ICSI - WIRC FOCUS

Vol. XXX • No. 12 •Dec 2013

Chairman’s Blog

Knowledge has to be improved, challenged, and increased constantly, or it vanishes.

Knowledge has to be improved, challenged, and increased constantly, or it vanishes.

- Peter Drucker

My Dear Professional Friends,

By the time this last issue of FOCUS for 2013 reaches you, all of you would be busy preparing yourself to welcome 2014. My BEST WISHES to all of you for 2014.

I am glad to inform that the ICSI – WIRC jointly with Indore Chapter is organizing Two Days Workshop and Panel Discussion on “The Companies Act, 2013” on Saturday and Sunday, January 04 & 05, 2014 at Hotel Fortune Landmark, Vijay Nagar, Indore, Madhya Pradesh. CS S N Ananthasubramanian, President, ICSI, will grace the occasion as the Chief Guest at the valedictory session scheduled on Sunday, January 05, 2014. The event will mark the beginning of 2014. Members are requested to register themselves for the Workshop.

The ICSI – WIRC is hosting Cricket Match, an annual event, between CS XI and MCA XI on 2nd January 2014 at Hindu Gymkhana, Marine Drive, Mumbai, which will be followed by Health Check-up & Blood Donation Camp jointly with MCA on 11th January 2014 at Office of the ROC, Mumbai. The members are requested to cheer up the cricket teams and also attend the Health Check-up & Blood Donation Camp. The ICSI-WIRC is in process of preparing Blood Donors’ Directory. I therefore request the member - donors to come forward and register their names and other details with WIRC. Separate communication with regard to above initiative will follow.

The renovated premises of the ICSI-WIRC on 5th Floor, Jolly Maker Chambers – II, Nariman Point was inaugurated by CS S N Ananthasubramanian, President, ICSI, in presence of CS Harish Vaid, Vice-President, ICSI, CS M.S. Sahoo, Secretary, ICSI and other Council and Regional Council members on 13th December 2013. The inauguration was preceded by “Gruh Pravesh Puja” at the renovated premises.

Many of our members are yet not the members of CS Benevolent Fund. ICSI – WIRC has initiated a ‘CSBF Drive’ to enroll more and more members to the CSBF. I request the members, who have not joined CSBF to immediately join COMPANY SECRETARIES BENEVOLENT FUND. The CSBF members are requested to pursue other members in this ‘movement’ and help ICSI-WIRC in this Cause.

With Warm Regards,

CS Hitesh Buch

Chairman

ICSI-WIRC

Ahmedabad, 26th December 2013

Editorial Board

Photo Feature

Indian Depository Receipts (IDRs) : Overview from the First Mover

Depository Receipts (DRs) as an instrument were created in 1927, primarily to circumvent the difficulties associated with different currencies in the foreign market. Investors attempting to enter the emerging markets or other foreign stock exchanges had to go through expensive commissions and currency exchange before successfully investing in a foreign market. With American Depository Receipts (ADRs), however, investors could take advantage of foreign markets while trading in U.S stock markets.

Depository Receipts (DRs) as an instrument were created in 1927, primarily to circumvent the difficulties associated with different currencies in the foreign market. Investors attempting to enter the emerging markets or other foreign stock exchanges had to go through expensive commissions and currency exchange before successfully investing in a foreign market. With American Depository Receipts (ADRs), however, investors could take advantage of foreign markets while trading in U.S stock markets.

In India, Ministry of Finance, Government of India, New Delhi released a Report of the High Powered Expert Committee on Making Mumbai an International Financial Centre (“IFC”) in 2007. Under the point titled “The incompatibility of capital controls in a 21st century IFC” it is stated that “In some ways it might appear to be theoretically feasible for India to make some progress towards internationalisation of finance while retaining an elaborate structure of capital controls. For example, an institutional mechanism for the issuance of Indian Depository Receipts (IDRs) could be created: a narrow opening in a system of controls through which one kind of transaction can be conducted. So while Ministry of Corporate Affairs had issued rules in 2004 around IDRs, the Securities and Exchange Board of India (SEBI) too started working around the rules for IDRs.

I. INTRODUCTION AND APPLICABLE REGULATIONS:

About the Instrument:

• What is an Indian Depository Receipt (“IDR”)

An IDR is an instrument denominated in Indian Rupees in the form of a depository receipt created by a Domestic Depository (custodian of securities registered with the Securities and Exchange Board of India) against the underlying equity shares of issuing company to enable foreign companies to raise funds from the Indian securities Markets.

The Companies Act, 2013 defines under section 2 (48) “Indian Depository Receipt” means any instrument in the form of a depository receipt created by a domestic depository in India and authorised by a company incorporated outside India making an issue of such depository receipts.

Ministry of Finance (Department of Company Affairs) vide Notification dated 23 February, 2004 announced rules called the Companies (Issue of Indian Depository Receipts) Rules, 2004 which defined IDRs under Section 3 (i) (d) as

“any instrument in the form of a depository receipt created by Domestic Depository in India against the underlying equity shares of issuing company”. (Pl. note there is no revision in these rules so far post notification of the Companies Act, 2013)

In case of Standard Chartered PLC (“SCPLC”) every 10 IDRs represent an ownership interest in equity Share of SCPLC. Shares underlying the IDRs are deposited with the Custodian who hold the Shares on behalf of the Depository in accordance with the terms of the Custody Agreement (for the purposes of this explanation, referred to as the ‘‘Deposited Shares’’). Each IDR also represents any securities, cash or other property attributable to the Deposited Shares that has been deposited with the Custodian or the Depository but has not been directly distributed to the IDR Holders (for the purposes of this explanation, together with the Deposited Shares, referred to as the ‘‘Deposited Property’’). Pursuant to the Issue, 240,000,000 IDRs representing 24,000,000 Deposited Shares were issued by the Depository. Every 10 IDRs represent one Share.

• What is the benefit for an issuer company?

The issuer company can raise funds in a cost effective manner and access the market in a country which they want to expand their presence into.

In case of SCPLC, it was already operating through its branch set up as one of the top foreign banks in India and for its parent to list in India not only strengthened its commitment to India market but also diversified its investor base. Capital was raised on acceptable terms with high quality institutional shareholders on the register. It also gave opportunity to retail investors who have been banks privileged customers for generations together. Incidentally, Standard Chartered Bank is the first foreign bank in India to open a branch in 1858 in Calcutta (India). It was a unique opportunity to raise the Company’s profile and allow investors in India to participate in the Company’s future.

• What is the benefit for an investor?

The Indian Investors can buy a foreign stock without attracting restrictive provisions of FEMA, integration of Indian capital market with the world market, increased arbitrage opportunity, and increased chances of Indian corporate sector being more efficient due to global competition in the primary market.

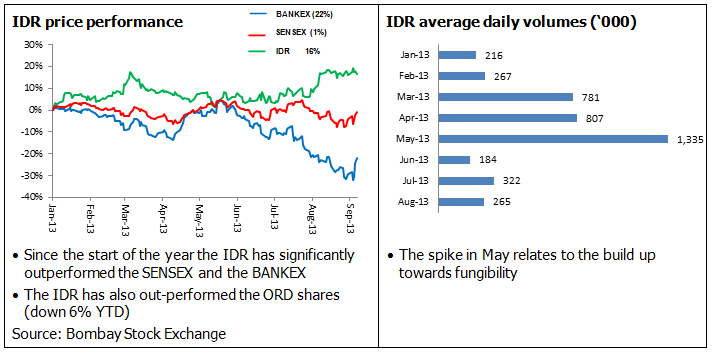

In case of SCPLC, the investors get a good return twice in a year in the form of dividend as is evidenced from the fact that, IDR as an instrument has significantly outperformed the SENSEX and the BANKEX since the start of the year. (Refer point IV in this article). The investors now also have option to convert their holding from IDR into underlying equity share and vice versa with the permissibility of fungibility by the regulators.

