more capacities, each including special rights and duties in relation to the same thing or matter or in relation to the same persons."

There may be a formal contract between a managing director and the company, evidencing the contractual relationship between the two. However, in the absence of a formal agreement the relationship may be established by an implied contract. Where a managing director is appointed, and acts as such, in accordance with the company's articles, and no separate formal contract is entered into, the existence of an implied contract may be inferred, although the articles do not constitute a contract between the company and the managing director qua managing director. An implied contract on the terms of the company's articles, which included a provision regarding managing director, was held to have been proved in absence of a formal express contract. The court observed:

"A contract may be either express or implied. An express contract can be proved by written or spoken words which constitute an agreement between the parties and an implied contract, on the other hand, may be proved by circumstantial evidence of an agreement. A contract may also be of a mixed character, that is, partly expressed in words and partly implied from acts of the parties and circumstances [Sardar Gulab Singh v Punjab Zamindara Bank Ltd. (1941) 11 Comp Cas 301 (Lahore)].

In Sardar Gulab Singh's case it was held that as the contract between the managing director and the company could not be specifically enforced and as the breach of such contract could be adequately compensated, an injunction should not be issued. The Court did not agree to the proposition that a managing director could be called an employee or servant (although it applied the same principles as to the issue of an injunction as they apply when a dismissed employee or servant would seek an injunction), but the Calcutta High Court treated the managing director as an employee and refused to grant an injunction against his removal, inasmuch as the court would not compel a company to keep one of its employees as the court does not enforce an agreement for employment specifically in case of personal service, and no court can compel an unwilling employer to keep a particular employee in whom the employer has lost confidence [Jogindar Singh Palta v Time Travels Pvt Ltd. (1984) 56 Comp Cas 103 (Cal); See also Gobind Pritamdas Malkani v Amarendra Nath Sircar (1980) 50 Comp Cas 219 (Cal).]

Whether appointment of a director is a contract or arrangement

It has been held that appointment of an additional director is not a contract or arrangement under this section [Madras Tube Co. Ltd. v Hari Kishen Somany (1985) 1 Comp LJ 195 (Mad): Shailesh Harilal Shah v Matushree Textiles Ltd. (1994) 2 Comp LJ 291 (Bom): (1995) 82 Comp Cas 5: (1994) 14 CLA 177].

However in Foster v Foster (1916) 1 Ch 532, Article 93 of a company provided that a director might contract with the company but prohibited a director from voting in respect of any contract in which he was interested, and under Article 99 the directors "may from time to time appoint any one or more of their body to be managing director or directors, for such period, at such remuneration and upon such terms as the directors think fit".

One Mrs. Foster who was one of the directors was appointed as chairman and joint managing director of the company without remuneration. The resolution appointing her to this office was passed at a meeting of the Board at which she was present and in which she voted, and the validity of those appointments was challenged on the ground of contravention of Article 93. Peterson J. rejected this contention by saying:

"... the appointment by the Directors of one of their body as chairman, or the appointment by the directors of one of their number as a managing director, without more is not a contract within Article 93, but is merely a delegation of their powers and is very similar to the power which they possess to appoint committees of themselves and delegate their powers to those committees. In my judgment, therefore, the appointments in question were not contracts within Article 93, and therefore Mrs. Foster was not disabled from voting in support of the resolutions."

On the question whether the provisions of the articles of a company requiring a director to disclose his interest in service contracts with a director, Paterson J said:

"In my judgment, if a resolution is passed at a directors' meeting that one of the directors be appointed a managing director at a remuneration and that director is present and accepts the appointment, there is a contract between the company and the director, and the director is not under article 93 able to vote in support of such a contract".

This issue has been dealt with by the Queen's Bench Division in its decision, Runciman v Walter Runciman Plc (1992) BCLC 1084 (QBD) where the learned judge observed:

".... to exclude service contracts from the ambit of section 317 (of the English Companies Act 1985, corresponding to section 299) would involve ridiculous and pointless distinctions being drawn: (a) between the employed and the self-employed director; and (b) between benefits given to a director as part of his contract of employment and those given separately. Finally on this point the defendants drew my attention to Foster v Foster All ER Rep 856 a decision holding in terms that the statutory predecessor to section 317 applied to service contracts ... And I accept too the defendants' fundamental argument that a variation of contract is itself a contract and that to construe section 317 otherwise would lead to pointless debate about whether a given agreement constitutes a variation or a fresh contract. Looking moreover to the purpose of the legislation and the mischief against which it is directed, there will certainly be cases where it is necessary for an interest to be declared in a variation of contract as in the making of the contract in the first place; take Guinness and suppose that the consideration for Ward's services had initially and in conformity with the articles been agreed at 5,000 and only later varied to the eventual figure of 5.2 m."

Conclusion

In conclusion, the relationship between a company and its managing director is contractual and the contract is the contract of employment. This contract is evidenced by either a resolution by which the managing director is appointed and, additionally, a formal agreement and hence it is a contract (and in any case arrangement) in which a director is interested (the managing director himself and besides his relative, if any, who is a director of the company) requiring disclosure of his interest as required by section 299 and also compliance with sections 300 and 301. This is equally applicable in the case of appointment of a whole-time director.

FAQs on Related Party Transactions

Related Party Transactions have always been a topic of dispute between corporates and the regulators, with some taking undue advantage of their stake in the organization to advance their personal interest. Concerns have been expressed on such abusive related party transactions in the international platform as well with majority shareholders expropriating wealth at the expense of unrelated shareholders. The Organisation for Economic Co-operation and Development (OECD) had come out with its Guide on Fighting Abusive Related Party Transactions in Asia, in 2009, wherein it discussed a framework of monitoring, approval and disclosure based system for curbing such abusive related party transactions.

Related Party Transactions have always been a topic of dispute between corporates and the regulators, with some taking undue advantage of their stake in the organization to advance their personal interest. Concerns have been expressed on such abusive related party transactions in the international platform as well with majority shareholders expropriating wealth at the expense of unrelated shareholders. The Organisation for Economic Co-operation and Development (OECD) had come out with its Guide on Fighting Abusive Related Party Transactions in Asia, in 2009, wherein it discussed a framework of monitoring, approval and disclosure based system for curbing such abusive related party transactions.

The Corporate Governance norms of various jurisdictions provides measures and safeguards based on approvals and

disclosures before entering into transactions with related parties. Interestingly, the Companies Act, 1956 (“Act, 1956”) did not contain any provision relating to who shall be considered as related party in relation to a company. The only authoritative definition was available under the Accounting Standard 18 (AS-18).

disclosures before entering into transactions with related parties. Interestingly, the Companies Act, 1956 (“Act, 1956”) did not contain any provision relating to who shall be considered as related party in relation to a company. The only authoritative definition was available under the Accounting Standard 18 (AS-18).

