ICSI - WIRC - FOCUS

Vol. XXX • No. 16 • APRIL-MAY-JUNE 2014

Chairman's Communique

Dear Professional Colleagues,

Dear Professional Colleagues,

The July showers have already started and we have just completed many professional Development Programs of topical relevance.The Period from March-June 2014 will be remembered for various programs and seminars organised by ICSI-WIRC. The Regional Council, chapters in the western belt and various Study Circle centres organised several programs on Companies Act,2013. We at WIRC have orgainsed two Orientation Programs on Companies Act. The participation in all these events were exemplary.

The inaguation of the Oral Teaching Classes was held on May 15, 2014 at WIRC premises. We have as of now five centres spread across the city and its suburbs which can cater to the needs of students.

The convocation of the Western Region was held on May 24,2014 at the BSE Convention Hall which was attended by around 780 delegates including Prize winners, guest and relatives.

ICSI-WIRC organised it Annual Regional Conference at Lavassa on June 06 & 07, 2014 on the theme “Ministerial to Managerial-Challenges and Opportunities” which was attended by around 220 delegates. I thanks all the resource persons who travelled all the way to Lavassa to share the experience with the delegates and made the conference memorable.

To add to the list of activities ICSI-WIRC was given an opportunity to host the 15th National PCS Conference which was attended by more than 300 members in practice from far and near.The deliberations in the conference were excellent.

Many programs on New Companies Act were held during the period,but many more to be organised in the days to come to create proficiency amongst our members. The target to achieve is like the team which chases the 20-20 version of cricket where the required runs are many a times more than the number of overs. Similarly in the coming months for the benefit of members many more innovative initiatives are in the pipeline.

I take this opportunity to compliment the Chairmen of various committees for showing sheer dedication and request them to maintain the same energy for better results.

Before I conclude I put forward two requests to all the members of region and they are; 1) Join the Professional Membership Scheme of ICSI-WIRC and 2) Be a Proud member of CSBF

The yester months have witnessed some turmoil but the months to come is going to be ours.It reminds me the famous quote of Aristotle Onassis who said “It is during our darkest moments that we must focus to see the light.”See you again next month.

Date: 12th June, 2014

Your's,

CS Ragini Chokshi

Chairperson

Editorial Board

Photo Feature

Analysis of the Bombay High Court

Analysis of the Bombay High Court Judgment on Court convened meetings & Voting by Postal Ballot

The Bombay High Court passed a landmark judgment on May 8, 2014 clarifying the provisions for holding a court convened meeting, passing a resolution through postal ballot and passing a resolution by electronic voting under Section 391 and 394 of the Companies Act, 1956 & Section 230 and Section 232 of the Companies Act, 2013 [yet to be notified]. The Bombay High Court also discussed about the validity of the Rules posted on the website of Ministry of Corporate Affairs [“MCA”] under the Companies Act, 2013 and the Circulars issued by SEBI .

The Bombay High Court passed a landmark judgment on May 8, 2014 clarifying the provisions for holding a court convened meeting, passing a resolution through postal ballot and passing a resolution by electronic voting under Section 391 and 394 of the Companies Act, 1956 & Section 230 and Section 232 of the Companies Act, 2013 [yet to be notified]. The Bombay High Court also discussed about the validity of the Rules posted on the website of Ministry of Corporate Affairs [“MCA”] under the Companies Act, 2013 and the Circulars issued by SEBI .

1. Wadala Commodities Limited [“Transferor Company”] and Godrej Industries Limited [“Transferee Company”] filed a Company Summons for Direction under Section 391 and 394 of the Companies Act, 1956;

2. Based on the provisions of the SEBI Circulars, Section 110 of the Companies Act, 2013 [relating to provisions Postal Ballot]; Companies (Management and Administration) Rules, 2014; the companies applied for the dispensation of the members meeting.

Issues involved:1. Based on the provisions of Section 110(1)(b) of the Companies Act, 2013 and the Circulars issued by SEBI relating to amendment in Equity Listing Agreement – Can a company pass a resolution by Postal Ballot for approving the scheme of amalgamation?

2. How can the Scheme of Arrangement be amended in case of voting by Postal Ballot?

3. What is meant by - “Calling of Meeting” under sections 391 and 394 of the Companies Act, 1956?

4. What is the validity of the Rules on the MCA Portal?

5. How to determine the votes in Electronic voting?

These issues are analysed and discussed below in detail in relation to the judgment passed by Bombay High Court.

Discussion: Issue 1 -Can a company pass a resolution by Postal Ballot for approving the scheme of amalgamation?

At the heart of corporate governance lies in transparency and a well-established principle of indoor democracy which gives the shareholders vital rights in matters relating to the functioning of the company. The principle is not merely to vote on any particular item of business; but it also includes the right to use the vote as an expression of an informed decision i.e. the shareholder has the following absolute and inalienable rights like:

(i) Right to ask questions;

(ii) Right to seek clarifications and;

(iii) Right to receive responses before the shareholder decides which way he will vote.

At a general meeting if a shareholder has not decided about the voting – which is common; then he may raise questions in the general meeting after hearing fellow shareholders or on hearing an explanation from a director. After getting clarity on the issue; then he may vote for or against the resolution. The right to persuade and right to be persuaded cannot be taken away from the shareholders.

G.S. Patel, Judge stated that it seems completely contrary to the legislative intent and spirit of the SEBI Circulars and amended Listing Agreement’s Clauses 35B and 49; that no meeting is required and that the shareholder must cast their vote only on the basis of the information that has been sent to them by post or email.

Discussion: Issue 2 -How can the Scheme of Arrangement be amended in case of voting by Postal Ballot?

The Schemes of Arrangement or Compromise may be / are amended at a meeting – whether General Meeting or Board Meeting. The said amendment is put to vote. In a Postal Ballot no such amendment is possible. G.S. Patel, Judge further mentioned that if we were to restrict ourselves to a postal ballot, no shareholder or any director could ever suggest any amendment and the scheme would stand or fall only in its original form. This is contrary to the mandate of Sections 391 and 394 of the Companies Act, 1956 [Corresponding to Section 230 and 232 of the Companies Act, 2013 – which is yet to be given effect]. Section 230 of the Companies Act, 2013, as currently framed, speaks of “the calling of a meeting” and “not merely putting the matter to vote”.

Since the scheme presented in the meeting are proposed schemes; this means that they are subject not only to approval by voting but also, possibly, to an amendment at the meeting itself.

Discussion: Issue 3 -What is meant by - “Calling of Meeting” under Sections 391 and 394 of the Companies Act, 1956?

Section 110 of the Companies Act, 2013 relates to provisions of Postal Ballot and same is called by the company. Meetings for approval of Schemes under Sections 391 and 394 of the Companies Act, 1956 [corresponding to Sections 230 and 232 of Companies Act, 2013] are not called by the Company but are ordered by the Court i.e. they are Court-convened meetings. A court may even dispense with such a meeting, irrespective of any provision for a Postal Ballot. Therefore, SEBI Circulars or Notifications that make Electronic Voting or Postal Ballot the exclusive method of voting on such schemes are clearly unlawful and contrary to the intent of Sections 391 and 394 of the Companies Act, 1956 [corresponding to Sections 230 and 232 of Companies Act, 2013]. The matters at a Court-convened meeting cannot in any case be decided by postal ballot “instead” of at a general meeting.

The Postal Ballot and Electronic Voting may be permitted or may even be required in addition to but not in replacement of a general meeting.

Discussion: Issue 4 -What is the validity of the Rules on the MCA Portal?