Applicable regulations:

• The SEBI Act, 1992, as amended from time to time.

• The SEBI (Disclosure and Investor Protection) Guidelines, 2000.

• Ministry of Finance (Department of Company Affairs) vide Notification dated 23 February, 2004 announced rules called the Companies (Issue of Indian Depository Receipts) Rules, 2004. (Annexure I)

• The SEBI vide its circular SEBI/CFD/DIL/IDR/1/2006/3/4 dated April 3, 2006 issued a model listing agreement specifically for IDRs. (Refer www.sebi.gov.in – Legal Framework – Circulars April 2006)

• Thereafter SEBI vide its circular SEBI/CFD/DIL/IDR/1/2009/16/06 dated June 16, 2009 issued separate Listing Agreement for issuing companies whose securities market regulators are signatories to the Multilateral Memorandum of Understanding (MMOU) of International Organization of Securities Commission (IOSCO)**. (Refer www.sebi.gov.in – Legal Framework – Circulars June 2009)

SEBI received suggestions from market participants to modify the said Model Listing Agreement so as to align it with the listing requirements of the issuers' home country so that there is no additional regulatory or cost burden to the issuers. Here the issuer with respect to most of the provisions especially Corporate Governance requirements and disclosure of periodical results, is allowed to follow the home country requirements provided equitable treatment is given to the IDR holders vis-à-vis holders of equity shares.

**IOSCO is recognized as the international standard setter for securities markets. The Organization's wide membership regulates more than 90% of the world's securities markets and IOSCO is the world's most important international cooperative forum for securities regulatory agencies. IOSCO members regulate more than one hundred jurisdictions.

• SEBI Board at its meeting held on 13 August 2008 approved amendments to certain SEBI regulations namely (Depositories and Participants) Regulations, 1996, SEBI (Foreign Institutional Investors) Regulations 1995, SEBI (Mutual Fund) Regulations, 1996 and SEBI (Custodian of Securities) Regulations, 1996 in order to facilitate the IDR issue process.

Regulation 28 of the DP regulations was amended to include by inserting the words “Indian Depository Receipts” after the words “debenture stock” and before the words “or other marketable securities of a like nature”.

With this amendment though IDRs were securities as per Section 2(h) of Securities Contracts (Regulation) Act (SCRA), IDRs were not expressly mentioned in Regulation 28 as securities eligible for being held in dematerialised form in a depository. For the purpose of clarity, an amendment was be made in the DP Regulations to include IDRs as securities eligible for being held in dematerialised form in a depository.

• The SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2009, as amended from time to time.

• The Reserve Bank of India (RBI) vide notification no. FEMA.223/2012-RB date 7 March 2012 in pursuance of clause (za) of Section 2 of the Foreign Exchange Management Act, 1999 (42 of 1999) (FEMA), notified Indian Depository Receipts (IDRs) as defined under clause © of sub-rule (i) of Rule 3 of Companies (Issue of Indian Depository Receipts) Rules, 2004, as "security" for the purposes of FEMA. (Annexure II).

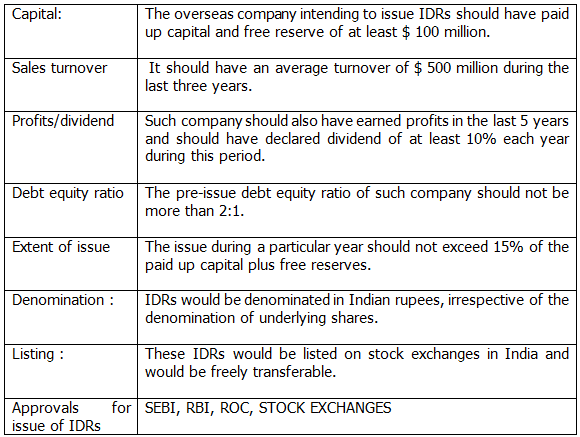

II. SUMMARY OF ELIGIBILITY RULES FOR A PROSPECTIVE ISSUER:

Source: Companies (Issue of Indian Depository Receipts) Rules, 2004 under the erstwhile Companies Act, 1956

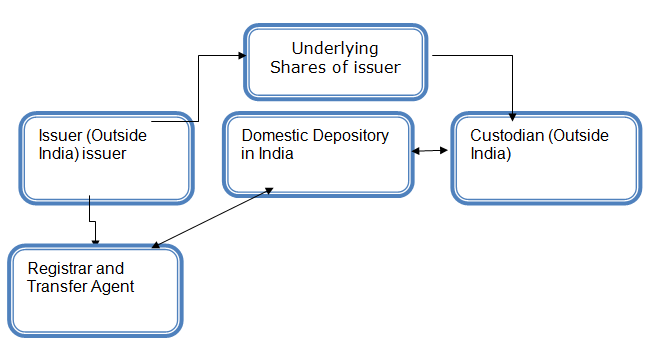

III. KEY ROLE PLAYERS:

Source: SEBI (Depositories and Participants) Regulations, 1996

• Role of Domestic Depository:

In case of SCPLC it is Standard Chartered Bank, Mumbai.

o Submission of Master Creation form and intimation to Security Depositories and the Indian Stock Exchanges of admission of the Dematerialised IDRs.

o Maintain or cause to be maintained through Register and Transfer agents a register of IDR holders.

o To exchange or arrange to exchange any Dematerialised IDRs for an IDR certificate in physical form.

o To maintain accounts of investors.

o Dematerialisation and rematerialisation of IDRs.

o Settlement of market transaction through the release and receipt of securities in the investor's account.

o Off market transfers, distribution of dividend.

o Conversion of IDRs into underlying shares in conjunction with Custodian.

• Role of Custodian:

In case of SCPLC it is Bank of New York Mellon in London.

o To hold the underlying shares on behalf of the Depository in accordance with the terms of the Custody Agreement.

o Upon receipt of instruction from IDR holders’ custodian shall appoint the relevant persons as proxies in respect of Deposited shares to vote at shareholders meeting.

o Gatekeeper and administrator in respect of the issuance and cancellation process within the local market

o Monitoring for Headroom in case of fungibility.

o To ensure that depositing brokers are responsible for their SDRT obligations on new IDR issuances.

• Role of Registrar and Transfer Agent:

Source: SECURITIES AND EXCHANGE BOARD OF INDIA (REGISTRARS TO AN ISSUE AND SHARE TRANSFER AGENTS) (AMENDMENT) REGULATIONS, 2006

Role of a registrar to an issue is defined as follows:

“(f) “registrar to an issue” means the person appointed by a body corporate or any person or group of persons to carry on the following activities on its or his or their behalf:

a. collecting applications from investors in respect of an issue;

b. keeping a proper record of applications and monies received from investors or paid to the seller of the securities; and

c. assisting body corporate or person or group of persons in:

d. determining the basis of allotment of securities in consultation with stock exchange;

e. finalising list of persons entitled to allotment;

f. processing and dispatching allotment letters, refund orders or certificates and other related documents in respect of an issue;

(g) “share transfer agent” means –

a. any person, who on behalf of any body corporate, maintains the records of holders of securities issued by such body corporate and deals with all matters connected with the transfer and redemption of its securities;

b. a department or division, by whatever name called, of a body corporate performing the activities referred in sub-clause (i) if at any time the total number of the holders of its securities issued exceed one lakh;”

One difference in case of equity listing and IDRs is that in case of IDRs two Registrar and Transfer agents are involved. One from the Issuer Company - Home Country side, and the other in that Country in which IDRs are issued.