However, the term ‘related party’ finds a new and wider definition under the new Companies Act, 2013 (“Act, 2013”) alongwith controlling regulations relating to doing business with such related parties. Though now we have two barometers to judge related party transactions – Act, 2013 and AS 18, the purpose of both the laws differ. The Act, 2013 aims at a more approval based regime to curb abusive RPTs, whereas AS 18 is disclosure based. The Article aims at answering certain practical questions that may arise in view of new Act. The answers can be best understood if they are read seriatim.

1. Who are ‘Related Parties’?

Section 2(76) of the Act, 2013 defines the term ‘related party’ with reference to a company, as under:

(i) A director / KMP / their relatives;

(ii) A firm, in which a director / manager / their relative is a partner;

(iii) A private company, in which a director / manager is a member or director;

(iv) A public company, in which a director / manager is a director or holds alongwith his relatives, more than 2% of its paid-up share capital;

(v) A body corporate, whose Board of Directors / managing director / manager is accustomed to act in accordance with the advice, directions or instructions of a director or manager, other than in professional capacity;

(vi) Any person on whose advice, directions or instructions a director or manager is accustomed to act, other than in professional capacity

(vii) any company which is a holding / subsidiary / fellow subsidiary /associate company of the other company

(viii) such other person as may be prescribed;

Draft Rule 1.3 provides that the addition following persons, with reference to a company, shall be deemed to be a related party:

(1) a director or key managerial personnel of the holding, subsidiary or associate company of such company or his relative;

(2) any person appointed in senior management in the company or its holding, subsidiary or associate company i.e. personnel of the company or its holding, subsidiary or associate company who are members of core management team excluding Board of directors comprising all members of management one level below the executive directors, including the functional heads.

For the definitions of ‘key managerial personnel’ and ‘relative’, Sections 2(51) and 2(77) of the Act, 2013 has to be referred to along with the draft rules on the same.

2. What happens when the other party is a related party?

Section 188 of the Act, 2013 imposes certain restrictions on transactions between related parties. Thus if the other party is a related party, as defined under Section 2(76) of the Act, 2013, these restrictions will apply on such related party.

3. Why are such restrictions and disclosures required for RPTs?

Transactions between related parties have always been a cause of concern for the regulators and law makers since such transactions can be disguised to promote personal gains. Many corporates, in the guise of RPTs, have misused their controlling status to the detriment of the minority. Such abusive related party transactions dent the confidence of the investors and have damaged market integrity through inequitable treatment of shareholders.

A need was felt to deal with such abusive RPTs and accordingly approvals and disclosure requirements for the RPTs were enacted.

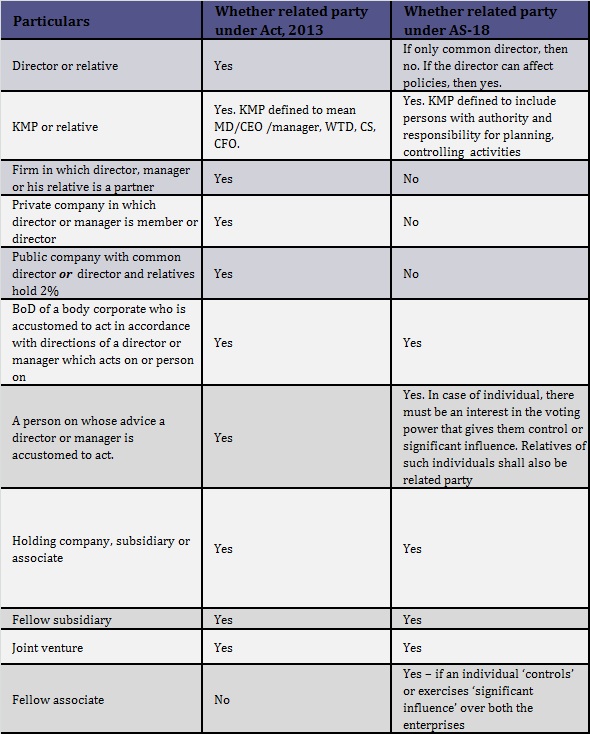

4. Is the meaning of related party same in Companies Act and accounting standards?

No. The definition of related party under the Act, 2013 is much wider than in AS 18. Parties would be considered as related under AS 18 if one party has the ability to control the other party or exercise significant influence over the other party in making financial and/or operating decisions. Thus, the two essential ingredients for determining related party status under AS 18 is control and significant influence. However, under the Act, 2013 a director / KMP / their relatives shall be considered as ‘related party’ to the company, merely by virtue of their being a director / KMP.

To illustrate the above view, let us have a look at the following table:

AS 18 also specifically provides that two parties shall not be deemed to be related parties merely by virtue of common directorship. The same cannot be said to be the case under the Act, 2013 (for more details refer Questions 5 and 6).

The draft rules to the Act, 2013 also provides that a director or KMP of the holding, subsidiary or associate company of such company or their relatives shall also be deemed to be related to the company. Senior managerial personnel (SMP) of the company or holding, subsidiary or associate company of such company shall be related party under the draft rules.

1. If A is related to B, does it mean that B is related to A?

The answer is No. If A is related to B, this does not essentially mean that B is also related to A. One has to refer to the definition of ‘related party’ under the Act, 2013 to establish the relationship of related party.

For instance, Company A is accustomed to act according to the directions of Company B, however, Company B is not accustomed to act according to the directions of Company A. In this case, though B is a related party to A, A is not a related party to B.

2. In case of 2 private companies, if there is a common director, are they related parties?

Yes. Section 2 (76) (iv) of the Act, 2013 provides that if a director or manager of any company (private or public) is a director or member in private company, then the private company would be a related party to the other company. Therefore two private companies will be treated as related parties in case of common directorship.

3. In case of 2 public companies, if there is a common director, are they related parties?

The answer would be Yes. Section 2 (76) (v) of the Act, 2013 provides that if a director or manager of any company is a director or holds alongwith his relatives more than 2% of the paid up share capital of a public company, then such public company would be treated as a related party to the other company. The presence or between the sentence implies that the two conditions are independent of each other. Accordingly, common directors in 2 public companies will attract the definition of related pary.

From the above, we can also deduce that if such director of one company is holding alongwith his relatives more than 2% of the paid up share capital of the other public company, the two companies shall be related to each other.

4. Will two companies be related party if:

(i) If a KMP of one company is KMP of another company?

(ii) Senior Management Personnel (SMP) of one company is SMP of another company?

(iii) If a KMP of one company is a director in another company?

(iv) If a SMP of one company is a director in another company?