The Companies (Management and Administration) Rules, 2014 has not been published in the Official Gazette of India. MCA online portal has Rules that are listed and are said to be effective 1st April 2014 but most of the Rules have not been published in the Official Gazette. G.S. Patel, Judge mentioned that how many of such Rules can be made effective on such basis; where the MCA simply puts up some scanned document under the signature of one of its without any publication in the Official Gazette. Such publication is not an idle formality but it had a well-established legal purpose. And he further mentioned that till such time as these Rules are published in Official Gazette, or there is some provision made for the dispensation of Official Gazette Notification; none of the Rules in the MCA .pdf document that are not yet gazetted can be said to be in force.

Discussion: Issue 5 -How to determine the votes in Electronic voting?

The Companies (Management and Administration) Rules, 2014 indicate that electronic voting must stop 3 days before the meeting. The Chairman of the meeting is to be given a tally of the electronic votes cast and the decision on any item of business is supposed to have been passed or not passed only on the basis of these electronic votes. G.S. Patel, Judge mentioned that, ex - facie, such activity is invalid and untenable.

Conclusion:1. All the provisions for compulsory voting by postal ballot and by electronic voting to the exclusion of an actual meeting cannot and do not apply to court-convened meetings. At such meetings, provision must be made for postal ballots and electronic voting, in addition to an actual meeting;

2. Electronic voting must also be made available at the venue of the meeting. Any shareholder who has cast his vote by Postal Ballot or by Electronic Voting from a remote location shall not be entitled to vote at the meeting. He or she may, however, attend the meeting and participate in those proceedings;

3. The effect, interpretation and implication of the provisions of the Companies Act, 2013 and the relevant SEBI circulars and notifications, to the extent that they mandate a compulsory or even optional conduct of certain items of business by Postal Ballot (which includes electronic voting) to the exclusion of an actual meeting are matters that require a fuller consideration. The judgment states that various government bodies are required to make a representation;

4. Prima-facie, the elimination of all shareholder participation at an actual meeting is anathema to some of the most vital of shareholders’ rights and no authority or any company should insist upon such a postal-ballot-only meeting to the exclusion of an actual meeting.

An Overview on Corporate Crimes

WHAT IS CORPORATE CRIME?

In criminology, Corporate Crime refers to crimes committed either by a corporation having a separate legal entity or by individuals acting on behalf of a corporation or other business entity.

Corporate crimes are offences committed by corporate officials for their corporation and the offences of the corporation themselves for corporate gain. The corporation or business entity is said to commit a corporate crime if it is organized for that purpose. The mission of a corporation of this type is to use illegal means to gain profits and remain in business. The crime is often carried out by all levels of the corporation, such as the board of directors, the officers, and corporate managers. Some of the criminal offenses that are common to corporate criminals include falsification of corporate financial statements, corporate abuse of anti-trust laws, and bribing government officials for their corporation’s gain. When corporations are organized for money laundering purposes, they can be charged with corporate crimes.

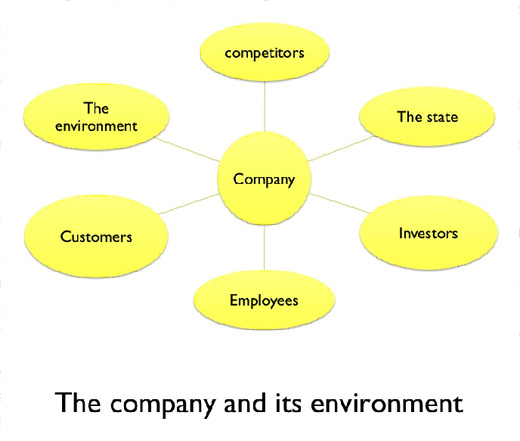

WHAT IS CORPORATE CRIME?

• white-collar crime, because the majority of individuals who may act as or represent the interests of the corporation are white-collar professionals;

• Organized crime, because criminals may set up corporations either for the purposes of crime or as vehicles for laundering the proceeds of crime. The world’s gross criminal product has been estimated at 20 per cent of world trade. (de Brie 2000); and

• State - corporate crime because, in many contexts, the opportunity to commit crime emerges from the relationship between the corporation and the state.

| COMPETITORS | Stealing customers from your competitors by bribery or other 'dirty tricks' |

| THE STATE | Evading taxes, making false claims for subsidies, over-pricing of contracts |

| INVESTORS | Siphoning off investors’ money for personal use, insider trading, share support operations |

| EMPLOYEES | Health and safety violations, diversion of pension funds for other company use |

| CUSTOMERS | Price fixing, faulty or counterfeit products, falsification of test results (e.g. On pharmaceutical products) |

| THE ENVIRONMENT | Pollution, dumping of toxic waste products |

WHO ARE THE CORPORATE CRIMINALS?

Corporate crimes are being committed on large and small scales every day. While many white collar criminals will not get caught, in the last decade government and private citizen groups have rallied together to better protect American citizens from such criminals through legislation, punishment, and accountability. Here are some examples of corporate criminals from the past few decades.

EXAMPLES OF CORPORATE CRIME:

Fraud, Bribery and Corruption

Fraud, Bribery and Corruption

Insider dealing and market abuse

Insider dealing and market abuse

Money laundering and terrorist financing

Money laundering and terrorist financing

Tax Crimes

Tax Crimes

CORPORATE CRIMES ACCORDING TO THE ACT: -

| Sr.No | ACT | REMARKS |

| 1. | SECURITIES & EXCHANGE BOARD OF INDIA, 1992 | • INSIDER TRADING – If any insider who either on his own behalf of any other person deals in securities of a body corporate listed on any stock exchange on the basis of any unpublished price sensitive information. |

| 2. | INDIAN PENAL CODE, 1860 | • FORGERY – Forgery is making any false document or false electronic record with intention to either cause damage or injury to any person • Falsification of accounts |

| 3. | INCOME TAX ACT, 1961 | • Tax Crimes - Various tax crimes (such as tax evasion, smuggling, customs duty evasion, valued added tax evasion, and tax fraud) can be prosecuted under Income Tax Act 1961, Customs Act 1962, Central Sales Tax Act 1956 & Central Excise Act 1944. • Managers, officers and directors may have personal liability for aiding, abetting, counselling or procuring the commission of an offence. |

| 4. | PREVENTION OF MONEY LAUNDERING ACT, 2002 | • Money Laundering - The process of creating the appearance that large amounts of money obtained from serious crimes, such as drug trafficking or terrorist activity, originated from a legitimate source. • The Reserve Bank of India (RBI) issued Know-Your-Customers (KYC) Guidelines Anti-Money Laundering Standards on 16 August 2005, under which Banks are advised to follow certain customer identification procedures for opening of accounts and monitoring transactions of a suspicious nature and reporting it to the appropriate authority. |

GOVERNING AUTHORITIES FOR CORPORATE CRIME:

CENTRAL BUREAU OF INVSTIGATION (CBI):-

CENTRAL BUREAU OF INVSTIGATION (CBI):-

The CBI normally investigates and prosecutes cases of serious fraud or cheating that may have ramifications in more than one state. It also investigates corruption cases.

SERIOUS FRAUD INVESTIGATION OFFICE (SFIO):-

SERIOUS FRAUD INVESTIGATION OFFICE (SFIO):-

A multi- disciplinary organisation under the Ministry of Corporate Affairs, it detects and prosecutes or recommends for prosecution of white-collar crimes/frauds.

SERIOUS FRAUD INVESTIGATION OFFICE (SFIO):-

SERIOUS FRAUD INVESTIGATION OFFICE (SFIO):-

A multi- disciplinary organisation under the Ministry of Corporate Affairs, it detects and prosecutes or recommends for prosecution of white-collar crimes/frauds.

