The

MSME sector has emerged as a dynamic sector of the Indian economy over the last

five decades. MSMEs contribute enormously to the socio-economic development of

the country. MSME have a large share of jobs, production and exports. The primary

responsibility of promotion and development of MSMEs is of the State

Governments. However, the Government of India, supplements the efforts of the

State Governments through various initiatives.

Ministry of Agro and Rural Industries and

Ministry of Small Scale Industries have been merged into a single Ministry,

namely, “MINISTRY OF MICRO, SMALL AND MEDIUM ENTERPRISES” to direct and govern

the establishment, registration and functioning of MSMEs.

As per the report of Ministry of Micro Small and Medium

Enterprises, Government of India; MSME sector is serving numerous benefits

towards the inclusive growth of Indian economy. Major contribution of MSMEs is

as follows:

1. It provides opportunities at comparatively lower cost;

2.

It helps in industrialization of rural

and backward areas;

3.

Reduce Regional imbalances through the

optimum utilization of their resources;

4.

More equitable distribution of national

income and wealth;

5.

Major partner in the process of

inclusive growth.

Definition

of MSME:

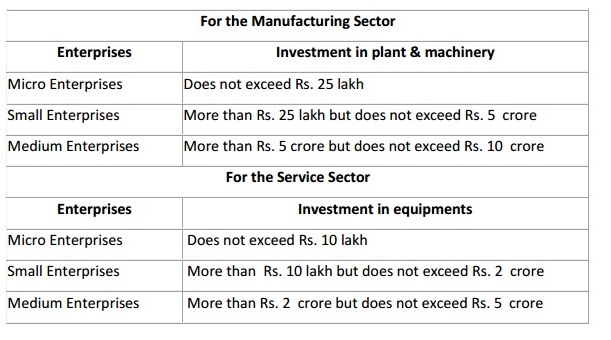

The Micro Small and Medium Enterprises have been

defined under MSME Act, 2006. According to the Act, MSME have been broadly

classified in two categories:

1.

Enterprises engaged in the manufacturing

and production of goods pertaining to any industry;

2.

Enterprises engaged in providing or

rendering services

The manufacturing enterprises have been further

defined in terms of investment in plants and machinery wherein the service

enterprises have been defined in terms of their investment in equipment. The

further classification of manufacturing and service enterprises can be seen

below.

The conceptual and legal framework for small

scale and ancillary industrial undertakings is derived from the Industries Development

and Regulation Act, 1951. The Act provided the necessary powers to the Central

Government to amend the provisions of this act from time to time so as to

encourage small scale and ancillary undertakings. The Small and Medium

Enterprises Development Bill 2005 which was enacted in June 2006 was renamed as

“Micro, Small & Medium Enterprises Development Act, 2006” aims at

facilitating the promotion and development of small and medium enterprises.

Various notifications issued by the Central Government from time to time

relating to increase in slap rate of investments in plant & Machinery for

manufacturing enterprises and equipments in service

enterprises provides a clear cut proof that the economy of our country is

striving towards achieving the economies of scale by increasing the volume of

production of goods. The Micro, Small and Medium Enterprise Development Act,

2006 (MSMEDA) extends the scope to accomplishes many long -standing goals of

the government and stakeholders in the MSME sector including the service

sector.

Micro, Small and Medium Enterprises (MSME)

contribute nearly 8 percent of the country’s GDP, 45 percent of the

manufacturing output and 40 percent of the exports. They provide the largest

share of employment after agriculture. They are the nurseries for

entrepreneurship and innovation. They are widely dispersed across the country

and produce a diverse range of products and services to meet the needs of the

local markets, the global market and the national and international value

chains.

As per Ministry of Small Scale

industries notification dated 5th day of October, 2006, the investment in Plant

and Machinery referred to in respective limits is the Original Price,

irrespective of whether the plant and machinery are new or second handed, shall

be taken into account provided that in the case of imported machinery, the

following shall be included in calculating

the value, namely;

i. Import duty (excluding

miscellaneous expenses such as transportation from the port to the site of the

factory, demurrage paid at the port);

ii. Shipping charges;

iii. Customs clearance charges; and

iv. Sales tax or value added tax.

Further, as per the said notification, the following

are excluded while calculating the

investment in Plant and Machinery:-

i. Equipment such

as tools, jigs, dyes, moulds and spare parts for maintenance and the cost of

consumables stores;

ii. Installation of plant and machinery;

iii. Research and development equipment

and pollution controlled equipment

iv. Power generation set and extra

transformer installed by the enterprise as per regulations of the State

Electricity Board;

v. Bank charges and service charges paid

to the National Small Industries Corporation or the State Small Industries

Corporation;

vi. Procurement or installation of

cables, wiring, bus bars, electrical control panels (not mounded on individual

machines), oil circuit breakers or miniature circuit breakers which are

necessarily to be used for providing electrical power to the plant and

machinery or for safety measures;

vii Gas producers

plants;

viii. Transportation charges (excluding

sales-tax or value added tax and excise duty) for indigenous machinery from the

place of the manufacture to the site of the enterprise;

ix. Charges paid for technical know-how

for erection of plant and machinery;

x. Such storage tanks which store raw material

and finished produces and are not linked with the manufacturing process; and

xi. Fire fighting

equipment.

Further, investment in Land, Building,

Vehicles, Furniture and fixtures, Office Equipment etc

shall not be considered in determining the threshold limit of plant and

machinery or Equipment as the case may be.