The above questions are answered seriatim:

(i) Per Se, the Act, 2013 does not provide that common KMPs between two companies will make them ‘related party’. However if the common KMP is a director (either managing director / whole-time director), the two companies shall be deemed to be related party.

(ii) The concept of a SMP is provided under the draft rules, which are yet to be finalized. However the rule does not provide that two companies would be related if they have common SMP.

(iii) The answer to this Question has two parts:

(a) Where the KMP is a managing director / whole-time director / manager – In this case if such KMP is a director in another company, the two companies shall be related.

(b) Where the KMP is a CEO (who is not a director) / CS / CFO – If such a KMP is a director in another company, the two companies shall not be considered as related parties. This follows from the fact that a person, first has to be a director / manager in a company A and thereafter a director in company B, for B to be a related party to A.

(iv) As per draft rules, if a SMP of company A is a director of company B, the two companies will not be related. However a SMP of a holding / subsidiary / associate company of company A will be treated as a ‘related party’ to company A.

5. A director in company A does not hold any shares in public company B. However his ‘relatives’ hold more than 2% of the paid up share capital in B. Will A and B still be related?

Section 2 (76) (v) of the Act, 2013 provides that if a director in one company holds alongwith his relatives, more than 2% of the paid up share capital in a public company, the two companies would be related.

In this case, the director of A is not holding any shares in B; however his relatives are holding more than 2% of the paid up share capital in B. Here, though the director is not holding any shares in B, however, he alongwith his relatives is still holding more than 2% of the paid up share capital in B. Here the expression alongwith will have to be seen in an expansive sense and not in a restrictive sense. It will not serve the purpose of the definition if a director could get away with the impact of the section merely by parking his interest in B in the name of his relatives.

Therefore, A and B will be related parties under the Act, 2013.

6. Which types of contracts between related parties are prohibited under the Act, 2013, except with the consent of the Board of Directors?

Section 188 of the Act, 2013 provides that a company will not enter into any contract or arrangement with a related party (RPT) with respect to the following, except by passing a resolution at a meeting of the Board of Directors:

(a) sale, purchase or supply of any goods or materials;

(b) selling or otherwise disposing of, or buying, property of any kind;

(c) leasing of property of any kind;

(d) availing or rendering of any services;

(e) appointment of any agent for purchase or sale of goods, materials, services or property;

(f) such related party's appointment to any office or place of profit in the company, its subsidiary company or associate company; and

(g) underwriting the subscription of any securities or derivatives thereof, of the company.

Also, the draft rules provide that where any director is interested in any of the aforesaid RPTs, he shall not be present in the meeting in which such discussions take place.

7. Will the provisions of the Act, 2013 be applicable on RPTs other than the abovementioned list of RPTs?

The Act, 2013 seeks to regulate only the RPTs mentioned under Section 188 (1), as above. Therefore it can be said that RPTs outside such list will fall outside the purview of Section 188.

8. Does this mean that all of the above transactions, mentioned in Question 10 above, can be entered into by any company with a related party merely by passing a Board resolution?

Section 188 (1) of the Act provides that a company can enter into the above contracts / arrangements by passing a board resolution.

However the first proviso to Section 188 (1) to the Act, 2013 read with the draft rules provide that companies with paid-up share capital of Rs. 1 crore or more shall not enter into any of the above contracts / arrangements, except by passing of a special resolution at a meeting of the members of the company.

The draft rules also provide that, except with the prior approval of the members of the company by way of special resolution, a company shall not enter into the above RPTs, where the RPTs to be entered into:

(a) individually or taken together with previous RPTs during a financial year, exceeds 5% of the annual turnover or 20% of the net worth of the company as per its last audited financial statements, whichever is higher.

(b) relates to appointment to any office or place of profit in the company, its subsidiary company or associate company at a monthly remuneration exceeding Rs. 1 lakh.

(c) is for a remuneration for underwriting the subscription of any securities or derivatives thereof of the company exceeding Rs. 10 lakh.

9. Does this mean that a company having a paid up share capital of less than Rs. 1 crore, need not pass a special resolution for entering into a RPT?

The answer is No. The draft rules provide that a special resolution will be required to be passed either if the company:

(i) Has a paid up share capital of Rs. 1 crore or more; or

(ii) The company is entering into any of the transactions enumerated in (a) to (c) under Question 10 above.

Accordingly, even if the company is not having a paid up share capital of Rs. 1 crore, but is entering into any of the transactions enumerated in (a) to (c) under Question 10 above, it has to pass a special resolution.

10. Will a company with paid up share capital of Rs, 1 crore or more need to take approval from the Central Government for entering into a RPT, as required under the Act, 1956?

No. The requirement of taking prior Central Government approval by companies with paid up share capital of Rs. 1 crore or more has been done away with. The special resolution passed by the members approving such transactions will suffice.

11. A is a member of company B, and is also a related party to B. In this scenario, can A vote on the special resolution to be passed by B for entering into a RPT?

The answer would be No. The second proviso to Section 188 (1) of the Act, 2013 provides that no member, who is also a related party, can vote on a special resolution, to approve any contract or arrangement which may be entered into by the company.

Therefore X, being a related party to Y, cannot vote on a special resolution requiring approval of members for entering into a RPT.

12. A is a related party to B but is not interested in the special resolution for RPT. Can A vote on the special resolution to be passed for entering in a RPT?

No. The section clearly implies that even if A is not interested in the related party contract or arrangement, merely by virtue of his being a ‘related party’ to Y, he is prohibited from voting on such resolution. Neither do the draft rules state anything to the contrary.

13. In light to the answer to Question 15, what will be the position in case of a wholly owned subsidiary company, where the holding company is the only member of the subsidiary and is also a related party?

The Act, 2013 does not provide any clarity to this aspect. However, the draft rules to the Act, 2013 provides that in case of wholly owned subsidiaries, the special resolution passed by the holding company shall be sufficient for the purpose of entering into the RPT between a wholly owned subsidiary and holding company, i.e. the wholly owned subsidiary will not need to separately pass a special resolution.

Accordingly, this rule, if implemented, will act as an exception to the second proviso to Section 188 (1) of the Act, 2013.

14. Can we presume that the disinterested minority shareholders will now dictate the results of the special resolution which may negatively impact a Company and create a situation of deadlock?

The language of the Section 188 seems to imply as much.

Imagine a scenario where 60% of the majority shareholding in A is held by related parties. Now, if A was to enter into a RPT, then the 60% majority are prohibited from voting in the general meeting, which mean that only the remaining 40% disinterested shareholders would vote. Since, approvals under Section 188 are to be taken by special resolution, 30% approval of disinterested shareholders would be required. In this way, any shareholder holding 10% or more in A can impede any such RPT from being passed which can make functioning of companies difficult, resulting in a situation of ‘hung companies’.