So in the case of SCPLC IDRs Karvy Computer Share is the R&T in India and Computer Share is the R&T in London where SCPLC has the registered office.

IV. PERFORMANCE OF THE INSTRUMENT:

IDRs of SCPLC were listed on the Bombay and National Stock Exchange in June 2010.

The issue was priced at INR 104 per IDR with 5% discount offered to Retail Investors and Eligible employees.

A 52 week high has been INR 135 with the SCPLC declaring dividend twice in a year.

V. WHAT HAS CHANGED SINCE LISTING IN 2010:

ANNOUNCEMENT OF TWO WAY FUNGIBILITY:

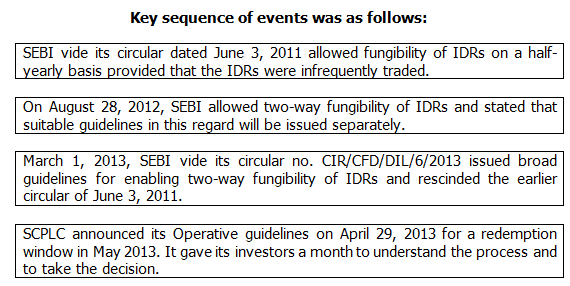

In the RBI/2009-10/106 A.P. (DIR Series) Circular No. 05 dated 22 July 2009 on Issue of Indian Depository Receipts, RBI had stated that automatic fungibility was not permitted. Moreover, IDRs were not redeemable into underlying equity shares before the expiry of one year period from the date of issue of the IDRs.

The Reserve Bank of India (RBI), the Indian central bank and the Securities and Exchange Board of India (SEBI), the Indian securities market regulator, have vide their respective circulars 1 each dated August 28, 2012, paved the way for limited two-way fungibility for Indian depository receipt (IDR). Fungibility in this context refers to the ability of the holder of an IDR to convert such IDR into the underlying equity security and vice versa.

However, from a retail investor standpoint a noteworthy regulatory requirement in terms of the RBI circular dated July 22, 2009, is that while listed Indian companies and Indian mutual funds registered with SEBI may either sell or continue to hold the underlying Equity Shares subject to the terms and conditions in Regulation 6B and 7 of Foreign Exchange Management (Transfer or Issue of any Foreign Security) Regulations, 2004, as amended; other persons resident in India including resident individuals are allowed to hold the underlying Equity Shares only for the purpose of sale within a period of 30 days from the date of redemption of the IDRs into underlying Equity Shares. This coupled with limited awareness about CREST account requirements has to some extent discouraged retail investors.

VI. IMPENDING CHANGE:

TAX:

Presently, there are no specific tax provisions under the Income-tax Act, 1961 with respect to tax implications at the time of redemption of IDRs into underlying equity shares. While SEBI and RBI have provided for limited two way fungibility, there exists no provision providing incentives under the tax laws to make the IDR regime attractive, viz, (i) any gains arising on redemptions of IDR into the underlying equity shares if not specifically exempt would lead to a situation of the holder being subjected to tax in the absence of any realised gains and hence making a redemption unattractive (ii) dividends received would be subject to tax as income from other sources and taxed at the regular tax rates applicable to the tax payer.

INSURANCE SECTOR PARTICIPATION:

Section 27C of the Insurance Act bars investment of insurance funds outside India; this is primarily to protect the investor’s money. IRDA restricts insurers to invest in IDRs as would amount to indirect investment made outside India.

Similarly, pension sector regulations also do not allow pension fund to be invested outside the country.

VII. ROLE OF A COMPANY SECRETARY:

Clause 26 of the IDR listing agreement requires the issuer company to appoint a Company secretary in India who is the registered member of the Institute of Company Secretaries of India to act as the Compliance officer of the issuing Company who would directly liaise with authorities such as SEBI, the Stock Exchanges, and Registrar of Companies etc. and investors with respect to implementation of various rules, regulations, guidelines and other related matters.

Following are some of the continuing obligations as a Compliance officer: (the list is illustrative and not exhaustive)

• Filing of Annual Report, Financials with the stock exchanges;

• Submission of IDR holding pattern every quarter;

• Updates on complaints raised with SEBI by IDR holders, and closure of the same;

• Custodian of agreements like custody agreement, R&T agreement;

• Periodic filings with RBI if any mandated in their approvals.

• Announcements with the stock exchanges for all changes in Issuer Company at Board level, change in capital, price sensitive information, intended declaration of dividend, any major expansion plans, execution of new projects, significant change in polices, and all actions which trigger an announcement as per the Home Country regulations;

• Inform the stock exchanges at least 7 days in advance of the record date for corporate actions such as rights issues, bonuses, splits and payment of any dividend to IDR holders (IDR Listing Agreement, Clause 4);

• Compliance to fungibility guidelines and the SEBI regulations.

VIII. FIRST MOVER EXPERIENCE:

The project achieved the first Listing in India by any overseas company. Being “first mover” inevitably also presented a number of risks and challenges. Following areas played a key role in the final success:

• Planning the details - as they say the “devil is in the detail”. Sub-division of project’s scope into work streams, master time line along with standalone time line for each work stream, milestone tracker and monitoring.

• Regulatory consultation and co-operation – Consultation with SEBI, Home Country regulators on each of the concerns and the implementation capabilities ensured that governance with regulations is smooth, seamless and achievable.

• Regulatory filings and listing process - drafting of clear documentation, internal processes, and timelines took a lot of time but was perfected by the team.

• Prospectus drafting

• Marketing and investor relations – An issuer should invest in a good PR agency to manage Road shows, advertising campaigns to facilitate awareness amongst investors about the product being offered.

• Bid process

• Legal support

• People

IX. CONCLUSION:

In 2006 the picture looked like a non starter for foreign companies wanting to be part of the India story even though SEBI had conceptualised IDR with fanfare during the regime of the then SEBI Chairman Shri. GN Bajpai. Five months after the IDR guidelines were announced, not a single company had come to the market regulator seeking approval for issuance of the financial instrument.

In 2010, SEBI came out with simplified rules and regulation for IDR listing and in June 2010 SCPLC was the first to issue IDRs.

In 2013 here we are “been there done that”. Not only is the instrument trading in the market it has also experienced the first fungibility cycle in 2013.

One question could arise is if IDR is the local answer to ADR or GDR, then why IDR as an instrument is not being explored by other foreign companies wanting to raise capital. While top Indian Companies like Dr. Reddy’s, GAIL, Grasim Industries, ICICI Bank, Infosys Tech, Tata Motors, Ranbaxy and more have issued Global Depository Receipts; the Country is the host for only one IDR issuance.

Mature markets, depth of investors, Arbitrage / speculation opportunities’ and highly liquid market could be the reasons for ADR / GDR being successful. Further, for a foreign issuer if its own market is more liquid than the IDR market, the incentive drops.

To conclude, while fungibility has taken one more step in the right direction to encourage other foreign companies, such as Vodafone, HSBC and Citi, to take the IDR route to tap Indian market, tax benefits and participation of insurance sector will aid retention of equity on domestic bourses, narrow the discount and increase the market for IDR.