CENTRAL VIGILANCE COMMISION:-

CENTRAL VIGILANCE COMMISION:-

The Central Vigilance Commission supervises corruption cases in governmental departments. It has supervisory powers over the CBI but does not have authority to prosecute individuals.

CENTRAL ECONOMIC INTELLIGENCE BUREAU:-

CENTRAL ECONOMIC INTELLIGENCE BUREAU:-

The Central Economic Intelligence Bureau monitors economic offences and co-ordinates co-operation with international agencies in relation to economic offences.

DIRECTORATE OF ENFORCEMENT:-

DIRECTORATE OF ENFORCEMENT:-

Foreign Exchange Management Act, 1999 and Prevention of Money Laundering Act, 2002. The Enforcement of organisation falls under theMinistry of Finance and is headquartered in New Delhi.

ECONOMIC INTELLIGENCE COUNCIL:-

ECONOMIC INTELLIGENCE COUNCIL:-

Established under the Ministry of Finance to facilitate co-ordination among the enforcement agencies dealing with economic offences.

CASE LAWS:

SAHARA VS. SEBI - AN ANALYSIS OF THE LANDMARK SUPREME COURT RULING :

The Supreme Court on 31st August, 2012 in one of its most anticipated judgment of recent times has directed the Sahara Group and its two group companies Sahara India Real Estate Corporation Limited (SIRECL) and Sahara Housing Investment Corporation Limited (SHICL) to refund around Rs 17,400 crore to their investors within 3 months from the date of the order with an interest of 15%. The Supreme Court while confirming the findings of the SAT has further asked SEBI to probe into the matter and find out the actual investor base who have subscribed to the Optionally Fully Convertible Debentures (OFCDs) issued by the two group companies SIRECL and SHICL.

Background:

Earlier SIRECL and SHICL floated an issue of OFCDs and started collecting subscriptions from investors with effect from 25th April 2008 up to 13th April 2011. During this period, the company had a total collection of over Rs 17,656 crore. The amount was collected from about 30 million investors in the guise of a "Private Placement" without complying with the requirements applicable to the public offerings of securities. The Whole Time Member of SEBI while taking cognizance of the matter passed an order dated 23rd June, 2011 thereby directing the two companies to refund the money so collected to the investors and also restrained the promoters of the two companies including Mr. Subrata Roy from accessing the securities market till further orders. Sahara then preferred an appeal before SAT against the order of the Whole Time Member and after hearing the SAT confirmed and maintained the order of the Whole Time Member by an order dated 18th October, 2011. Subsequently Sahara filed an appeal before the Supreme Court of India against the SAT order.

Conclusion:

This landmark Judgment is undoubtedly a milestone in India's Corporate landscape, as it not only sanctifies SEBI's absolute power to investigate into the matters of listed companies, but also into the matters pertaining to the unlisted companies. It vests SEBI with myriad powers to investigate into any matter concerning the interest of the investors even if it pertains to companies which are not listed. It clarifies significant points of law and removes the grey areas relating to issue of securities by the so called unlisted companies taking advantage of the loopholes of law. Also, in the matters of jurisdiction, this Judgment has bridged the jurisdictional gap which previously existed between that of the Ministry of Corporate Affairs and SEBI. It is hoped that in future this judgment will be instrumental in preventing turf war between the MCA and SEBI concerning jurisdictional issues as it categorically iterates that in the matter of public interest, both SEBI and MCA will have concurrent jurisdiction. This is a welcome relief, as in the past many defaulting parties have taken advantage of this jurisdictional lacuna and have been able to easily get off the hooks. Sahara has already filed a review petition against this judgment before the Supreme Court. In a public statement they have also said even if the review petition fails, they will challenge the same vide a curative petition before the Supreme Court. Whether Sahara gets any relief in the near future remains to be seen. It however, seems to be a tough legal battle ahead of them.

ROLE OF COMPANY SECRETARY IN AVERTING CORPORATE CRIMES:-

A Company Secretary is in a senior position in a private sector company or public sector organisation. The Company Secretary is responsible for the efficient administration of a company, particularly with regard to ensuring compliance with statutory and regulatory requirements and for ensuring that decisions of the Board of Directors are implemented as per law.

Company Secretaries is also Corporate Governance Officer (CGO) and required to perform following roles:

1. To ensure compliances of all listing rules, other Regulatory Codes and Act.

2. Work with Board of Directors, Management to ensure that all regulatory reporting

is correct and does not lead to errors resulting in offences under Various Acts.

3. Act as the Conscience Keeper of the Company.

Before Reporting or Whistle Blowing, Company Secretary should consider following factors:

1. Whether he has enough facts and evidences to support his allegations?

2. Whether there is any other mechanism or channel other than whistle blowing for reporting and

which system should be opted to blow whistle, Internal or External?

3. What protections the Company or law will provide for whistle blowing and whether there are any

chances of success?

Practical Challenges for Company Secretary as Whistle Blower:

Company Secretary may get punished, terminated, suspended or at risk of their own well beings. Few instances where whistle blowers had to face harsh consequences even to the extent of losing their life:

• Satyendra Dubey (1973–2003) was an Indian Engineering Service (IES) officer. He was the Project Director in the National Highways Authority of India (NHAI) at Koderma. He was murdered in Gaya, Bihar after fighting corruption in the Golden Quadrilateral highway construction project.

• Shanmugam Manjunath (1978–2005) was a marketing manager (grade A officer) for the Indian Oil Corporation (IOC) who was murdered for sealing a corrupt petrol station in Lakhimpur Kheri, UP. This incident inspired several students at IIM, IIT and other institutes culminating with the IIM students setting up the "The Manjunath Shanmugam Trust".

• CS Shasheendran (2011) The most recent case of sudden demise of 46-year-old Company Secretary, who had worked as the company secretary in Malabar Cements Limited (MCL) for 12 years had been a prime witness in corruption cases registered against senior company officials and Radhakrishan. But the probe could not reach a conclusion as to whether this was a case of suicide or murder.

CONCLUSION:-

Today with scandals like Satyam, Tyco, AIG, Enron, WorldCom, Xerox, there is a need for more ethical governance. Whistle blowing has already been described as one of the basic tenets of Corporate Governance, but in India, there is no definite Whistle Blower law. If this tool of Corporate Governance is used in true letter and spirit, it can be saviour for protecting the stakeholders and the larger public interest. It can be success factor for survival of corporates, build their brand image, which will support in raising funds and can be effective tool in curbing and reporting corporate frauds, which earlier used to go unreported.

As it is always said, norms of Corporate Governance are not merely to be complied with but have to be adopted as day-to-day practice of any organisation. Hence, Corporate Governance is a mixture of meeting both the letter and spirit of law. It is high time India Inc., which is an emerging economic powerhouse to strive to raise the standards of Corporate Governance Practices to a Global Benchmark.

DRR Provisions Retained in Final Rules 2014

Ministry restores Debenture Redemption Reserve Provisions – Bond market can heave some sigh of relief

Background: Provisions under Companies Act, 1956

Section 117C of the Companies Act, 1956 (the “Act”) required every company issuing debentures to create a debenture redemption reserve (“DRR”) for the redemption of such debentures and transfer an ‘adequate’ amount from its profits every year to such DRR until the issued debentures were redeemed. Hence, every issue of redeemable debentures required creation of DRR. The said Section, however, did not provide the meaning of the word ‘adequate’. In the year 2002, the Ministry of Corporate Affairs (“MCA”) issued a circular clarifying the meaning of ‘adequate’ and provided the percentage which was mandatorily required to be transferred to DRR by certain class of companies (the “Circular 2002”)1. However, to develop the bonds market, MCA issued another clarification circular on February 11, 2013 (the “Circular 2013”)2.