15. Will related party transactions entered into in the ‘ordinary course of business’ require to be passed by such special resolutions?

The third proviso to Section 188 (1) of the Act, 2013 provides that the company will not require the approval of the Board and / or shareholders provided the transactions are entered into by the company with the related party:

(i) in the ordinary course of business; and

(ii) such transactions are on an arms’ length basis

Accordingly, any transaction which takes place in the ordinary course of business, but is not on an arms’ length basis will be covered under the provisions of Section 188 (1) of the Act, 2013.

16. Will RPTs which are on an arms’ length basis but does not take place in the ordinary course of business be covered by the provisions of Section 188 (1) of the Act, 2013?

Yes. A RPT to be exempted from the provisions of Section 188 (1) of the Act, 2013 must necessarily be in the ordinary course of business. It is prerequisite for availing the exemption.

Accordingly, RPTs on an arms’ length basis but not in the ordinary course of business will be covered by the provisions of Section 188 (1) of the Act, 2013.

17. Which RPTs will be considered as arms’ length transaction?

Arms’ length transaction, as provided under the Act, 2013 means a transaction between two related parties that is conducted as if they were unrelated, so that there is no conflict of interest.

This, in essence, it means that those RPTs which are on terms, including consideration, not biased by the fact of relationship between the parties, will be considered as arms’ length transaction. Accordingly, every aspect of the transaction must be at arms’ length, for instance – pricing, credit terms, repayment, interest rates etc.

18. Has any criteria been prescribed for determining which RPTs has been entered into on an arms’ length basis?

No. The Act, 2013 does not prescribe any criteria for determining whether the RPT was entered into on an arms’ length basis. It would, therefore, be a subjective decision to be decided upon by the Board of Directors of every company.

19. Has any exemption been given to transactions between holding and subsidiary companies, considering that most of the transactions between them can never be on arms’ length basis?

The very concept of a holding subsidiary relationship is that the subsidiaries mainly thrive on the transactions with their holding companies. However, no exemption has been given to holding subsidiary transactions which are not on an arms’ length transactions. This will make passing of resolutions between them difficult, especially when special resolution is required to be passed by the companies.

20. Does it mean that RPTs which are in the ordinary course of business and on an arms’ length basis will not be required to be passed by the Board?

The Act, 2013 provides that nothing contained in Section 188 (1) shall apply to RPTs which are in the ordinary course of business and on an arms’ length basis. Accordingly, it can be derived that RPTs in the ordinary course of business and on an arms’ length basis will not require a board resolution.

However, all RPTs entered into by a company alongwith any modifications to the same will require prior approval of the Audit Committee of the company, if any. Therefore, it seems that while all arms’ length transactions in ordinary course of business with related parties are not required to be approved by the Board or shareholders, they would still require approval of the Audit Committee, if any.

21. Are directors liable for any loss suffered by the company with respect to RPTs?

The Act, 2013 imposed special liability on directors with regard to RPTs.

(1) Section 188 (3) of the Act provides that any RPTs entered into by a director or any other employee, without prior approval of the Board or passing of special resolution by the shareholders, if required, the transaction needs to be ratified by the necessary resolution within 3 months of entering into such RTPs. If the same is not ratified within the said 3 months:

(i) The RPT shall become voidable at the instance of the Board; and

(ii) If the RTP is with a related party to any director, or is authorised by any other director, the director(s) concerned shall indemnify the company against any loss incurred by it.

(2) Section 188 (4) further provides that where any RTP has been entered in contravention of the provisions of Section 188, and any loss has been occurred due to such contract, the company has power to initiate any proceeding against director or employee who has entered into such contract or arrangement.

(3) Furthering such liability on directors with regard to RTPs, Section 164 provides that a person who has been convicted of an offence relating to RPTs during the preceding 5 years, he shall be disqualified for appointment as a director of any other company.

22. Can criminal liability be imposed on a director who has been convicted for contravention of Section 188?

Section 188 (5) of the Act, 2013 provides that any director or employee of the company who had entered into or authorised the contract or arrangement in violation of the provisions of this section shall:

(i) in case of listed company, be punishable with imprisonment for a term which may extend to 1 year or with fine which shall not be less than Rs. 25,000 but which may extend to Rs. 5,00,000, or with both; and

(ii) in case of any other company, be punishable with fine which shall not be less than Rs. 25,000 but which may extend to Rs. 5,00,000.

Accordingly directors or employees of only listed companies may face criminal liability in case they have been convicted for contravention of provisions of Section 188.

23. Are the indemnifying provisions under section 188 (3) and prosecution liability under section 188 (5) the same?

No, both are different provisions and effective under different situations.

The indemnifying provision under section 188 (3) will become applicable against a director only if the company has suffered a loss on account of an RPT entered into in violation of the provisions of section 188 (1). Accordingly if the company has not suffered a loss or has gained from such RPT, this provision will not be applicable.

However, the prosecution liability under section 188 (5) of the Act, 2013 will become enforceable in the event of a violation of the provisions of the section, irrespective of the fact that the company stands to lose or gain from the RPT.

24. Are independent directors required to exercise additional precaution in relation to RPTs?

Schedule IV to the Act, 2013, which spells out the mandatory Code of Conduct for independent directors, casts additional duty upon independent directors to:

(i) pay sufficient attention and ensure that adequate deliberations are held before approving RPTs; and

(ii) assure themselves that the same are in the interest of the company.

In any event, the liabilities attached to directors under Section 188 of the Act, 2013 will apply to such independent directors as well. Non-executive and independent directors are entitled to immunity from prosecution under Section 188 only when they can demonstrate evidence of due diligence.

25. What is the role of Audit Committee with regard to RPTs?

The terms of reference of an Audit Committee, as provided under Section 177 of the Act, 2013 has been enhanced to include approval / modification of any RPT entered into by a company. Therefore the Committee has an added responsibility to oversee transactions with related parties and recommend to the Board accordingly.

Further, the Audit Committee has the authority to investigate into any matter falling under its domain and the power to obtain professional advice from external sources and have full access to information contained in the records of the company.

Under the Act, 1956, the audit committee had to merely review RPTs at periodic intervals, which left little scope for effective preventive intervention.