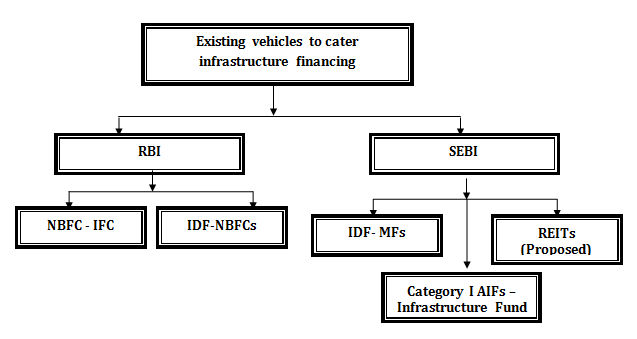

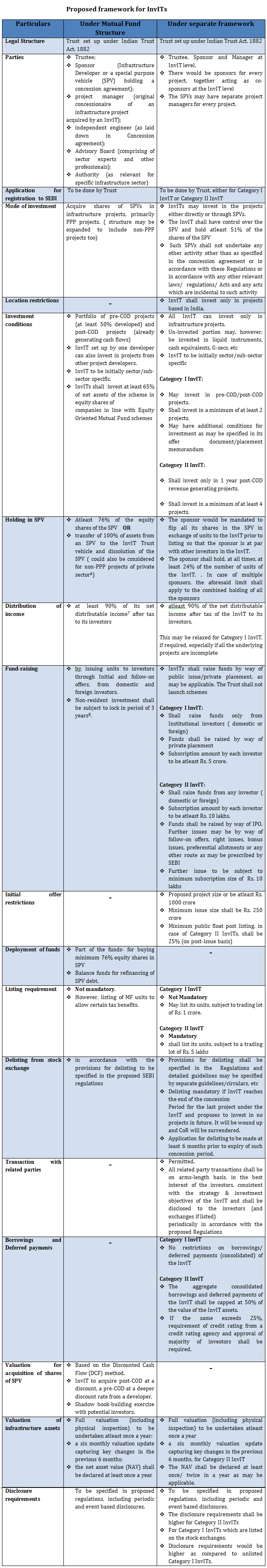

SEBI issues framework for Infrastructure Investment Trusts- Will this be just another vehicle for infra funding?

Background

Infrastructure is the foundation for development of Indian economy. This is evident from the huge investment in infrastructure sector of around Rs. 65 lakh crores, targeted to be achieved in the 12th Five Year Plan (2012-2017). The Cabinet Committee on Infrastructure (CCI) identified a Harmonized Master List of infrastructure sub-sectors, to guide all the agencies responsible for supporting infrastructure in various ways.

Infrastructure is the foundation for development of Indian economy. This is evident from the huge investment in infrastructure sector of around Rs. 65 lakh crores, targeted to be achieved in the 12th Five Year Plan (2012-2017). The Cabinet Committee on Infrastructure (CCI) identified a Harmonized Master List of infrastructure sub-sectors, to guide all the agencies responsible for supporting infrastructure in various ways.

Government attempts to fulfill this huge requirement of funds by way of Public Private Partnerships (PPP), Bank finance, Foreign Direct Investments, take out financing, External Commercial Borrowing, setting up of Infrastructure Debt funds ( either as a mutual fund or NBFC) etc.

Current scenario

As per SEBI’s annual report for 2012-13 , during 2012-13 four new mutual funds were granted registration. Out of the same, 3 are IDF-MFs . Further, during 2012-13, 42 AIFs have been registered with SEBI. Out of 42 registered AIFs Category I, II and III AIFs are 13, 22 and 7 respectively. Further, out of the 13 AIFs registered in Category I, only 3 are registered as Infrastructure AIFs.

Recently, SEBI on 10th October, 2013, issued a Consultation paper on draft SEBI (Real Estate Investment Trusts) Regulations, 2013 ( REITs).

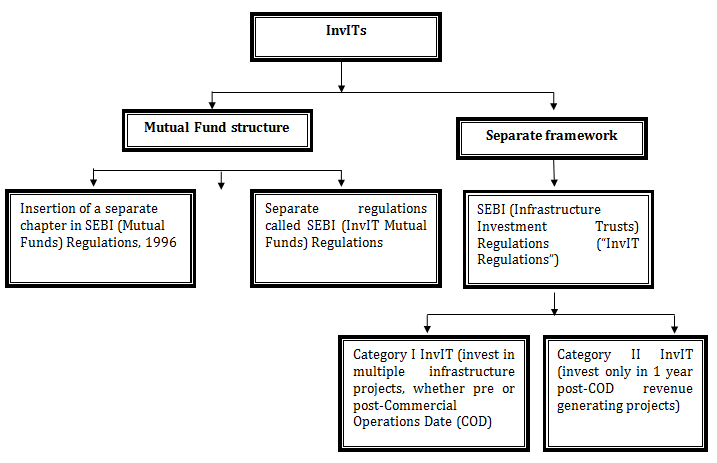

Infrastructure Investment Trusts- a New Vehicle!

SEBI vide Press Release PR No. 119/2013 on 10th December, 2013 conveyed about the discussions held at the third meeting of the International Advisory Board (IAB) of SEBI held at Bangalore on December 9 & 10, 2013 . While discussing about ‘REITs & Business Trusts: Proposed framework for India vis-à-vis global practices’, IAB suggested having a separate framework for Infrastructure Investment Trusts (InvITs). In view of the same, in an attempt to explore appropriate framework for introducing InvITs in the country, SEBI issued a consultation paper on InvITs on December 20, 2013 inviting public comments on the same latest by January 20, 2014.

SEBI’s objectives in proposing a structure for InvITs:

• To provide a suitable structure for financing/refinancing of infrastructure projects ( including completed/substantially completed) in the country;

• To free up current developer capital for reinvestment into infrastructure projects;

• To refinance/takeout existing high cost debt with long-term low-cost capital;

• To help banks to free up/ reduce loan exposure, thereby enabling banks to cater new funding requirements;

• To create an investment option for smaller investors

Other objects that SEBI intends to achieve through InvITs:

• Adding of projects in future in the same vehicle to enable investors to benefit from portfolio diversification;

• To attract international finance into Indian Infrastructure sector

• To bring higher standards of governance into infrastructure development and management, distribution of income from assets to attract investor interest.

Need for a separate framework

SEBI was in receipt of several comments on the draft (Real Estate Investment Trust) REITs regulations to the effect that infrastructure assets may be included as a part of REITs framework. However, the same was not regarded as suitable owing to difference in inherent nature of infrastructure assets and real estate assets, coupled with unique characteristics of sub-sectors, to avoid excluding other types of assets that may be added to the framework etc.

Proposed structure for InvITs:

Water Water Everywhere and Not a Drop to Drink!

As one may observe from above, there are several existing vehicle to fund the infrastructure sector. While the sector is still parched of funds, whether this additional framework proposed by SEBI, may prove just another vehicle?

Real Estate Investment Trust - REITs

A REIT, or Real Estate Investment Trust, is a type of real estate company modelled after mutual funds. REITs were created in the United States when President Dwight Eisenhower signed into law the REIT Act to give Americans the opportunity to invest in income-producing real estate in a manner similar to how many Americans invest in stocks and bonds through mutual funds. Income-producing real estate refers to land and the improvements on it – such as apartments, offices or hotels. REITs may invest in the properties themselves, generating income through the collection of rent, or they may invest in mortgages or mortgage securities tied to the properties, helping to finance the properties and generating interest income.

A REIT, or Real Estate Investment Trust, is a type of real estate company modelled after mutual funds. REITs were created in the United States when President Dwight Eisenhower signed into law the REIT Act to give Americans the opportunity to invest in income-producing real estate in a manner similar to how many Americans invest in stocks and bonds through mutual funds. Income-producing real estate refers to land and the improvements on it – such as apartments, offices or hotels. REITs may invest in the properties themselves, generating income through the collection of rent, or they may invest in mortgages or mortgage securities tied to the properties, helping to finance the properties and generating interest income.