Requirements under Circular 2002:

Category |

Amount of DRR to be maintained |

| All India Financial Institutions (AIFIs) regulated by Reserve Bank of India and Banking Companies |

No DRR required for both public as well as privately placed debentures. |

| Other Financial Institutions within the meaning of Section 4A of the Act |

As applicable to NBFCs registered with the RBI. |

| NBFCs registered with the RBI under Section 45-IA of the RBI (Amendment) Act, 1997 |

issue as per SEBI (Disclosure and Investor Protection) Guidelines 2000. |

| Manufacturing and Infrastructure companies |

issue. |

Requirements under Circular, 2013:

1 Text of the Circular, 2002 is available here:

http://www.mca.gov.in/Ministry/circulars/cir2002/cir_18042002.html

2 Text of the Circular, 2013 is available here:

http://www.mca.gov.in/Ministry/pdf/General_Circular_04_2013.pdf

The Circular 2013 had the following effect:

Category |

Amount of DRR to be maintained |

| All India Financial Institutions (AIFIs) regulated by Reserve Bank of India and Banking Companies |

No DRR required for both public as well as privately placed debentures. |

| Other Financial Institutions within the meaning of Section 4A of the Act |

As applicable to NBFCs registered with the RBI. |

| NBFCs registered with the RBI under Section 45-IA of the RBI (Amendment) Act, 1997 |

(Issue and Listing of Debt Securities) Regulations, 2008. |

| Other Companies including manufacturing and infrastructure companies |

public issue as per present SEBI (Issue and Listing of Debt Securities) Regulations, 2008. listed companies. privately placed debentures by unlisted companies. |

In addition to imposing the condition of creation of DRR by every company for every issue of debentures; whether public or privately placed, the Circular 2013 further required every such company to park, on or before 30th day of April each year, a sum of at least 15% of the amount of its debentures, maturing during the year ending on the 31st day of March next following, in any one or more of the following methods:

a) in deposits with any scheduled bank, free from charge or lien;

b) in unencumbered securities of the Central Government or of any State Government;

c) in unencumbered securities mentioned in clauses (a) to (d) & (ee) of Section 20 of the

Indian Trusts Act, 1882;

d) in unencumbered bonds issued by any other company which is notified under clause

(f) of Section 20 of the Indian Trusts Act, 1882;

The money so parked could be utilized only for the purpose of repayment of debentures maturing during the year. The amount remaining deposited /invested was not at any time to fall below 15% of the amount of debentures maturing during that year ending 31st March.

Provision under Rules notified by MCA under Act, 2013 Rule

Rule 18 (7) of Companies (Share Capital and Debenture) Rules, 2014, notified by MCA w.e.f 1st April, 2014 for the purpose Section 71 (4) of the Companies Act, 2013 provided the following:

(b) the company shall create Debenture Redemption Reserve equivalent to at least fifty percent of the amount raised through the debenture issue before debenture redemption commences.

Provision under Rules published in Extraordinary Gazette of India

Rule 18 (7) of Companies (Share Capital and Debenture) Rules, 2014 (Final Rules, 2014) , published in Official Gazette w.e.f 1st April, 2014 for the purpose Section 71 (4) of the Companies Act, 2013 provided the following:

(b) the company shall create Debenture Redemption Reserve (DRR) in accordance with following conditions:-

(i) No DRR is required for debentures issued by All India Financial Institutions (AIFIs) regulated by Reserve Bank of India and Banking Companies for both public as well as privately placed debentures. For other Financial Institutions (FIs) within the meaning of clause (72) of section 2 of the Companies Act, 2013, DRR will be as applicable to NBFCs registered with RBI.

(ii) For NBFCs registered with the RBI under Section 45-IA of the RBI (Amendment) Act, 1997, ‘the adequacy’ of DRR will be 25% of the value of debentures issued through public issue as per present SEBI (Issue and Listing of Debt Securities) Regulations,

(iii) For other companies including manufacturing and infrastructure companies, the adequacy of DRR will be 25% of the value of debentures issued through public issue as per present SEBI (Issue and Listing of Debt Securities), Regulations 2008 and also 25% DRR is required in the case of privately placed debentures by listed companies. For unlisted companies issuing debentures on private placement basis, the DRR will be 25% of the value of debentures.

Our Analysis:

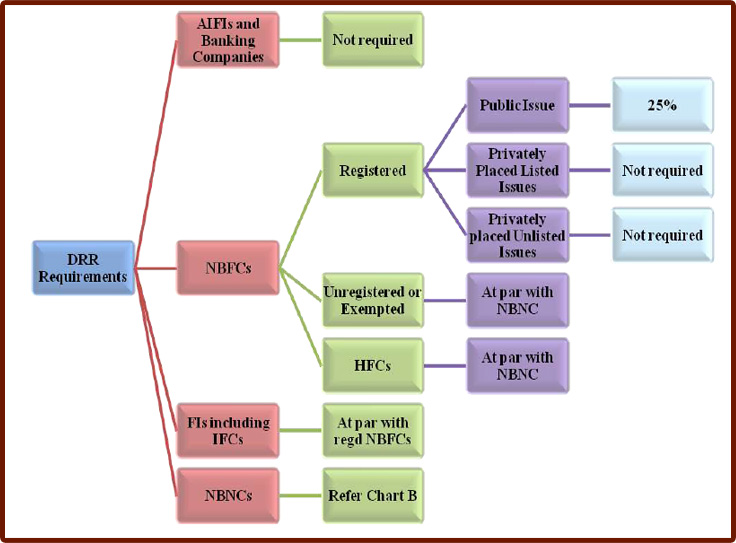

The impact of the Final Rules, 2014 on the companies issuing debentures, with respect to maintenance of DRR, can be explained better through the following chart:

CHART A

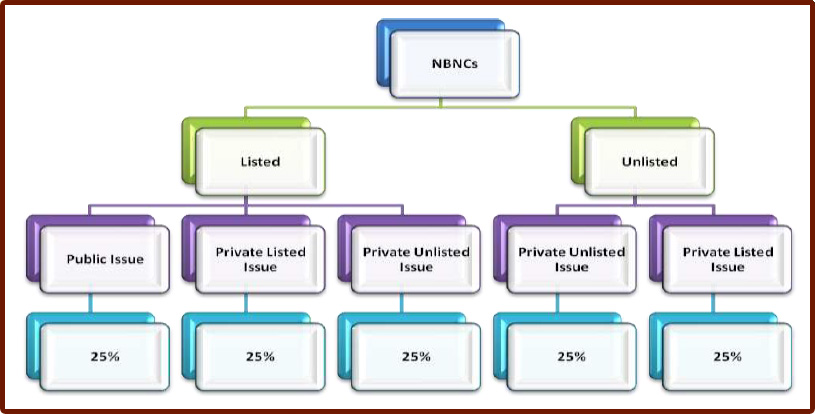

CHART B

Status of Housing Finance Companies (“HFCs”):

The Final Rules, 2014 issued does not clearly state any specific amount of DRR to be maintained by HFCs registered with National Housing Bank (“NHB”). It provides an exemption to privately placed issues of debentures by NBFCs registered with RBI only.