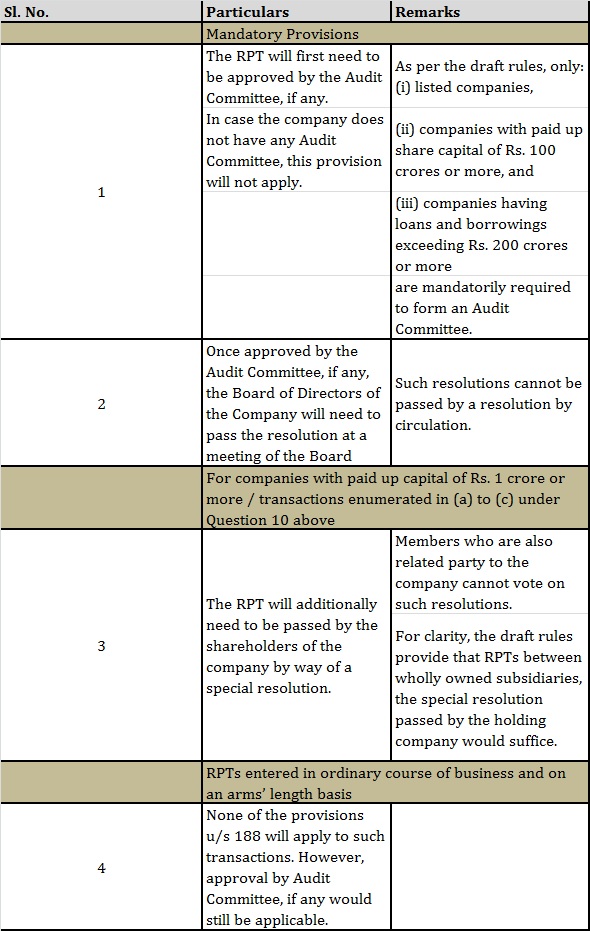

26. Is it mandatory for a company to get its RPTs approved by an Audit Committee?

All companies are not required to form an Audit Committee. Therefore companies not having Audit Committees are not required to get its RPTs approved by the Audit Committee.

However, where a company has an Audit Committee, approval of the RPT by the Audit Committee is necessary since the Committee is required to act in accordance with its terms of reference. Once approved by the Audit Committee, the same may be recommended to the Board for its approval.

27. In short, can you provide the procedure to be followed for entering into RPTs?

32. If a contract is a related party contract as per the Act, 2013, will it require disclosure under AS 18?

No, AS 18 requires disclosures only with regard to transactions which are enumerated under Para 3 to the Standard, which consists of the following;

a) enterprises that directly, or indirectly through one or more intermediaries, control, or are controlled by, or are under common control with, the reporting enterprise (this includes holding companies, subsidiaries and fellow subsidiaries);

b) associates and joint ventures of the reporting enterprise and the investing party or venturer in respect of which the reporting enterprise is an associate or a joint venture;

c) individuals owning, directly or indirectly, an interest in the voting power of the reporting enterprise that gives them control or significant influence over the enterprise, and relatives of any such individual;

d) KMP / their relatives; and

e) enterprises over which any person described in (c) or (d) is able to exercise significant influence. This includes enterprises owned by directors or major shareholders of the reporting enterprise and enterprises that have a member of key management in common with the reporting enterprise.

Transactions with related parties other than as mentioned above will not require disclosure under AS 18.

33. What are the provisions contained in the listing agreement to attend to the problem of abusive RPTs?

The Listing Agreement prescribes disclosure requirements for RPTs. Presently, Clause 32 of the Listing Agreement requires listed entities to disclose ‘Related Party Transactions’ in their annual report in compliance with the provisions of AS 18. Clause 49 of the Listing agreement also provides that material RPTs should be disclosed by the company to the Audit Committee.

In this regard, SEBI, in its consultative paper on Review of Corporate Governance Norms in India discusses certain provisions to curb abusive RPTs by making amendments to the listing agreement. Some of them are as follows:

(a) Divestment of shares in subsidiaries to require prior shareholder approval, which is presently not required under the Act, 1956.

(b) Immediate reporting of material RPTs to the stock exchanges. Presently, such reporting is done only annually where the information reaches the investors much after the transactions were carried out.

(c) Mandating approval of major RPTs by majority of the minority or disinterested shareholders – already incorporated under the Act, 2013.

(d) Pre-approval of RPTs by Audit Committee and encouraging them to refer major RPTs for third party valuation – incorporated under the Act, 2013.

(e) Approval of disinterested / minority shareholders for managerial remuneration beyond a particular limit – incorporated under the Act, 2013.

New provisions on compromises and arrangements– shifting the balance from minority interests to corporate convenience

In an era which beckons increased shareholder activism, the Companies Act, 2013 (“Act, 2013”) also has also in its own way ensured the same. By incorporating provisions relating to class action suits, freezing of assets of company on inquiry and investigation, the Act, 2013 seemed to have given more mileage to the cause of minority shareholder activism. However, the Act, 2013 has also taken a step back by deleting the ‘headcount test’ under section 230(6) and ruling out the opportunity to raise objections by minority shareholders by incorporating proviso to section 230(4). What transpires from these sections is that mileage has clearly been given to corporate convenience. We discuss in detail below about both the provisions in these sub-sections.

In an era which beckons increased shareholder activism, the Companies Act, 2013 (“Act, 2013”) also has also in its own way ensured the same. By incorporating provisions relating to class action suits, freezing of assets of company on inquiry and investigation, the Act, 2013 seemed to have given more mileage to the cause of minority shareholder activism. However, the Act, 2013 has also taken a step back by deleting the ‘headcount test’ under section 230(6) and ruling out the opportunity to raise objections by minority shareholders by incorporating proviso to section 230(4). What transpires from these sections is that mileage has clearly been given to corporate convenience. We discuss in detail below about both the provisions in these sub-sections.

The proviso to section 230(4)

The proviso to section 230(4) of Act, 2013 reads as:

“Provided that any objection to the compromise or arrangement shall be made only by persons holding not less than ten per cent. of the shareholding or having outstanding debt amounting to not less than five per cent. of the total outstanding debt as per the latest audited financial statement.” [emphasis supplied]

Scenario outside India

Section 411(17)(b) of Corporations Act, 2001 in Australia allows a court to not sanction a scheme of arrangement unless a no objection is received from Australian Securities and Investments Commission (“ASIC”). Any member can undertake to the ASIC that he will object to the scheme.

The Report of the JJ Irani Committee and its effect

The JJ Irani Committee in its report dated May 31, 2005 stated that with a vexatious attitude, shareholders with insignificant stake raise objections to a scheme of arrangement. It suggested that only shareholders with a significant stake should be allowed to raise any objection, so as to streamline the procedure of articulation of the minority interest while restricting the obstructionist attitude on the part of any section of minority.