REITs allow anyone to invest in portfolios of large-scale properties the same way they invest in other industries – through the purchase of shares. In the same way shareholders benefit by owning shares in other companies, the investor of a REIT earn a share of the income produced through real estate investment – without actually having to go out and buy or finance property. REITs are now global: Nearly 30 countries have adopted variations of the U.S. REIT model. Today, anyone in the world can invest in REITs around the world. Globally REITs own many of the shopping malls, apartment buildings, student housing complexes, homes, medical facilities, office buildings, hotels, cell towers and timberlands. REIT-owned properties are located in many countries and contribute millions of dollars in jobs and investment income to the global economy each year.

The REIT industry has a diverse profile, which offers many investment opportunities. REITs often are classified in one of two categories: equity or mortgage. However 90% of the REITs globally are equity REITs

Equity REITs:

Equity REITs mostly own and operate income-producing real estate. They increasingly have become real estate operating companies engaged in a wide range of real estate activities, including leasing, maintenance and development of real property and tenant services. One major distinction between REITs and other real estate companies is that a REIT must acquire and develop its properties primarily to operate them as part of its own portfolio rather than to resell them once they are developed.

Mortgage REITs:

Mortgage REITs mostly lend money directly to real estate owners and operators or extend credit indirectly through the acquisition of loans or mortgage-backed securities. Today's mortgage REITs generally extend mortgage credit only on existing properties. Many mortgage REITs also manage their interest rate and credit risks using securitized mortgage investments, dynamic hedging techniques and other accepted derivative strategies.

Mode of raising money

REITs need capital, just like any other company. The way a publicly traded REIT (real estate investment trust) does that is by IPO -- initial public offering. This is just like selling any other stock to the public, who are investing in the company’s income-generating real estate. The people who buy IPOs are investing in real estate which is managed like a stock portfolio. These external funds that raise capital enable the REIT to buy real estate, develop and manage it, for the purpose of generating profits. REITs generate income, and a major portion of the income is distributed to the shareholders on a regular basis. REITs make money from the properties they purchase by renting, leasing or selling them. .

Indian Scenario

SEBI had put in the public domain the draft SEBI (Real Estate Investment Trusts) Regulations, 2013 for public comments. According to these draft regulations REIT shall be set up as a Trust under the provisions of the Indian Trusts Act, 1882 and will not be allowed to launch any schemes.

REITs would be allowed to list on stock exchanges through Initial Public Offer (IPO). For coming out with an IPO, REIT should have minimum asset size of Rs 1,000 crore. Therefore this is only meant for large and established players. Further, minimum initial offer size is kept at Rs 250 crore and minimum public float of 25 per cent is required on a continuous basis.

After IPO they can raised funds further through only follow-on offers and not through any other mode of fund raising like preferential issue or rights issue. REIT may raise funds from any investors, resident or foreign. However, initially, till the market develops, it is proposed that the units of REITs may be offered only to HNIs /institutions. Consequently, it is proposed that the minimum subscription size would be Rs 2 lakh and unit size shall be Rs 1 lakh. Going by this REITs is not meant for retail investor.

Where are REITs allowed to invest?

As per draft regulation, at least 90 per cent of the value of the REIT assets shall be in completed revenue generating properties. Revenue or rent generating property shall mean property of which not less than 75 per cent of the area has been rented/leased out. In nutshell it will include commercial property and not residential property.

The remaining 10 per cent of REIT assets can be invested in

a. developmental properties, provided that such investment shall only be in properties which shall be held by the REIT for not less than three years after completion and shall be leased out;

b. listed or unlisted debt of companies; mortgage backed securities; shares of public listed companies which derive at least 75 per cent of their revenues from real estate activity;

c. government securities or money market instruments or cash equivalents.

The REIT shall not invest in vacant land or agricultural land or mortgages other than mortgage backed securities. Further, the REIT shall only invest in assets based in India. It shall not invest in units of other REITs.

What will the shareholders of REIT get?

To ensure regular income to the investors, the draft rules provide for the distribution of at least 90 per cent of the net distributable income after tax of the REIT to the investor.

When is it expected to become a reality?

The Reserve Bank of India has cleared the initial decks favouring changes in the Foreign Exchange Management Act (FEMA) and Foreign Direct Investment rules, as sought by the market regulator SEBI. I guess REITs most probably will see the light of the day after the Lok Sabha elections in 2014.

Happy New Year to all of you !!!

RD Column

Introduction and some routine issues

I have joined as Regional Director, Western Region, Mumbai on 06-11-2013 after my transfer from the O/o Regional Director, NRW, Ahmedabad where I was working as Regional Director since July, 2011. I am proud to be a part of the Company Secretary profession as I am fellow member of the Institute of Company Secretaries of India besides being fellow member of Institute of Chartered Accountants of India and Institute of Cost Accountants of India. I started my career as Company Secretary in Sutlej Cotton Mills Ltd. (Listed Company) in 1982 and after serving in Private and semi Government Sector for about 9 years, I joined the ICLS in 1991 and my first posting was as the Registrar of Companies, Punjab Himachal and Chandigarh with the office at Chandigarh. Since I had started my career as Company Secretary and for some time I was also office bearer of the Local Chapter of Institute of Company Secretaries of Chandigarh, so, I always feel a part of the team of Company Secretaries Professionals as I know their working from both sides of the desk.

I have joined as Regional Director, Western Region, Mumbai on 06-11-2013 after my transfer from the O/o Regional Director, NRW, Ahmedabad where I was working as Regional Director since July, 2011. I am proud to be a part of the Company Secretary profession as I am fellow member of the Institute of Company Secretaries of India besides being fellow member of Institute of Chartered Accountants of India and Institute of Cost Accountants of India. I started my career as Company Secretary in Sutlej Cotton Mills Ltd. (Listed Company) in 1982 and after serving in Private and semi Government Sector for about 9 years, I joined the ICLS in 1991 and my first posting was as the Registrar of Companies, Punjab Himachal and Chandigarh with the office at Chandigarh. Since I had started my career as Company Secretary and for some time I was also office bearer of the Local Chapter of Institute of Company Secretaries of Chandigarh, so, I always feel a part of the team of Company Secretaries Professionals as I know their working from both sides of the desk.

While in office I will always try to adopt the professional approach for quick delivery of services to the Stakeholders. During the course of my stay of about one month in Mumbai I have the chance to meet the professionals of Mumbai and I appreciate their approach and work culture. I would like to share my view on the following issues which are relevant in routine dealing with my office:-

1. While submitting the applications for approval of related party transactions, the professionals should ensure that all the applications should meet the spirit of section 297 of the Act, i.e. resources of a company should be diverted to the companies/entities floated by the directors/interested parties and also the contractee party/ parties should not survive solely on the basis of sale/purchase/supplies from the applicant company. In this regard while submitting the applications, care should be taken that in single or multiple applications, the total of all sales/purchases/supplies/services etc. should not exceed a specific percentage of total sale/purchases/supplies of the company, besides fulfilling the other requirements. Similarly, it should be ensured that the contractee parties should not be allowed to survive mainly on the basis of transactions which are subject matter of approval.

2. During my stay at Ahmedabad as well as in Mumbai as RD, I have seen that in many cases the reasons for shifting of registered office from one State to other State, are not substantiated but are only hypothically. For example in many cases grounds are given such as company is “The company is in the process of setting up of business in the proposed transferee State”. In some cases, no documents are supplied in support of their assertion and reasoning remain simply a hypothetical proposition. Similarly, in many cases it is stated that it will be more economical to run the business in the proposed transferee State. In such cases also no documents are submitted to prove that how it will be economical. In nutshell, it is requested that while submitting the petitions under section 17 of the Companies Act, 1956 for shifting the registered office, the reasons made in the petitions should be substantiated with documentation.