However, the HFCs which are registered with NHB will not get any exemption and accordingly, the Final Rules, 2014 intends to treat HFCs at par with the Non Banking Non Financial Companies (“NBNCs”) and hence, HFCs will also be required to maintain a DRR of 25% of the value of debentures in case of their public as well as privately placed issues of debentures.

Status of NBFCs3

The only benefit from the Final Rules, 2014 is that it has reduced the DRR requirements for registered NBFCs from 50% to 25%. However, Core Investment Companies (“CICs”)4 are the class of NBFCs which does not require registration with RBI if they fulfill the prescribed conditions. Such companies are NBFCs but not registered. The Final Rules, 2014 covers only registered NBFCs, hence, it would mean that the CICs has also been treated at par with NBNCs.

To know more about NBFCs, click http://india-financing.com/staff-publications-nbfc.html

Status of Private Companies

In Circular 2002, the last category included manufacturing and infrastructure companies only. Service and other companies were not specifically required to create any DRR under the Circular 2002. However, the vague language of Circular 2013 used the terms ‘other companies including manufacturing and infrastructure companies’ which covered every company. The Circular 2013 further covered issue of debentures on private placement basis by ‘unlisted companies’ and hence, private companies also came within its ambit. The Final Rules, 2014 also has the same wordings, and therefore private companies will be covered.

Stringent condition of earmarking 15% of the maturing amount of debentures every year

The Circular 2013 required the companies issuing debentures and required to maintain DRR to ear mark an amount not less than 15 % of the amount maturing in a particular year by way of investment and deposits in specified way. This was a new requirement inserted by the Circular 2013 as neither Section 117C of the Act, 1956 nor the Circular 2002 stipulated such requirement. The Final Rules, 2014 has retained the provision. Companies issuing short term debentures with a maturity of less than a year may not be required to park such funds, however, other issues of debentures will require such earmarking of funds and the HFCs and unlisted and private companies may face trouble.

Final Rules, 2014- Whether Prospective or Retroactive?

The Final Rules, 2014 is effective from 1st April, 2014 and companies may require ear marking a sum equal to 15% of value of debentures by April 30, 2014 for the debentures maturing during the year 2014-15.

Conclusion:

The intent of the Government seems to be benign as they have restored the provisions of Circular 2013 and have done away with the requirement of maintaining DRR of 50% of amount raised through debentures. Most companies retire debentures by issuing another set of debentures, hence, most companies don’t park funds for retiring debentures by creating any fund as envisaged in the Circular 2013 and Final Rules, 2014. The Final Rules, 2014 does not remove the hindrance of such companies. However, had the requirement of maintaining DRR of 50% of amount raised through debentures retained in Final Rules, 2014 it would have adversely affected the Bond Market.

See our write ups on CICs at http://india-financing.com/core-investment-companies.html

To Read our other Company Law articles: Click Here

Registered Valuers

REGISTERED VALUERS UNDER THE COMPANIES ACT, 2013

The term ‘Registered Valuer’ has not been defined in Companies Act, 2013 (CA 2013). However, Chapter XVII in CA 2013 has one section 247, which contains in all 4 sub sections dealing with “Registered Valuers”. It is necessary to obtain valuation report from a Registered Valuers for all valuations under the Act in respect to any property, stock, shares, debentures, securities, goodwill or any other assets of the company including its net worth and liabilities.

The term ‘Registered Valuer’ has not been defined in Companies Act, 2013 (CA 2013). However, Chapter XVII in CA 2013 has one section 247, which contains in all 4 sub sections dealing with “Registered Valuers”. It is necessary to obtain valuation report from a Registered Valuers for all valuations under the Act in respect to any property, stock, shares, debentures, securities, goodwill or any other assets of the company including its net worth and liabilities.

As per Section 247,

(1) Where a valuation is required to be made in respect of any property, stocks, shares, debentures, securities or goodwill or any other assets(herein referred to as the assets) or net worth of a company or its liabilities under the provision of this Act, it shall be valued by a person having such qualifications and experience and registered as a valuer in such manner, on such terms and conditions as may be prescribed and appointed by the audit committee or in its absence by the Board of Directors of that company.

(2) The valuer appointed under sub-section

(1) shall,--

(a) make an impartial, true and fair valuation of any assets which may be required to be

valued;

(b) exercise due diligence while performing the functions as valuer;

(c) make the valuation in accordance with such rules as may be prescribed; and

(d) not undertake valuation of any assets in which he has a direct or indirect interest or

becomes so interested at any time during or after the valuation of assets.

(3) If a valuer contravenes the provisions of this section or the rules made thereunder, the valuer shall be punishable with fine which shall not be less than twenty-five thousand rupees but which may extend to one lakh rupees:

Provided that if the valuer has contravened such provisions with the intention to defraud the company or its members, he shall be punishable with imprisonment for a term which may extend to one year and with fine which shall not be less than one lakh rupees but which may extend to five lakh rupees.

(4) Where a valuer has been convicted under sub-section (3), he shall be liable to--

(i) refund the remuneration received by him to the company; and

(ii) pay for damages to the company or to any other person for loss arising out of incorrect or misleading statements of particulars made in his report.

REFERENCE TO REGISTERED VALUERS IN CA 2013

In the CA ompanies Act, 2013 there is reference to the requirement of a registered valuer in the following provisions:-

• Further Issue of shares (Section 62)

• Valuation of assets in case of arrangement of non-cash transactions involving

directors (Section 192)

• Valuing shares, property and assets of the company under a scheme of Corporate Debt

Restructuring (Section 230(2)

• Valuation under a scheme of compromise / arrangement (Section 230(3)

• Valuation under a scheme in which exit opportunity is provided to shareholders of listed

transferor company, where transferee company is unlisted (Section 232)

• Valuation of Equity Shares held by Minority Shareholders (Section 236)

• Valuation of assets for submission of report by Liquidator (Section 281)

• Valuation of assets for preparation of declaration of solvency under voluntary

winding up (Section 305)

• Valuation of interest of dissenting member of the transferor company not voting in

favour of special resolution as required by Company Liquidator (Section 319)

However, Section 247 itself and the final rules are still to be notified, though substantial part of the operative provisions of CA 2013 and the rules have been notified to be effective from 1st April, 2014. Also Section 62 (Further Issue of Shares) and section 192 (Non cash transactions involving directors) are effective from 1st April, 2014, which means that in such cases there would be requirement to obtain valuation report and file the same along with the forms prescribed for return of allotment. It is not clear how the compliance of these provisions will be addressed with respect to Valuation Report, in the absence of a defined framework for Registered Valuers.

Until now, what we have are the draft rules, which provide that a Register of Valuers shall be maintained by the Central Government. The eligibility criteria to be registered as a valuer have been provided in the Draft Rules. Perhaps, the only way out till the notification of rules relating to Registered Valuer, is to obtain and attach a valuation report from CA / CS / CMA in such cases where such requirement arises.

WHO IS ELIGIBLE TO APPLY TO ACT AS REGISTERED VALUER

Draft Rule 17.2 (2) provides that (2) tThe following persons shall be eligible to apply for being registered as a valuer: -

(a) a chartered accountant, company secretary or cost accountant who is in whole-time

practice, or any person holding equivalent Indian or foreign qualification as the

Ministry of Corporate Affairs may recognise by an order; Provided that such foreign

qualification is acquired by Indian citizen.

(b) a Merchant Banker registered with the Securities and Exchange Board of India,

and who has in his employment person(s) having qualifications prescribed under

(a) above tocarry out valuation by such qualified persons;

(c) member of the Institute of Engineers and who is in whole-time practice;

(d) member of the Institute of Architects and who is in whole-time practice;

(e) A person or entity possessing necessary competence and qualification as may be

notified by the Central Government from time to time.