The Act, 2013 resultantly prescribed a minimum threshold for the same under section 230(4). However, where section 230(4) related to serving of notice for a court convened meeting, the inclusion of this proviso seems to be misplaced. The intention behind the JJ Irani committee prescribing such a minimum threshold was to curtail any vexatious attempt to the scheme. This however, did not mean putting a restriction on voting to the scheme itself. Voting being a fundamental right cannot be taken away by way of any statute. What the proviso actually means is that after the court convened meeting, once the scheme comes to the court for the final hearing, the shareholders fulfilling the minimum threshold may raise objections. Where in a court convened meeting, the minority shareholder can raise objection, the same may not hold any value as the majority shareholders may see the resolution approving the scheme through by the value of their votes.

Such minority shareholders could have objected to the scheme by filing affidavits with the court under the Companies Act, 1956. This right has however been taken away by the proviso to section 230(4) because the minimum criteria prescribed may be difficult to achieve.

Interpretation of the word “persons”

Although, the suggestion of the JJ Irani Committee was noble, yet it has actually turned out to be counterproductive by completely ruling out the chance for minority shareholders say holding less than 10% of the shareholding, to raise an objection. What transpires from a reading of the proviso is that only if such minority shareholders hold 10% of total shareholding or have outstanding debt of Rs. 5.00 lakhs will they be able to object to the scheme. Such a threshold may not be easy to muster. Although, Order I to First Schedule of Civil Procedure Code, 1908 allows two or more persons to raise an objection only if they have a common cause, yet in the judicial process the minority shareholders may not be able to voice their concerns at all.

Section 230(6) of Act, 2013

This section corresponds to section 391(4) of Act, 1956. On a plain reading of the section it is clear that the section requires the approval of the scheme of arrangement by the creditors or members of the company. However, a closer look shows that the line “If a majority in number representing three-fourths in value” etc. can actually have a dual meaning. The use of the words ‘number’ and ‘value’ show that under section 391(4) of Act, 1956 approval to a scheme of arrangement requires the majority by way of:

1. Persons in number attending and voting i.e. the ‘headcount test’

2. Value of shares held i.e. ‘voted-share test’

The difficulty in the ‘headcount test’

Since, in a court convened meeting, even proxies can be counted consider the case of an individual attending meeting as a proxy for 50 shareholders. General contention will be to count his vote as only one vote for the purpose of headcount test. However, logic would demand that his votes be counted as 50 since he is acting as proxy for 50 shareholders. Then again, a shareholder may split his shares among various proxies to impede the passing of any resolution by way of headcount test. A similar situation was discussed in the case of In Re. Little Sheep by the Grand Court of Cayman Islands. The applicant company had asked the court to count the nominee of the clearing house as one person and to achieve this, the votes cast in favour of the resolution shall be set off by votes cast against the resolution. The Grand Court held that holding such a view would be “highly artificial”.

The provision of section 391(2) of Act, 1956 is similar to section 206 of United Kingdom Companies, Act 1948. The same language has been used in several other countries like section 411 of Corporate Act, 2001 of Australia and Section 210 of Companies Act, 2001 (1994 Ed) (Cap 50) in Singapore. Also, section 899 of United Kingdom Act, 1985 reads the same as section 391(2) of Act, 1956.

The headcount test came under serious scrutiny in the Discussion Paper dated June, 2008 titled “Members’ scheme of arrangement” by the Corporations and Markets Advisory Committee of the Australian Government . The discussion paper discussed at length that the intent of vexatious shareholders could be achieved if they resorted to splitting their shareholding among various proxies, thereby stopping the resolution from being passed by way of headcount test. In order to combat this, the Law Council Australia in its submission to the Treasury on the Exposure Draft of the Corporations Amendment (Insolvency) Bill, 2007 suggested the following:

1. If in any provision power given to court to dispense with the headcount test is retained, rather than completely letting it go, it should explicitly go beyond share splitting.

2. The headcount test should be amended such that there is a minimum threshold for a valid headcount test and only upon appropriate proof of a trust arrangement for anyone voting on behalf of beneficial owners, would the voting be counted.

3. The headcount test be completely abolished such that only voted-share test and approval of court is retained.

4. The headcount test need not be done away with but a higher threshold is imposed for satisfaction of voted-share test.

In fact, this dichotomy in the headcount test is what led it to its complete deletion in Hong Kong by the Hong Kong Companies Ordinance which was passed in the year 2012.

In India the difficulty in applying the headcount test was discussed in JJ Irani Committee Report dated May 31, 2005. The committee stated that since the voted-value test is also a criterion to determine the intent of the shareholders, the headcount test may be done away with. It was suggested that the requirement may be modified to provide only for approval by 3/4th in value of shareholders and creditors, present and voting. It is in keeping with this that the word ‘number’ was replaced with the word ‘persons’ in section 230(6) of Act, 2013. Resultantly, section 230(6) reads as:

“Where, at a meeting held in pursuance of sub-section (1), majority of persons representing three-fourths in value of the creditors, or class of creditors or members or class of members, as the case may be, voting in person or by proxy or by postal ballot, agree to any compromise or arrangement and if such compromise or arrangement is sanctioned by the Tribunal by an order, the same shall be binding on the company, all the creditors, or class of creditors or members or class of members, as the case may be, or, in case of a company being wound up, on the liquidator and the contributories of the company.”

Thus, where the Act, 2013 scores by dropping the headcount test and adopting a meaningful approach to the process of seeking members’ approval, yet it also takes a step back by prescribing a minimum threshold for raising objections by shareholders/creditors. This has resulted in the balance being tilted towards corporate convenience.

WIRC Advertisements/Announcements

WIRC Advertisements/Announcements

NEW TEAM OF ICSI-WIRC

CS Ragini Chokshi, Chairperson

CS Ragini Chokshi, she is a founder partner of the firm Ragini Chokshi & Co. Practicing Company Secretaries in Mumbai. The firm has specialization in corporate laws,

listing, merger & amalgamation, managerial remuneration, organization restructuring, conversion of balance sheet & profit & loss a/c into XBRL & corporate legal counseling

to companies & appearance before company law board, regional director, ministry of corporate affairs, SAT, SEBI, etc. The firm is associated with listed and unlisted companies. The firm has an in-depth knowledge of corporate governance, compliance certificate related aspects, secretarial audit, due diligence matters, listing and re-listing of securities on stock exchange and other corporate law matters for domestic and international clients.

listing, merger & amalgamation, managerial remuneration, organization restructuring, conversion of balance sheet & profit & loss a/c into XBRL & corporate legal counseling

to companies & appearance before company law board, regional director, ministry of corporate affairs, SAT, SEBI, etc. The firm is associated with listed and unlisted companies. The firm has an in-depth knowledge of corporate governance, compliance certificate related aspects, secretarial audit, due diligence matters, listing and re-listing of securities on stock exchange and other corporate law matters for domestic and international clients.