3. We have a general perception while executing the documents such as Power of Attorney, agreements, affidavits etc. that stamp papers in hand are valid only for 6 months. Here I would like to add that Stamp papers do not have any expiry period and it was made clear in the Supreme Court Judgment dated 19-02-2008 in the case of Thiruvengada Pillai Vs. Navneethammal and Anr. Besides that The Indian Stamp Act, 1899, nowhere prescribes any expiry date for use of a stamp paper. Section 54 of the Stamp Act merely provides that a person possessing a stamp paper for which he has no immediate use (which is not spoiled or rendered unfit or useless), can seek refund of the value thereof by surrendering such stamp paper to the Collector provided it was purchased within the period of six months next preceding the date on which it was so surrendered. The stipulation of the period of six months prescribed in Section 54 is only for the purpose of seeking refund of value of the unused stamp paper, and not for use of the stamp paper. Section 54 does not require the person who has purchased a stamp paper, to use it within six months. Therefore, there is no impediment for a stamp paper purchased more than six months prior to the proposed date of execution being used for a document.

As we are leading towards the New Year 2014, so I wish you a very very happy and prosperous New Year 2014.

(K.L.KAMBOJ)

REGIONAL DIRECTOR

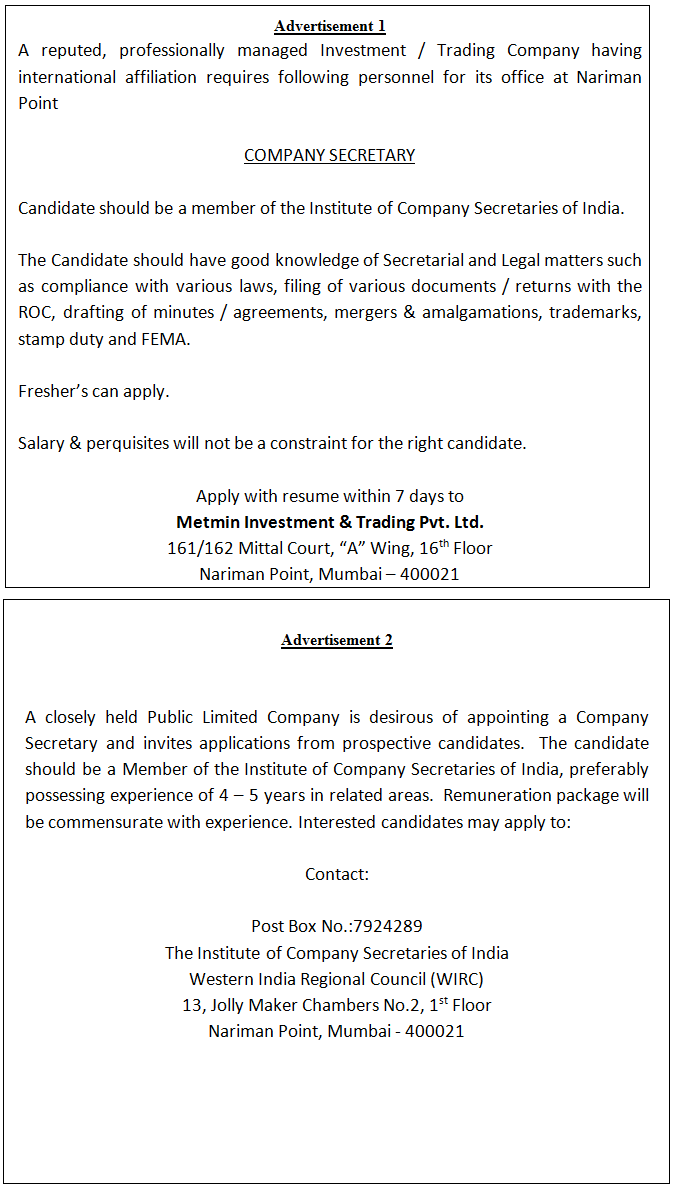

WIRC Advertisements

Case Laws at a Glance

A Bird’s Eye View: Recent judgements on Company Law

1) COMPROMISE AND ARRANGEMENT

1) COMPROMISE AND ARRANGEMENT

Petitioner – Transferor companies and Transferee-company sought for sanction of their scheme of arrangement which was entered into to promote infrastructure sharing among telecommunications service providers. Regional Director stated that Transferee-company might be directed to obtain necessary approvals from Ministry of Telecommunication; that an unsecured creditor of Transferor-company had opposed scheme and that income tax department (ITD) had objected to scheme on ground that no separate notice was given to Central Govt. and it should be permitted to proceed with recovery in respect of any existing or future tax liability of Transferor Companies or Transferee company in respect of assets sought to be transferred under scheme. Since each of Transferor companies and Transferee-company were separately registered with DOT, there was no question of transfer of registration certificate from Transferor companies to Transferee-company and, therefore, no approval was required. Since requisite majority of unsecured creditors had approved scheme, fact that one unsecured creditor had objected to it would not make a difference. In terms of section 637(l), Regional Director accepts notices in Petitions under section 394A on behalf of both MCA Central Government and, therefore, contention if ITD that instant Petition could not proceed for want of separate notice to Central Government was to be rejected. Grant of sanctions of scheme would not defeat right of ITD to take appropriate recourse for recovery of previous liabilities of any of Transferor companies or Transferee-company. Thus, proposed scheme of arrangement was to be sanctioned. – VODAFONE INFRASTRUCTURE LTD. IN RE [2013] 120 SCL 27 (DELHI)

2) OPPRESSION AND MISMANAGEMENT

Even for an unconditional withdrawal of a Petition under section 397 or section 398 Petitioner is required to seek leave of CLB and unless such leave is granted company Petition cannot be withdrawn. Petitioners i.e., Petitioner and ST, were shareholders of family company SFI which had only 4 shareholders. They had filed a Petition under sections 397 & 398 against Respondents AT and DT. However, during pendency of Petition, a settlement was arrived at between parties before Company Law Board. Petitioners filed application seeking to withdraw company Petition. Since permitting withdrawal of Petition would not be against public interest, Petitioners were to be granted leave to withdraw company Petition. - PRASHANT MODU TIMPLO V. SOCIEDADE DE FOMENT INDUSTRIAL (P.) LTD. [2013] 120 SCL 130 (CLB – NEW DELHI) (MAG.)

3) AMALGAMATION

Petition was filed for sanctioning scheme of amalgamation, which was duly sanctioned by company court. As per scheme, each 500 shares held in transferee company was to be replaced with one share in new company and shares below 50 in number were to be treated as fractional shares and to be sold by trustee through private placement. Appellant contended that shareholders, whose shareholding was being treated as fraction under scheme, should be treated as spate class and a separate meeting qua them should have been held. Application was filed by appellant seeking recall of scheme was dismissed. Decisive factor determining class of shareholder is not shareholding pattern but category of shares that one holds and merely because individual held small fraction of shares would not make them a separate class. Since on merit, company court found scheme to be fair and reasonable, same would be sanctioned. – RAM KOHLI V. INDRAMA INVESTMENT (P.) LTD. [2013] 120 SCL 125 (DELHI) (MAG.)