It is provided that in the case of a CA, CMA or CS, the concerned member shall have not less than five years post membership continuous experience. Also in the case of a Merchant Banker registered with SEBI, the persons employed by the Merchant Banker having prescribed qualifications (CA,CMA or CS) shall have not less than five years post membership continuous experience.

CS AS A REGISTERED VALUER

Looking at the intention of the regulator, it appears that Company Secretaries will have a major role to play in terms of what they can offer with respect to a valuation assignment. However, the very nature of valuation being a multi-disciplinary concept involving intricate understanding of concepts of value, costs, pricing as well as applicable regulatory framework, in addition to having a good command over business transactions and market mechanisms, CS as also other recognized professionals (CA/CMA) would do well to network with other professionals/ specialists having relevant expertise, thereby strengthening their credentials for establishing themselves as successful valuers.

Regime - Related Party & Related Party Transactions

Related Party Transactions (RPTs) had been always an important subject matter in and for preparation of financial statements of any company. It has always been view by regulators that some advantage been passing to personal interest of the party having stake in the company.

Related Party Transactions (RPTs) had been always an important subject matter in and for preparation of financial statements of any company. It has always been view by regulators that some advantage been passing to personal interest of the party having stake in the company.

The Companies Act, 1956 did not had any provisions covering aspects of related party, and or their transactions. However, only Accounting Standard 18 (As-18) provides for disclosure norms to follow for preparation of financial statements.

The term “related party” and “related party transactions” prescribed in provisions of respective clause 2(76) and clause 188 of the new Companies Act, 2013 have wider coverage. The following paragraphs explains the new provisions in context of the requirements, conditions, consent, approval, disclosure, voidable and penalty along with identifying such transactions.

Further, the SEBI Board, also in its meeting held in New Delhi on February 13, 2014 inter-alia took the decisions to amend the listing agreement with regards to RPTs more in line with the provisions of Companies Act, 2013. The important aspects which SEBI proposes to make it applicable to all listed companies with effect from October 1, 2014 covered are as under:

Prior approval of Audit Committee for all material RPTs.

Prior approval of Audit Committee for all material RPTs.

Approval of all material RPTs by shareholders through special resolution with related

Approval of all material RPTs by shareholders through special resolution with related

parties abstaining from voting.

Policy on dealing with RPTs and such policy to be posted on the website of the company.

Policy on dealing with RPTs and such policy to be posted on the website of the company.

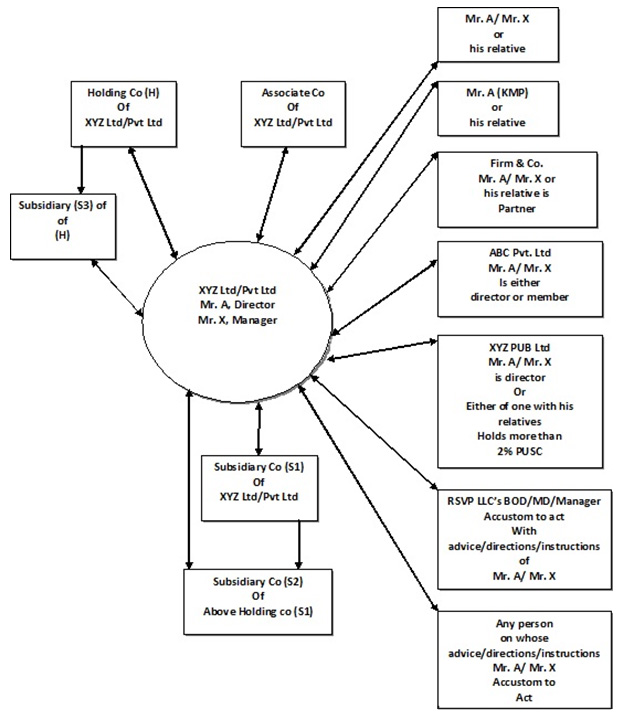

The term “related party’ has been presented in simple format for the sake of simple understanding.

Company (be it public or private) as One Party enters transactions with any one of the entity as mentioned below as Second Party.

| Sr. No. | Second Party: |

Type of Second Party |

| 1. | A Director or his relative. | Individual |

| 2. | A key managerial personnel or his relative. | Individual |

| 3. | A firm, in which a director, manager or his relative is a partner. | firm |

| 4. | A private company in which a director or manager is a member or director. | Private Company |

| 5. | A public company in which a director or manager is a director or holds along with his relatives, more than two per cent of its paid-up share capital. | Public Company |

| 6. | Anybody corporate whose board of directors, managing director or manager is accustomed to act in accordance with the advice, directions or instructions of a director or manager. (Does not cover the advice, directions or instructions given in a professional capacity) | Body corporate |

| 07. | Any person on whose advice, directions or instructions a director or manager is accustomed to act. (Does not cover the advice, directions or instructions given in a professional capacity) | Person |

| 08. | A holding company of such company. | Private / Public |

| 09. | A subsidiary company of such company. | Private / Public |

| 10. | An associate company of such company. | Private / Public |

| 11. | Any company which is a subsidiary of a holding company to which it is also a subsidiary. | It means all vertical and horizontal holding and subsidiary companies are related party. |

| 12. | Any person as may be prescribed by Government; Below is as prescribed under Companies (Meeting of Board and its powers) Rules, 201; A director or key managerial personnel of the holding company or his relative with reference to a company shall be deemed to be a related party. |

Director/KMP of holding company is deemed related to subsidiary. |

The following chart depicts the different related party covered under the new law; “Double sided arrow shows the parties are “related”.”

The following types of contract or arrangements are covered under the provisions of new law; Table 1

| Sr. No. | Type of contracts or arrangements |

Remarks |

| a. | Sale, purchase or supply of any goods or materials; | |

| b. | Selling or otherwise disposing of, or buying, property of any kind; | Movable/immovable |

| c. | Leasing of property of any kind; | Movable/immovable |

| d. | Availing or rendering of any services; | All types of services |

| e. | Appointment of any agent for purchase or sale of goods, materials, services or property; | |

| f. | Such related party's appointment to any office or place of profit in the company, its subsidiary company or associate company; and | |

| g. | Underwriting the subscription of any securities or derivatives thereof, of the company. |

Office or Place of profit shall mean:

In case of a Director:

Any office or place held by a Director and he receives some remuneration over and above the remuneration he is otherwise entitled to as a Director, by way of salary, fee, commission, perquisites, any rent-free accommodation, or otherwise.

In case of any other entity:

Any office or place held by an individual other than a Director, or by any firm, Private Company or other Body Corporate, and such an entity receives from the company anything by way of remuneration, salary, fee, commission, perquisites, any rent-free accommodation, or otherwise

Requirements of the law:

I. Board consent in meeting

Consent of the board by resolution passed in its meeting is required, if the company enter into any contract or arrangement with a related party (RPT) with respect to the transactions mentioned in Table 1 above. Where any director is interested then such director shall not be present in the meeting during discussion of the matter of such contract or arrangement.

The company can enter into contracts or arrangements by passing resolution in its board meeting provided that the transactions does not cross limits mentioned in Table 2 and paid up share capital of the company is less than ten crore rupees.

II. Shareholders prior approval

Prior approval of the company by way of special resolution required where:-

a) Paid up share capital of the company is INR 10 Crore or more;

b) Transaction or transactions to be entered into as contracts or arrangements referred in Table 2 with prescribed criteria or amounts.

Accordingly, even if the company is not having a paid up share capital of Rs. 10 crore, but is entering into any of the transactions enumerated in Table 2, it has to pass a special resolution.