CS Ashish Doshi, Vice Chairman

Shri Ashish Doshi has been elected as Vice Chairman of Western India Regional Council of ICSI for the year 2014. He is a Practising Company Secretary from Ahmedabad,

Gujarat. He is M. Com and FCS - a Fellow member of The institute of Company Secretaries of India. He carries with him rich experience of more than two decades and has expertise

in corporate law advisory services including corporate restructuring, due diligence and other related activities.

Gujarat. He is M. Com and FCS - a Fellow member of The institute of Company Secretaries of India. He carries with him rich experience of more than two decades and has expertise

in corporate law advisory services including corporate restructuring, due diligence and other related activities.

He is past Chairman of Ahmedabad Chapter of the ICSI. He has held various positions in Western India Regional council as Treasurer, Editor Focus and had contributed as chairman of various sub committees since last couple of years. He was also appointed as Co-chairman of Capital Markets Committee of Gujarat Chamber of Commerce and industries (GCCI). He had been regular faculty at various training sessions, and workshops organized by ICSI and had invited to delivered talk at Branches of ICAI.

CS Ashish Garg, Secretary

CS Ashish Garg, is a Post Graduate in Economics and Commerce and Graduate in Law from the Vikram University, Ujjain and a Fellow Member of the Institute of the Company

Secretaries of India. He is a member of the Western India Regional Council of The ICSI for 2007 to 2010 and again re-elected for 2011-2014. Presently He is re-elected as the Secretary of WIRC for 2014.

Secretaries of India. He is a member of the Western India Regional Council of The ICSI for 2007 to 2010 and again re-elected for 2011-2014. Presently He is re-elected as the Secretary of WIRC for 2014.

Earlier he was the Chairman of Information Technology Committee of the WIRC in 2007 and part in recommendation and implementation of IT Policy in New Look - WIRC and Editor of monthly journal FOCUS of WIRC in 2008 and 2009 and commenced the circulation of Focus into an Electronic Newsletter and Chairman of Practicing Company Secretary Committee of WIRC for 2011 and in 2012 he was Treasurer of WIRC and in 2013 he was Secretary of WIRC.

He was the Secretary and Vice Chairman of Indore Chapter of the ICSI in 2004 and 2005.

He is Practicing Company Secretary at Indore since more than last 13 years and having specialization in corporate laws, organizational restructuring and corporate legal counseling to companies and appearances before Company Law Board, Regional Director, Ministry Corporate Affairs. Mr. Ashish Garg is highly concerned about Profession and he actively participates in the activities of the Institute. He is a visionary, good organizer and a friendly gentleman. He has been the visiting faculty at various Management Institutes of Indore for MBA and other Professional courses and delivered lectures regularly as invited speaker in the conference of Company Secretaries and Chartered Accountants.

CS Amit Kumar Jain, Treasurer

CS Amit Kumar Jain is a Graduate in Commerce and Law from the Barkatullah University, Bhopal and a Fellow Member of the Institute of the Company Secretaries of India.

Presently He is a member of the Western India Regional Council of The ICSI for the tenure of 2011 to 2014. He was the Chairman of Training & Educational Facilities Committee (TEFC), Chairman - Public Relation Committee and Chairman - Library Committee of WIRC of ICSI for the year 2013.

Presently He is a member of the Western India Regional Council of The ICSI for the tenure of 2011 to 2014. He was the Chairman of Training & Educational Facilities Committee (TEFC), Chairman - Public Relation Committee and Chairman - Library Committee of WIRC of ICSI for the year 2013.

He was Editor of monthly journal FOCUS of WIRC and Chairman of Public Relation Committee of WIRC for the year 2012. He was the Chairman of Placement Committee of the WIRC in 2011. He was the Treasurer of Bhopal Chapter of the ICSI in 2008, 2009 and 2010. He is also elected as the Treasurer of Western India Regional Council for the year 2014.

He is Practicing Company Secretary at Bhopal since last 8 years and main area of practice is Project Finance, Working Capital Finance, CC Limit etc. He is a very socially active member and is highly concerned for professional development. He is also associated with other organization like President of DJSG Professional, Bhopal, Treasurer of Bhartiya Jain Sanganthana (Bhopal Unit), Pune, alongwith others.

He is a visionary, good organizer and a friendly gentleman. He has been the visiting faculty at various Management Institutes of Bhopal.

WIRC Advertisements/Announcements

CONGRATULATIONS

CS C.V. Sajeevan, Joint Director - Western Region, Mumbai

CS. C. V. Sajeevan is an Associate Member of ICSI and promoted to Joint Director in the office of Regional Director of Ministry of

Corporate Affairs, Mumbai.

CS. C. V. Sajeevan has held various senior positions in ROC/ RD /CLB office and possess wide experience of 15 years as member ICLS of MCA.

Before joining ICLS CS. Sajeevan was working with Comptroller and Auditor General of India (CAG) as Audit officer. CS.C. V. Sajeevan is

actively associated with various activities of ICSI-WIRC.

WIRC Advertisements/Announcements

Book Review

“All & everything in Diagrams – Organic Whole of the entire esoteric knowledge”

“All & everything in Diagrams – Organic Whole of the entire esoteric knowledge”

- A book by CS Mohan Vaishnav,

Published by Narrow Gate Press, London MMXIII

In this book the 4th Way & Hindu esoteric ideas has been synthesized to structure the organic whole of the entire body of the esoteric knowledge by placing in hierarchical order almost all significant esoteric ideas in various Diagrams in pictorial & tabular way, in the form which that ideas assume at various Cosmos levels and at various levels of being. For example, the 4th Way idea of the law of three has been synthesized with the Hindu idea of Satva, Rajasa & Tamasa, the 4th Way idea of consciousness has been synthesized with Vedantic ideas of Mandukya Upnishad, in the same way the ideas of Patanjali YogaSutra has been synthesized with the 4th Way ideas, to unfold more clear & complete picture.

This book also deals with the physical & psychological (spiritual) aspects of the structure of Man & Universe from the connected & combined (nutshell) view points of Physics, Chemistry, Biology, Mathematics, Astronomy, Astrology, Ayurveda, Psychology, Yoga & Spirituality.

This book also deals with (1) practical Work on oneself (Sadhana), (2) higher method of learning and (3) practical relevance of connectedness of various esoteric ideas and inter-connection between various Cosmoses in one’s personal Work.

Further, in an attempt not to load it with lengthy theory, the esoteric ideas has been intentionally presented in simple diagrams and in brief explanatory notes, so that the grasp of the Picture of the Whole & Parts enter directly into our that part, which understands things without words (e.g. when one sees the symbol +, one understands entire significance of + without words). Then, one may explore the minute details of a particular idea, keeping in view its relative place in that whole, in such a way that any possibility of lopsidedness or bias can be minimized.