4) TRANSFER OF SHARES

Duplicate share certificates issued without compliance of procedure do not deserve to get entitlement as to the ownership. Sections 108 and 111A – SAMRIDDHI MEGA STRUCTURES LTD. V. VALENTINO INTERNATIONAL (P.) LTD. [2013] 117 CLA 62 (CLB)

5) REDEEMABLE PREFERENCE SHARES

Claims of the Petitioners have to be settled where the Petitioners are objectors to the reissue of fresh issue of preference shares. Sections 80 and 80A read with section 634A – K K JINDAL V. RAJARAM CORN PRODUCTS (PB) (P.) LTD. [2013] 117 CLA 71 (CLB)

6) BOARD MEETING

There cannot be quorum in absence of one director when company is having only two directors. Sections 285, 287 and 290 – TARJITSINGH BAKHATAWARSING BATTH V. RATAN WOOD (P.) LTD. [2013] 117 CLA 129 (CLB)

7) ARTICLES OF ASSOCIATION

Where company has acted upon/derived benefits under a private agreement, it is bound by the terms of the agreement, even if the terms do not form part of the Articles of the company. Section 36 – HARSHADBHAI B PATEL V. BHAGIRATH CONSTRUCTION CO. (P.) LTD. [2013] 117 CLA 52 (CLB)

Circulars & Notifications

MINISTRY OF CORPORATE AFFAIRS

MINISTRY OF CORPORATE AFFAIRS

1. REGARDING COMPANIES INCORPORATED WITH THE NAME CONTAINING THE EXPRESSION “ELECTORAL TRUST”.

Notification

In exercise of the powers conferred by sub-section (6) of section 25 of the Companies Act, 1956 (1 of 1956) (hereinafter referred to as the said Act), the Central Government hereby directs that the companies incorporated with the name containing the expression "electoral trust" and approved in accordance with the procedure laid down in the Electoral Trusts Scheme, 2013, notified vide number S.O. 309(E), dated 31st January, 2013, and to which licence is granted under section 25 of the said Act, shall be exempt from the provisions of clause (b) of sub-section (1) and sub-section (2) of section 293A of the said Act which has since been replaced by sub-section (1) of section 182 of the Companies Act, 2013 (18 of 2013) and notified vide number S.O. 2754(E) dated 12th September,2013.

2. REGARDING CLARIFICATION WITH REGARD TO APPLICABILITY OF SECTION 182(3) OF THE COMPANIES ACT, 2013.

General Circular No. 19/2013

Source: www.mca.gov.in

Ministry has received representations seeking clarification on disclosures to be made under section 182 of the companies Act, 2013. The same have been examined with the coming into force of the scheme relating to 'Electoral trust companies' in terms of section (24AA) of the Income Tax Act, 1961 read with Ministry of Finance Notification No. S.O.309(E) dated 31st January, 2013 it will be expedient to explain the requirements of disclosure on part of a company of any amount or amounts contributed by it to any political parties under section 182(3) of the Companies Act, 2013.

It is hereby clarified as under;

It is hereby clarified as under;

(i) Companies contributing any amount or amounts to an ‘Electoral Trust Company' for contributing to a political party or parties are not required to make disclosures required under section 182(3) of Companies Act 2013. It will suffice if the Accounts of the company disclose the amount released to an Electoral Trust Company.

(ii) Companies contributing any amount or amounts directly to a political party or parties will be required to make the disclosures laid down in section 192(3) of the Companies Act, 2013.

(iii) Electoral trust companies will be required to disclose all amounts received by them from other companies/sources in their Books of Accounts and also disclose the amount or amounts contributed by them to a political party or parties as required by section 182(3) of Companies Act, 2013.

CENTRAL EXCISE

1. REGARDING EXTENSION OF WAREHOUSING AND ACCEPTANCE OF LUT IN PLACE OF BANK GUARANTEE FOR EXPORT WAREHOUSING FOR STATUS HOLDER MANUFACTURER EXPORTERS

Circular No. 976/10/2013-CX

Source: www.cbec.gov.in

I am directed to invite your attention to Circular No. 579/16/2001–CX dated 26.06.2001 and Circular No. 581/18/2001-CX dated 29.06.2001, which prescribe conditions, procedures and safeguards applicable for storage in a warehouse registered at such places as may be specified by the Board and export therefrom regarding all excisable goods specified in the First Schedule to the Central Excise Tariff Act, 1985.

2. Paragraph 6 of the Circular No. 579/16/2001–CX dated 26.06.2001 contains provisions relating to “Period of warehousing“. The provisions in clause (a) and clause (b) are not detailed and therefore in pursuance of notification no 46/2001-CE (N.T.) dated 26.06.2001 and sub-rule (2) of rule 20 of the Central Excise Rules, 2002, it has been decided to further elaborate the provisions by replacing the existing clause (a) and clause (b) in paragraph 6 with the following new clause (a) and clause (b), to read as follows:-

(a) Warehousing of goods shall initially be allowed for a period upto six months, which may be further extended by the Assistant /Deputy Commissioner, each extension being for a period not exceeding six months, subject to the verification that the goods have not deteriorated in quality. The maximum period, for which goods may be left in the warehouse in which they are deposited, or in any warehouse to which such goods have been removed, shall be three years from the date on which such goods were first warehoused. Excisable goods shall be deemed to be cleared for home consumption on expiry of the warehousing period including the extensions granted, if any. Duty and interest @ 24% per annum shall be charged on such deemed removal.

(b) If the registration of a warehouse is revoked or suspended, the excisable goods lodged therein shall either be cleared for home consumption on payment of duty and interest @ 24% per annum or shall be removed to another warehouse without payment of duty.

3. Paragraph 3.2 and paragraph 4.2.1 of the Circular No. 581/18/2001-CX dated 29.06.2001 contain provisions requiring an exporter to furnish security equal to 25% of the Bond amount for availing the facility of export warehousing.

4. Reference has been received in the Board that submission of BG (Bank Guarantee) leads to increase in transaction cost and, therefore, manufacturer exporters who are also status holders may be allowed to submit Letter of Undertaking (LUT) in place of BG. On examination the problem has been found to be legitimate and, therefore, it has been decided to amend paragraph 3.2 and paragraph 4.2.1 of the Circular dated 29.06.2001. Accordingly Board specifies that these paragraphs be amended as follows:

(i) Paragraph 3.2: After the words “backed by twenty five percent security of the bond amount “ the words “in the manner as prescribed in paragraph 4.2“ shall be added.

(ii) Paragraph 4.2.1: A proviso, as follows, shall be inserted at the end of the paragraph.

Provided that where the exporter is a manufacturer and a Status Holder with a clean track record, the requirement to furnish security equal to 25% of the bond amount shall be replaced by the requirement of furnishing an LUT initially for a period upto six months which may be extended by a further period not exceeding six months. Further extensions in the warehousing period in terms of paragraph 6(a) of the Circular No. 579/16/2001-CX dated 26.06.2001 shall be allowed to such exporter only on furnishing security of 25% of the bond amount.

5. There is also a need to amend the terms “Super Star Trading House” or “Star Trading House” used at paragraph 2(1) in the Circular No. 581/18/2001-CX dated 29.06.2001 and to replace it with the current nomenclature. Accordingly Board also specifies that paragraph 2(1) of the Circular be amended as follows:

Paragraph 2(1): In this paragraph dealing with Exporters, expression “The exporters who have been accorded status of Super Star Trading House or Star Trading House” may be replaced with the expression “The exporters who are Status Holder under FTP - 2009-14”. Export warehousing facility would become available to all Status Holders under FTP of 2009-14 due to this amendment.

6. The contents of this Circular may be brought to the notice of the trade / exporters by issuing suitable Trade / Public Notices. Suitable Standing Orders / Instructions may be issued for the guidance of the assessing officers. Difficulties faced, if any, in implementation of the Circular may please be brought to the notice of the Board at an early date.