Also on the other hand, even if the company entering into any of the transactions not crossing the limits enumerated in Table 2, but paid up share capital is Rs. 10 crore or more, the company has to pass special resolution.

Table 2

| Sr. No. | Type of transaction or transactions requiring prior shareholder approval by special resolution |

Prescribed criteria or amounts |

| 1. | Sale, purchase or supply of any goods or materials directly or through appointment of agents as mentioned in clause (a) and clause (e) respectively of Table 1 | Exceeding 25% of the annual turnover |

| 2. | Selling or otherwise disposing of, or buying, property of any kind directly or through appointment of agents as mentioned in clause (b) and clause (e) respectively of Table 1 | Exceeding 10% of net worth |

| 3. | Leasing of property of any kind as mentioned in clause (c) of Table 1 | Exceeding 10% of the net worth Or Exceeding 10% of turnover |

| 4. | Availing or rendering of any services directly or through appointment of agents as mentioned in clause (d) and clause (e) of Table 1 | Exceeding 10% of the net worth |

| 5. | Appointment to any office or place of profit in the company, its subsidiary company or associate company as mentioned in clause (f) of Table 1 | Exceeding monthly remuneration of Rs. 2.5 Laks |

| 6. | Remuneration for underwriting the subscription of any securities or derivatives thereof of the company as mentioned in clause (g) of Table 1 |

Exceeding 1% of the net worth |

The Turnover or Net worth shall be on the basis of Audited Financial Statement of preceding Financial Year.

c) In case of wholly owned subsidiary, the special resolution passed by the holding company shall be sufficient for the purpose of entering into the transactions between wholly owned subsidiary and holding company, i.e. the wholly owned subsidiary will not need to separately pass a special resolution.

III. Member not permitted to vote

If any member is related party then no such member can vote on special resolution to approve the contract/arrangement under consideration. Interested member need not to vote on special resolution to approve any contracts or arrangements required to be entered by the company. This requirement of law implies that disinterested minority shareholders can dictate the results of special resolution and may lead to a situation of impacting the business decision of the company.

To understand the practical difficulties as may be faced due to above requirements, for example company A in which 60% is held related parties. Now, if company A wants to enter into a transaction which is related party transaction and therefore by virtue of the provisions 60% majority are prohibited to vote in general meeting and the balance disinterested 40% shareholders should only vote. Since, approval by special resolution is required it means approval by only 30% of disinterested shareholders will be required. The situation may arise that any person holding 10% in company A could vote against the decision thus resulting into the total constraint in taking business decision, though could be good for the growth of the company, but merely by 10% minority shareholder, who may not have understood the transaction, which is good for the growth of the company A and as a result, despite promoters shareholders sincere and genuine efforts for the growth of company A may go in ruin.

IV. Disclosure requirements in the Board report and explanatory statement attached to notice to shareholders

All related party transactions to be disclosed in board report with justification for entering into it. These disclosure requirements of law will increase more disclosure on transparency to the shareholders of the company.

The explanatory statement annexed to the notice convening general meeting for obtaining shareholders approval must contain the following particulars, namely:-

a) name of the related party;

b) name of the director or key managerial personnel;

c) nature of relationship;

d) nature, material terms, monetary value and particulars of the contract or arrangement;

e) any other information relevant or important for the members to take a decision on the proposed resolution.

V. Ratification

If contract entered without consent of board of prior approval of shareholders, as the case may be, the same can be ratified by the board or shareholder as the case may be within 3 months from date of entering it into.

VI. Provisions for Voidable contract/arrangement

The contract/arrangements if not so ratified in 3 months period then such contract or arrangement shall be voidable at the option of the Board.

VII. Indemnity against losses and recovery of any losses to/by the company

If the contract/ arrangement is with a party related to a director, or is authorized by another director, then the concerned directors shall indemnify the company against any losses incurred by it. Moreover now the law provides that company can proceeds against such directors or any other employee to recover any loss incurred by it due to such contract/arrangement entered in contravention of the law.

VIII. Penalty

To director or any other employee who authorized or entered such contract in contravention the penalty imposed is; in case of listed company imprisonment up to 1 year; or fine INR 25,000 may extend to INR 5, 00,000 or with both. In case of any other company fine INR 25,000 may extend to INR 5, 00,000

The question now here arises that are there any related party transactions which can be entered without attracting the provisions of the new Act. The Act, 2013 provides that nothing contained in Section 188 (1) shall apply to related party transactions which are in the ordinary course of business and on an arms’ length basis.

Therefore it is inferred that the transactions which are

i) in ordinary course of business and are

ii) at arm’s-length basis are permissible without attracting any of the conditions prescribed in the Act.

The new law explained the term “Arm’s length Transaction” which means a transaction between 2 related parties that is conducted as if they were unrelated, so that there is no conflict of interest.

The test for applicability of the provisions can be made by asking following 2 questions;

i) Is the contract is in ordinary course of business?

ii) Is the contract is at arm’s-length basis?

The provisions of new law will not get invoked if the answer to both questions is in affirmative.

WIRC Anouncement

Notice for students

CCGRT of ICSI, Navi Mumbai requires 06 ( six ) Management Trainees. Students who have passed all modules of CS Professional Examination are eligible to be appointed. Stipend : Rs 7000/- per month.

Interested students may send their Bio-data by e-mail at nidhi@icsi.edu with a copy to ccgrt@icsi.edu In the subject line, please mention “ Application for Management Trainee at CCGRT, Navi Mumbai”.

PMQ Notice

Case Law at Glance

A BIRD’S EYE VIEW: RECENT JUDGEMENTS ON COMPANY LAW

A BIRD’S EYE VIEW: RECENT JUDGEMENTS ON COMPANY LAW

Shareholding plays an important role in taking control of companies and a status quo order with regard to shareholding binds parties before Court. In case of amalgamation, if status quo order with regard to shareholding in concerned companies is not maintained, there is a danger of parties wriggling out of sweep of status quo order – ANITA RAJ GARHIA V. ASIAN HOTELS (NORTH) LTD. [2014] 124 SCL 113 (DELHI).

2)OPPRESSION AND MISMANAGEMENTAn agreement of restructuring was entered into between appellant, Govt. of West Bengal and HPL to transfer shares to ensure that CPMC held 51% of total paid up capital of HPL. Agreement provided for reference of all disputes to arbitration. Disputes arose between parties and appellant sought to invoke arbitration but respondent filed a suit before High Court to declare arbitration clause in agreement as void. High Court passed impugned order of injunction. Since arbitration clause in principle agreement was valid, appellant was entitled to invoke arbitration clause for settling their disputes. Since arbitration clause was valid, suit filed by respondent for declaration and permanent injunction was unsustainable in law and was liable to be dismissed. Parties were directed to resolve their disputes through arbitration. - CHATTERJEE PETROCHEM CO. V. HALDIA PETROCHEMICALS LTD [2014] 124 SCL 93 (SC).