(The 4th Way is a scientific way of spiritual/psychological evolution by (1) observing & understanding within oneself the Intellect, Emotion, Physical impulse, and also the spark of divinity, (2) rightly balancing their workings, (3) learning to apply them all simultaneously in unified manner in day-t0-day activities with intentional & enhanced awareness, and thereby eventually attaining spiritual purity & higher states of consciousness. In 20th Century G. I. Gurdjieff and P. D. Ouspensky expounded the 4th Way in their teachings and writings, which was further elaborated and refined in writings of Rodney Collin).

The book is available online on Amazon.in on following link:

http://www.amazon.in/dp/0956549756/ref=cm_sw_r_fa_awd_5WaIsb1K5WGRJ

Author’s email : mohan.vaishnav@gmail.com

REVIEW OF THE BOOK BY

Mr. Hiren – A professor, teaching Electronics Engineering and presently doing PHD in IIT, Delhi.

Dear Mohanbhai,

Here is the review of the book, This is the least praise effort on my part,I have hold myself back in not praising you and focusing on book during entire period.

Mr. Ouspensky has presented fragments of unknown teaching in his In search of the miraculous, While Mr. Mohan Vaishnav in ALL & Everything in Diagrams has presented the WHOLE picture in which the fragments have found its relative and hierarchical places. This work has completed the picture what Mr.Ouspensky had started.

I have always wondered, Can one’s spiritual evolution lead one to discover the unexplored domain of science, hence contributing to material world without having been at science school. Here is book where modern science can have answer of those questions which it can’t even conceive of. Analogy drawn between material and psychological phenomena has blown my scientific mind! The author being professionally in commerce field has attained the level of a quantum physicist.

This work is unified theory of Astronomy, Astrology, Alchemy, Psychology, Physics, Chemistry and Spirituality and Poetry which can eventually be realized in Practice if rightly taken. The real beauty of book lies in conveying seeming most difficult ideas in a very simple and yet profoundly effective language, I have never read about the phenomenon Deathexplained in a single page so simply. Another dimension of the book is that while reading one’s logical mind will not find any contradiction even if one is mechanically prone to do so.

Do not err the book just to be a road map of spiritual evolution only, In fact the chapter on Practical Work provides one material enough to work upon oneself for life time and will build an authentic and real foundation on which one can base one’s work. If you are a modern time seeker and who needs explanation of GOD or Self-realization in scientific language then the book is the answer.

In Friendship,

Hiren

Case Laws at a Glance

A Bird’s Eye View: Recent judgements on Company Law

1) COMPROMISE AND ARRANGEMENT

1) COMPROMISE AND ARRANGEMENT

Company was not in a position to dispute liability towards its creditors for revival, there must be a proposal by company to discharge such

liability. Since unsecured creditors and workers were able to establish their claim to a substantial extent that could not be confronted by

company, there could be no proposal for revival. – ICICI BANK LTD. V. DUNLOP INDIA LTD. [2013] 120 SCL 148 (CLA) (MAG.)

2) AMALGAMATION

Petitioner – transferor and transferee companies sought for sanction of scheme of their amalgamation. Meetings of equity shareholders and secured

creditors was dispensed with in view of their written consent. Meetings of unsecured creditors was held who approved proposed scheme by

majority. However, scheme was objected to by an objector in his capacity as shareholder, creditor and also in public interest. It was alleged

that scheme was detrimental to interest of employees of Transferor Company. IBPL as stock option was given a go-by and was only for personal

enrichment of promoters of Transferor Company. INTAS group. Since objector had transferred shares held by him, objector was not shareholder

either of transferor companies or Transferee Company related to scheme under consideration. Therefore, objector had no Locus standi to raise

objections on basis that he was a shareholder. Status of objector as a creditor was also not only doubtful but was a disputed and even if it

was presumed, it was less than even minimal for which objector had other remedy under law land and, therefore, on ground that objector was a

creditor scheme could not be halted. Since objector, who was an ex-employee, had come forward to raise objections for his personal interest

rather than public interest and proposed scheme was in interest of all stock holders, i.e., shareholders, creditors as well as in public

interest, proposed scheme was to be sanctioned. – ASTORM RESEARCH LTD., IN REJOINDER [2013] 120 SCL 19 (GUJ) (MAG.)

3) OPPRESSION AND MISMANAGEMENT

Main Petition is pending for adjudication interim reliefs which are in nature of main reliefs cannot be granted. CLB will not interfere in

internal affairs of company when there is no illegality and violation of any provisions of law or articles of company. – ARUN AMIDWAR V.

GRIP TIGHT PACKAGING (INDIA) (P.) LTD. [2013] 119 SCL 319 (CLB - MUMBAI)

4) RECTIFICATION OF REGISTER ON TRANSFER

Petitioner may pursue appropriate remedy in appropriate forum, and is at liberty to apply for rectification subsequent to adjudication in the

present company Petition under Section 111A – AMREX MARKETING (P.) LTD. V. ALCON RESERT HOLDINGS LTD. [2013] 117 CLA 111 (CLB)

5) TRANSFER OF SHARES

Where title of shares is dependent on undisputed pledge of shares, the company cannot refuse to register shares in favour of pledgee-transferee.

Under Sections 108 and 111A – ASUTOSH ENTERPRISES LTD. V. BANK OF RAJASTHAN LTD. [2013] 117 CLA 105 (CLB)

6) OFFENCES AND PROSECUTION

Sub-section (2) of section 633 does not limit the jurisdiction and powers of the High Court only to apprehended proceedings.

Section 633 – Visram Financial Services (P.) ltd. V. V. Rajendran & Anr. [2013] 117 CLA 351 (Mad.)

7) OPPRESSION / MISMANAGEMENT

An application for dismissal of company Petition is liable to be allowed when the reliefs sought are the same against same parties as in lis

pending before the High Court. Section 397/398 – STAR BUS SERVICES (P.) LTD., IN RE. [2013] 117 CLA 154 (CLB)

Circulars & Notifications

MINISTRY OF CORPORATE AFFAIRS

MINISTRY OF CORPORATE AFFAIRS

1. REGARDING CLARIFICATION WITH REGARD TO HOLDING OF SHARES OR EXERCISING POWER IN A FIDUCIARY CAPACITY HOLDING AND SUBSIDIARY RELATIONSHIP UNDER SECTION 2(87) OF THE

COMPANIES ACT, 2013.

General Circular No. 20/2013

Source: www.mca.gov.in

Ministry has received a number of representations consequent upon notifying section 2(87) of the Companies Act, 2013 which defines "subsidiary company" or "subsidiary".