7. Receipt of this Circular may kindly be acknowledged.

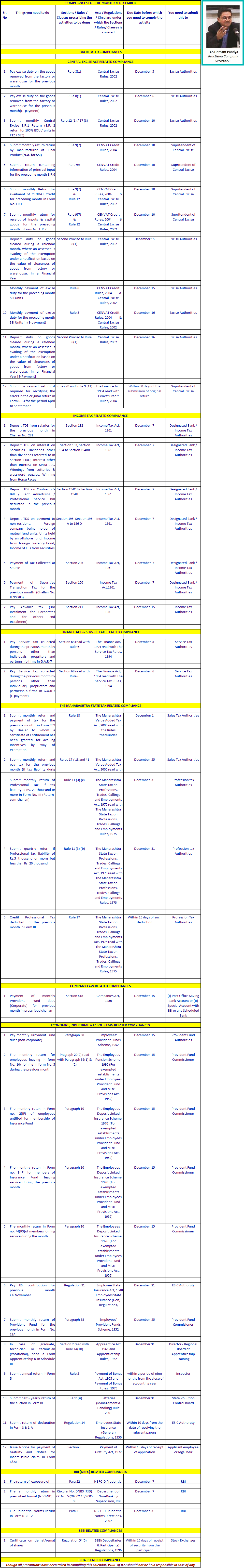

Monthly Compliance Calendar

Smile Please / Cartoon

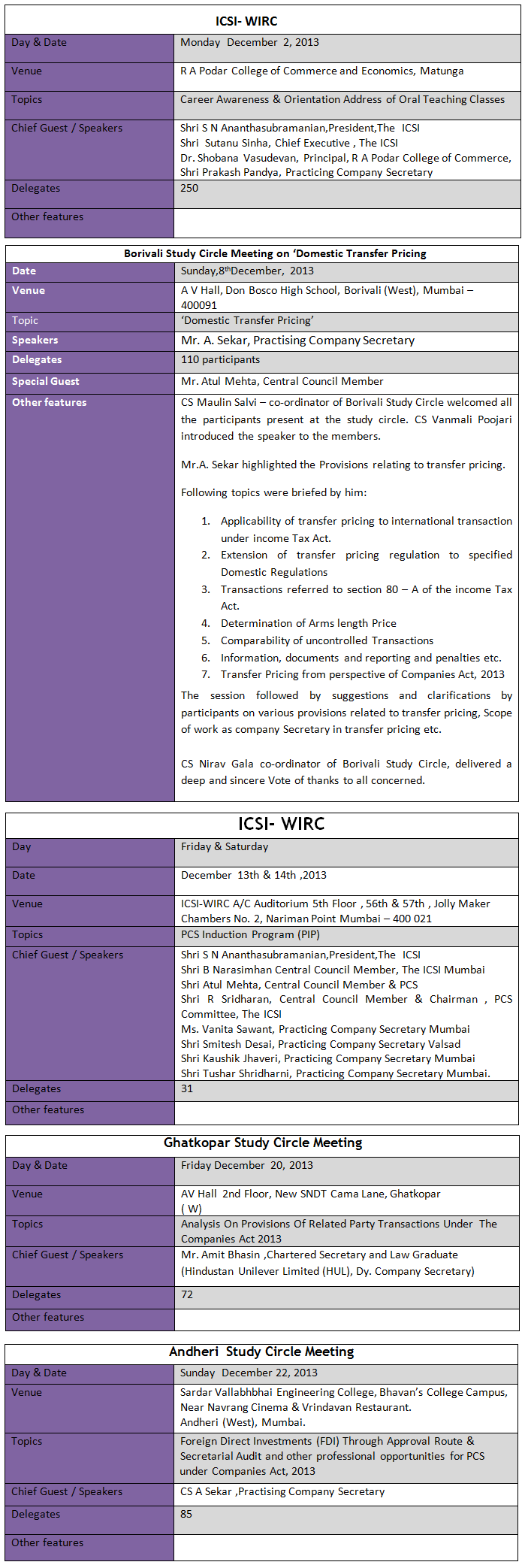

WIRC News

Chapter News

Chapter - Photo Gallery

WIRC - Photo Gallery

Career Opportunities & Vacancies

Editorial Policy

A : “FOCUS” published monthly as a magazine aims to be a forum for members of the Western India Regional Council of the Institute of Company Secretaries of India ( WIRC of ICSI) for;

a. DISSEMATING information,

b. COMMUNICATING developments affecting the Institute and its members in particular and the CS profession in general,

c. ARTICULATING issues of contemporary concern to the members of the profession.

d. CEMENTING and DEVELOPING relationships across membership by promoting discussion and dialogue on professional issues.

e. DISCUSSING and DEBATING issues particularly of public interest, which could be served by the CS profession.

f. FACILITATING Members of the profession to share their views on matters of professional interest by way of articles and write-ups.

B : The WIRC of ICSI recognizes the fact that;

a. There is a growing emphasis on the globalization of the CS profession;

b. There is an imminent need to position the profession in a business context which transcends the traditional and specific CS applications.

c. The Institute members increasingly will work across the globle and in global context.

C : Given this background the WIRC of ICSI strongly encourage contributions from the following groups of professionals;

a. Members of other Professional bodies across the globe

b. Regulators and Government officials

c. Professionals from allied professions

d. Academia

e. Professionals from other disciplines whose views are of interest to the CS profession

f. Business leaders

D : The magazine also seeks to keep members updated on the activities of the Institute including events on the various practice areas

and the various professional development programs on the anvil.

E : The WIRC of ICSI while encouraging stakeholders as in Section C to Contribute to the Magazine , it makes it clear that responsibility

for authenticity of the contents or opinions expressed in any material published in the Magazine is solely of its author and the WIRC of ICSI,

council members, any of its editors or members of Editorial Team & Advisory Board, the staff working on it or “FOCUS” is in no way holds

responsibility there for. In respect of the advertisements, the advertisers are solely responsible for contents of such advertisements

and implications of the same.

F : Finally and most importantly WIRC of ICSI strongly believes that the magazine must play its part in motivating students to grow fast as

Members of tomorrow to be capable of serving the Legal & Compliance area within ever demanding customer expectations.

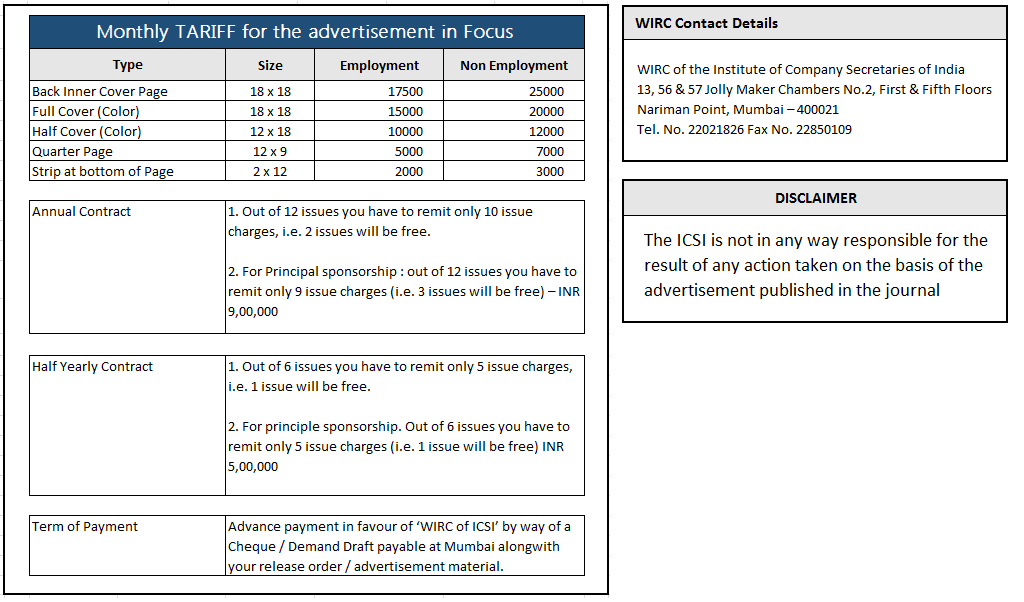

Tariff/Disclaimer

Previous Editions

June 2013

July - August 2013

September 2013

October 2013

November 2013