3)REDUCTION OF SHARE CAPITALPetitioner Company filed instant petition seeking confirmation of reduction of its share capital. It was noted that reduction of share capital was commercial and business verdict approved by majority of shareholders of Petitioner Company. Further, there was no objection filed either while special resolution approved by Board of Directors of Petitioner Company in its meeting or before Court after notices were published giving wide publicity. In view of the above, proposed scheme of reduction of share capital of Petitioner company was approved. - INDIA STEAMSHIP LTD., IN RE, [2014] 124 SCL 118 (RAJ)

4)APPEAL TO HIGH COURTAppeals filed before the jurisdictional High Court cannot be rejected on the principle of forum non conveniens – Section 10F – GULBARGA AIRPORT DEVELOPERS (P.)LTD. V. IL & FS TRANSPORTATION NETWORK LTD AND ORS [2014] 119 CLA 63 (AP)

5)COMPANY LAW BOARDCompany Law Board, while dealing with application under section 634A, sits as an executing court and is subject to all limitations which an executing court is subject to – Section 634A – PUNEET MALHOTRA V. WEIKFIELD PRODUCTS CO. INDIA (P.) LTD. [2014] 119 CLA 75 (CLB)

6)ARRANGEMENT/AMALGAMATION – COURT’S SANCTION TO SCHEMECourt cannot add terms to the scheme, as its power is limited to giving necessary directions for proper working of the scheme of arrangement/ amalgamation – Section 391 and 392 – REAL LIFESTYLE BROADCASTING (P.) LTD. V. TURNER ASIA PACIFIC VENTURES INC. [2014] 119 CLA 92 (DELHI)

Smile Please

| 9:00 a.m. | Starting Time |

| 9:30 a.m. | Arrive at Office |

| 9:45 a.m. | Coffee Break |

| 11:00 a.m. | Check Mails |

| 11: 15 a.m. | Prepare for Lunch |

| 12 noon | Lunch |

| 2:45 p.m. | Browse Internet |

| 3:00 p.m. | Tea Break |

| 4:00 p.m. | Finishing Work |

| 4:30 p.m. | Prepare to go home |

| 5:00 p.m. | Go home |

CONTRIBUTED BY:

CS GAURAV PINGLE, Pune.

Cartoon

WIRC News

Chapter News

Chapter Photo Gallery

WIRC Photo Gallery

Career Opportunities & Vacancies

|

ADVT - 1 REQUIRED COMPANY SECRETARY |

ADVT - 2 REQUIRED COMPANY SECRETARY |

A leading private company having its registered office in Mumbai requires a qualified Company Secretary with 3

years relevant experience.

A prospective candidate

should be well versed with the Companies Act 1956, SEBI, RBI Regulations, Legal Matters and must have handled work related to secretarial formalities and regulations. Interested candidates may send their detailed resume to:- Brilliant Polymers Private Limited 78 A Jolly Maker Chambers – II, Nariman Point, Mumbai – 400021 ________________________________________________ Advt - 3 Required a Company Secretary Candidate should be a members of Institute of Company Secretaries of India with 3 -5 years of experience and having legal background. Candidate should have knowledge of Secretarial and Legal Matters such as Compliance with various Laws, Filing of various documents / returns with the ROC, Drafting of minutes / agreements etc. Interested candidates may please apply within 7 – 10 days to : Hariyana Group 156, Maker Chambers VI 220 Jamnalal Bajaj Marg Nariman Point, Mumbi - 400021 |

A reputed, Professionally Managed Investment / Trading Company having international affiliation requires following personnel for its office at Nariman Point

COMPANY SECRETARY

Candidate should be a member of the Institute of Company Secretaries of India.

The Candidate should have good knowledge of Secretarial and Legal matters such as compliance with various laws, filing of various documents / returns with the RoC, drafting of minutes / agreements, mergers & amalgamations, trademarks, stamp duty and FEMA. Freshers can apply. Salary & perquisites will not be a constraint for the right candidate. Apply with resume within 7 days to:- Metmin Investment & Trading Pvt. Ltd. 161/162 Mittal Court, “A” Wing, 16th Floor Nariman Point, Mumbai - 400021 |

Editorial Policy

A : “FOCUS” published monthly as a magazine aims to be a forum for members of the Western India Regional Council of the Institute of Company Secretaries of India ( WIRC of ICSI) for;

a. DISSEMINATING information,

b. COMMUNICATING developments affecting the Institute and its members in particular and the

CS profession in general,

c. ARTICULATING issues of contemporary concern to the members of the profession.

d. CEMENTING and DEVELOPING relationships across membership by promoting discussion and

dialogue on professional issues.

e. DISCUSSING and DEBATING issues particularly of public interest, which could be served by

the CS profession.

f. FACILITATING Members of the profession to share their views on matters of professional

interest by way of articles and write-ups.

B : The WIRC of ICSI recognizes the fact that;

a. There is a growing emphasis on the globalization of the CS profession;

b. There is an imminent need to position the profession in a business context which transcends the

traditional and specific CS applications.

c. The Institute members increasingly will work across the globle and in global context.

C : Given this background the WIRC of ICSI strongly encourage contributions from the following

groups of professionals;

a. Members of other Professional bodies across the globe

b. Regulators and Government officials

c. Professionals from allied professions

d. Academia

e. Professionals from other disciplines whose views are of interest to the CS profession

f. Business leaders

D : The magazine also seeks to keep members updated on the activities of the Institute including events on the various practice areas and the various professional development programs on the anvil.

E : The WIRC of ICSI while encouraging stakeholders as in Section C to Contribute to the Magazine , it makes it clear that responsibility for authenticity of the contents or opinions expressed in any material published in the Magazine is solely of its author and the WIRC of ICSI, council members, any of its editors or members of Editorial Team & Advisory Board, the staff working on it or “FOCUS” is in no way holds responsibility there for. In respect of the advertisements, the advertisers are solely responsible for contents of such advertisements and implications of the same.

F : Finally and most importantly WIRC of ICSI strongly believes that the magazine must play its part in motivating students to grow fast as Members of tomorrow to be capable of serving the Legal & Compliance area within ever demanding customer expectations.

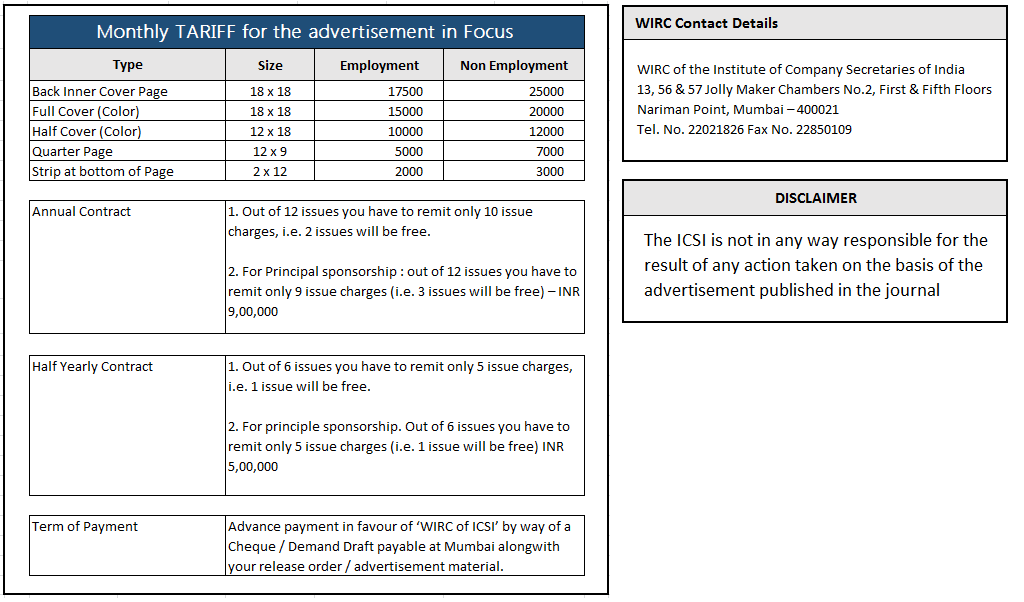

Tariff/Disclaimer